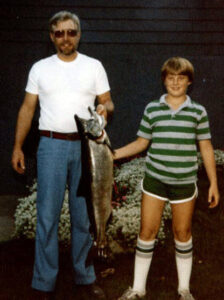

One of the more accurate descriptions of me growing up as a child would be, “A tiny hot mess.” I was a small kid in stature. A late bloomer so to speak. I graduated high school a whopping 5’6” tall and weighed in at 110 lbs. A strong breeze could unsettle my balance at the school bus stop on blustery winter days.

I always had a flair for style and fashion

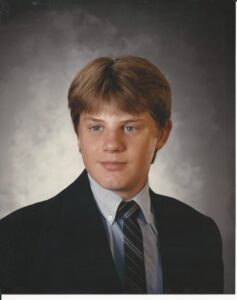

The future super-accountant (HS Graduation 1987)

To put it mildly, I had a difficult time defending myself against the other boys (or girls) in school or on the school bus. If I couldn’t talk my way out of a beatdown with some quick wit or a funny joke, then it was going to be a long and lonely day. Kids don’t have a particular fondness for future hall-of-fame accountants and number crunchers. That is true now, and it was true back then too. Some things never change.

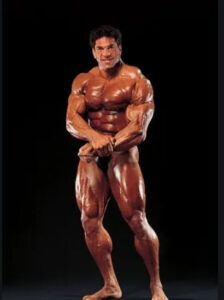

I did have my heroes though while growing up. I idolized men like Lou Ferrigno, Arnold Schwarzenegger, Sylvester Stallone, Chuck Norris, and Terry Bollea. These men were not just entertainment heroes in my eyes. They were real men, and I dreamed of having not only their muscles but their ability to defend themselves against the forces of evil. Hollywood just gave them a platform to share their ass-kicking abilities with the rest of us dreamers.

Keep in mind that this was in an age when action heroes had real muscles and real fighting skills.

Lou Ferrigno really was a Mr. America and Mr. Universe bodybuilding champion before being painted green to play the original Incredible Hulk.

Arnold Schwarzenegger really was a seven-time Mr. Olympia before morphing into characters like Conan the Barbarian, The Terminator, and Commando.

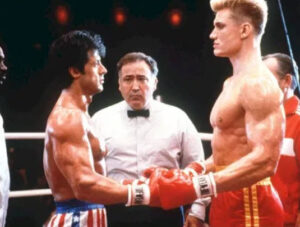

Sylvester Stallone really did look like that during the filming of the Rocky Movies or Rambo.

Chuck Norris really was a martial arts champion who could roundhouse kick you to the face.

And if you are wondering who Terry Bollea is, he’s the guy that would encourage me to, “Train hard, say your prayers, and eat your vitamins.” Hulkamaniacs ran wild in the 1980’s and I was sold!

But then two funny things started happening in California and in Hollywood films. Plastic surgery allowed men to get muscle implants, which became regularly done on the buttocks, calves, pectorals, biceps, and triceps. When plastic surgery wasn’t practical for a leading actor in a major action film, technology allowed for the creation and wearing of what best could be described as a muscle suit.

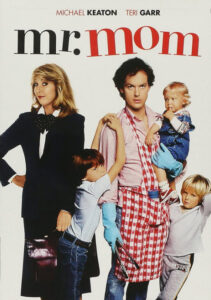

Through the use of muscle suits and fake muscles, you no longer needed “real tough guys” to play action heroes. You can take a good actor like Michael Keaton, who played in Mr. Mom, and turn him into Batman.

Imagine that. Fake muscles. Now anybody could be an action hero. Robert Downey Jr. can become Iron Man.

Life became a complete illusion.

About the same time that Hollywood began sucking all of the real testosterone out of movies, Wall Street started their own metamorphosis into the hype and promotion of illusions. Not only did entertainment evolve into fake muscles, business and investing began to evolve into fake companies listed on major stock exchanges.

