American’s have never been so prepared for quarantine as they are now; big screen TV…iPad…Xbox…high-speed internet…latest iPhone…Netflix subscription…358 channel cable package subscription…upscale house…gourmet kitchen…super-automatic espresso and cappuccino machine…nice car…a closet full of clothes…98 pairs of shoes…bass boat…RV…motorcycle…a drawer full of fancy jewelry.

One of the interesting things about central banks lowering interest rates over the past decade is that it gave us the false-confidence that everything is groovy in the economic world. It allowed governments, corporations, institutions, and individuals to borrow more and more while believing that there are no downsides or risks.

In 2008 and 2009, during the global economic meltdown, how did we fix a large debt crisis? Simple. We consistently lowered interest rates while extending more loans to anybody with a pulse. It didn’t matter if the long-term prognosis was positive or not. What mattered was that the economy, which was/is 70% consumer-based, kept moving forward so that we could dig our way out of the debt crisis. We could worry about the ramifications later, someday, further down the road. You know, kick-the-can. As long as the economy was chugging along, even if propped up by ever-increasing debt, we could ignore the sins of our past. We could pretend as if they never even existed.

Fast forward a dozen years, and global debt climbed to never-seen-before levels. It currently sits at over $250 Trillion. No biggie said our governments and leaders. As long as we could pressure the central banks to keep lowering interest rates and providing stimulus, everything would be fine, and we could keep partying like it was 1999. Debt leads to consumption. Consumption (no matter the source) leads to spending and spending leads to happy voters and politicians. Spending also leads to higher corporate revenues, which allow the corporations to borrow more money further keeping the cycle moving along.

Everything is groovy…until…it’s…not…groovy…

As we headed into 2020, we were living in paradise. Debts didn’t matter. Extreme stock valuations didn’t matter. All that mattered was that people were continuing to spend money. It’s the consumer that mattered, and as long as they had access to cheap credit and the ability to borrow just a bit more, the music kept playing.

But then the…music…stopped…playing…

And now we are seeing governments, municipalities, corporations, institutions, and individuals acting like cockroaches desperately looking…for…a…refrigerator…to…hide…under…

For a quick visual on our current debt situation, CNBC has put together this short video here.

HELLO CORONAVIRUS

What happens when you get a triple-whammy of;

- extreme valuations,

- record levels of debt,

- and a screeching halt of a consumer-based economy dependent on ever-increasing levels of debt and higher stock valuations?

That’s right kids. You get a full…fledged…shit…show.

Welcome to the shit-show 2020 edition…Grab a seat. Get your popcorn. Maybe a blanket and a soft pillow will be of use.

DON’T FORGET ABOUT YOUR BEHAVIORAL FINANCIAL BIASES

Behavioral finance is the study of the influence of psychology on the behavior of investors. It also includes the subsequent effects on the markets. It focuses on the fact that investors are not always rational, have limits to their self-control, and are influenced by their own biases.

At the top of those biases right now is “Recency Bias.” Recency bias is the tendency to overweight the most recent information available to us because that information is fresh in our minds. If we were recently in a raging and long-lasting bull market, we would anchor onto that recent experience. We have a tough time imagining a new reality even with plenty of data and information that says otherwise.

If a market index was recently at a particular high-point, we would anchor onto that high-point. If we were in a bull-market where pullbacks or corrections quickly recovered, we became trained to “buy the dip” no different than a dog is trained to salivate at the sound of a bell. It’s a Pavlovian response that paired a stimulus with a conditioned response.

It keeps working…until…it…doesn’t…

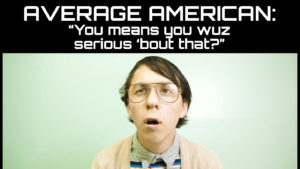

But once trained, investors can’t imagine any other scenario than the recent condition. That’s how investors get burned by Wall Street (over and over again throughout history). It’s the classic Nassim Taleb story from the book, “The Black Swan.” From Nassim Taleb;

“Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race ‘looking out for its best interests,’ as a politician would say.

On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief.”

We are discovering once again that Wall Street, the government, and central bankers have raised a bunch of turkeys ready for Thanksgiving dinner.

A few key points to file away for future reference;

- You can’t permanently solve a debt crisis with more debt. You can only create a larger debt crisis that will need a resolution tomorrow. Eventually, tomorrow comes.

- Valuations can’t rise to the moon and stay permanently elevated. It sure pays to know what mean valuations are so that you have an accurate and truthful anchor point based upon market history, which includes more than 