In the late 1990’s and early 2000’s Wall Street promoted billion-dollar companies that had zero revenues. Imagine that. Sure, it eventually blew itself to smithereens, but that didn’t stop the evolution on Wall Street. They just came up with their version of new “muscle suits” to hype and promote companies with inadequate earnings (or no earnings at all).

Rather than continuing to promote companies with zero revenues, Wall Street had to get more clever. Today, many companies may show lots of revenue, but it’s still an illusion if there aren’t earnings or operating cash flows left over. If you thought the entire purpose of an investment is to own a company that makes a profit, you are mistaken. There are hundreds (if not thousands) of companies in the U.S. economy that don’t make a dime in earnings, or they have so much debt that they can no longer even make the minimum interest payments on their debt obligations. These are called, “Zombie Companies.”

The problem with Zombie Companies is that they are not just limited to publicly traded companies on the traded stock exchanges. Our economy is loaded with privately held companies that have been zombie-fied.

Take LA Fitness for example. LA Fitness is an American Gym chain with more than 700 clubs across the United States and Canada. You have probably driven past an LA Fitness in your neighborhood and have seen the big and beautiful buildings that house the health clubs. Over the past 15 years, LA Fitness has gone on one major acquisition binge after another building out their presence in the health and fitness industry.

But there is something interesting about the health and fitness industry that isn’t just limited to LA Fitness. First, you don’t have to own your own building to open up a gym. You can just lease space. In the case of LA Fitness, you can take things one step further and have developers build custom buildings to fit your needs and then lease those buildings back from the real estate investors who own those buildings. So, if you are a gym owner and can’t afford your own buildings? No problem. Wall Street and banks have you covered.

Second, if you are a gym owner, you don’t even have to own your own equipment. Health and fitness equipment leasing has become a huge industry. Manufacturers who are always trying to come out with the latest and greatest technology and fitness equipment to stay ahead of the competition learned that the price of their equipment was cost-prohibitive to gyms that didn’t have the cash to pay for all of that fancy new equipment. Naturally, finance companies stepped in and allowed the gym owners to “lease with the option to buy” the equipment. This is no different than a person who can’t afford a new car but could afford the monthly lease payment on a new car. So, if you are a gym owner and can’t afford your own gym equipment? No problem. Wall Street and banks have you covered.

Third, if you are a gym who can’t afford to own a building to operate out of and you don’t have the money to buy equipment for your gym, you probably don’t have the money to pay for all of the employees to run and operate those big and expensive facilities. No problem…no problem at all. There are plenty of banks that are willing to either make operating loans or Wall Street firms that could line up bond offerings to fund your business operations for years on end.

Let’s return back to LA Fitness. COVID-19 interruptions led to some startling revelations about the LA Fitness business model. Mainly, the fitness chain was up to its eyeballs in a $1.7 billion debt load and experiencing a liquidity crunch. By September of 2020, they were already operating under a forbearance agreement on their real estate leases that expires October 15 (Source: Bloomberg)

Bloomberg reported that a key measure of the company’s debt relative to earnings is expected to rise above eight times by the end of 2020. To stem off the liquidity crunch, the company had to fully draw on its revolving credit facility, which is a term loan of $675 million due in 2025.

Our economy has morphed away from fundamental business practices. No longer are companies conservatively financed. Rather, they live and only survive on constantly revolving and increasing amounts of debt. Emphasis by investors is no longer focused on profits and cash flows but instead around hype, promotion, future potential, or just confusing finance jargon.

Paying Attention To Cycles – Bicycles and Markets

Many people have tried to tell me that I’m crazy for avoiding some of the most prolific stocks that are flying high on Wall Street in the last few years. But studying 110 years of market history and personally living through several stock market meltdowns has taught me some of the most valuable lessons about wealth building and wealth preservation. Mainly, there is a difference between real wealth and paper wealth. Real wealth is based upon anti-fragile cash flows and rock-solid financial statements. Paper wealth, as we have learned from past bubbles, could be here one day and gone the next. Paper wealth feels really exciting and prosperous right up until the time you lose your money, lose your house, or file bankruptcy once the illusion of wealth disappears.

Paper wealth is Wall Street’s version of fake muscles.

Take for instance the booming company Peloton. Peloton is an online fitness platform that uses the internet to stream cycling classes to its members while those members ride really cool Peloton indoor bicycles. Now, my wife and I love cycling. My wife and I have many friends who love cycling and many of which have a Peloton bike and monthly membership, which costs $39/month. And sales have been booming, especially during COVID-19 when gyms and fitness studios have been forced to close their doors or reduce the number of people they serve in each class.

Keep in mind, Peloton has REAL revenues (over $1.8 Billion for the 12 months ended June 30, 2020). They have a REAL product and a real service. Customers rave about the product and services.

There are just a few problems with investing in companies such as Peloton. First, the company has yet to turn a profit. For fiscal year 2017, the company lost $163 million. For fiscal year 2018, the company lost $48 million. For fiscal year 2019, the company lost $246 million. For fiscal year 2020 that ended June 30th, the company lost another $72 million.

Second, thus far, the company has been living off the sale of additional stock (which dilutes older shareholders) and escalating liabilities. Meanwhile, the company is currently valued at over $34 Billion.

Now I love the product, the service, the value proposition to the customer. Peloton has gotten millions of people to enjoy indoor cycling in the comfort of their own home. But what is the value of a company that analysts expect to make $0.11/share for their 2021 fiscal year?

I encourage all investors that invest in the stock market to imagine that the very stocks that they want to buy are actually privately held businesses. Imagine having the money to buy out the entire company. You would be the 100% owner which would entitle you to keep ALL the profits and cash flows from running the enterprise. Then ask yourself, “How much would I pay for this business if I had the money to buy out the entire enterprise?”

In Peloton’s case, it would cost you $34.05 Billion to buy the entire company. Every. Single. Share. And for that $34.05 million investment, you would hopefully earn $0.11/share in 2021. Since we know that there are 288.7 million shares outstanding, total earnings would be expected to be around $31.76 million dollars.

But now ask yourself, “How long would it take earning $31.76 million dollars a year to make back your $34.05 Billion dollar investment? (Answer: 1,072 years). I’m all for aiming for a life of longevity, and maybe Peloton will help us all live to 100 years old or beyond, but the future profits don’t appear to be worth the price of the acquisition. I’d be dead about a thousand years before I earned my investment back through profits unless something dramatically changes (and lasts) so far into the future that it would be tough to see that far out.

The juice isn’t worth the squeeze. It’s far more likely that the world will continue to evolve, people will move on to a new fad in exercising while Wall Street moves on to a new fad on investing and the shares of Peloton are forced to return back to sanity.

At a market cap of over $34 Billion, Peloton is the 288th largest asset by market cap now worth more than the following companies that are publicly traded:

- Bank of New York Mellon – $33.16 Billion

- Marriott International – $32.8 Billion

- Walgreens – $32.09 Billion

- Hershey Company – $30.0 Billion

- Allstate Corporation – $29.2 Billion

- Ford Motor Company – $29.2 Billion

- Kroger Co. – $26.85 Billion

- Southwest Airlines – $22.89 Billion

- Delta Airlines – $20.76 Billion

- Domino’s Pizza – $15.5 Billion

- E*Trade – $10.89 Billion

Investors are either betting on turning all of Africa, Asia, and India into indoor cyclists who want to pay a $39/month membership while buying a $1,995 stationary bike, or maybe they need to think through their math while using common sense.

Examples like this are throughout the publicly traded markets. You have companies that are worth billions (and billions) that are only promising us future profits at some unknown point in the future. These are just examples of “buyer beware” and irrational exuberance throughout the markets. We’ve seen similar situations in market cycles in the past and what history has taught us is that investors incur heavy losses as prices eventually reflect economic reality.

Uncertainties

A lot of investors are speaking out about all the uncertainties in the markets at the moment. It might be political uncertainties, or COVID-19 uncertainties. But I remind investors that uncertainties are always constantly around us, even when things appear to be going smoothly. We will NEVER know what lies right around the corner. It could be a severe weather event, it could be a war, it could be a terrorist attack, a pandemic, or the unexpected death of a political or business leader.

We must ALWAYS invest knowing that uncertainties are all around us. Uncertainties will never disappear during our long-term investment journey. Thus, investors are best served to always pay attention to valuations and seek appropriate margins of safety during their investing pursuits.

Today the uncertainties in the headlines are political, weather, and health related. But tomorrow and next year they will be something different.

Low (or zero percent) interest rates have become the only way our economy can function. We can’t go a few weeks without companies begging for bailouts or stimulus money. Quantitative easing or Central Bank intervention is now a necessity for the system to function. The Washington D.C. arguments aren’t about the need for stimulus, but rather how much and how long the next round of stimulus must last.

Monetary policy and Fiscal policy is now a way of life. Record low interest rates have distorted the markets. As Jim Grant recently wrote, “Needing income, investors will take imprudent risks to get it. And if 2% invites trouble, zero percent almost demands it.”

Valuations Matter

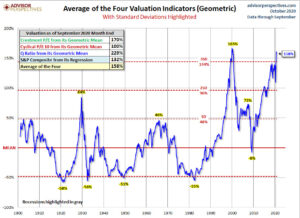

Overall, valuations continue to be at extreme levels depicting significant downside risks to investors. By most measures of valuation, we are currently at either the second-highest valuations in market history or the most expensive valuations in market history. Buyer beware.

(Source: Advisor Perspectives)

Due to the economic consequences of COVID-19 along with other uncertainties, we are actually starting to see more attractive valuations in the publicly traded and privately traded markets in certain sectors such as energy, sub-components of commercial real estate, precious metals, and specific value stocks. We expect to see much better valuations and far more attractive risk/reward scenarios in the publicly traded markets after a long-overdue repricing in the markets occurs. In the meantime, we will continue to invest prudently and defensively until we get opportunities to pursue what we should always be pursuing; good solid companies at attractive (or even reasonable) valuations.

In the meantime, don’t be fooled by fake muscles or fake businesses.

Ultimately businesses will be valued based upon their real earnings and cash flows, and you don’t want to be caught on the wrong side of that equation when the day of reckoning finally arrives.

Although some of the indexes make it appear that the market is strong and healthy, it’s simply not the case when you factor in every stock listed on the New York Stock Exchange. If we look at ALL stocks on the NYSE, the index is actually below where we were back at the end of January of 2018. It’s an entirely screwy dynamic in the markets the past few years and one to take note of.

Investing In Today’s Climate

Our objective in investing in today’s pandemic climate is the exact same, and that is to invest in proven principles of success. Mainly, we buy quality assets and investments at attractive (or even reasonable prices). We diversify. We do not chase lottery tickets. We grind forward in assets that have favorable probabilities so that we can build and protect our wealth in an anti-fragile way.

We are going to grind forward in the same way we did through the tech bubble, or the 9/11 terrorist attacks, or the hurricanes, or the real estate bubbles. Market cycles can often be like roller coasters, and a successful investor must be able to get through the valleys along with the peaks to enjoy the rewards of their grind.

This pandemic will one day pass. Nobody knows when for sure. It could take two more months, two more quarters, or two more years. Nobody knows. And guess what? Nobody says that something additional cannot pile on while this pandemic is going on. Nobody says that a hurricane cannot blow our house over in the fall, or that a wildfire cannot burn a region of the country, or that a new product or service will make our employer obsolete.

Our objectives should always remain the same, and that is to grind out daily improvements while we walk that path towards an anti-fragile lifestyle and philosophy.

In the meantime, my objective is to get you to become as anti-fragile as possible in the most effective and efficient ways possible. Whether that assistance is in the area of:

- Financial planning

- Investments

- Estimating insurance needs

- Getting out of debt

- Creating personal systems

- Delivering proven processes

- Providing you principles of success

I am here to serve you.

The easiest way to proceed through these is towards a debt-free and healthy lifestyle. As we can see yet again, the current pandemic is just one more example of the benefits of living a debt-free and healthy lifestyle.

Good habits lead to good behaviors. Good behaviors lead to good decisions. Good decisions lead to a good life.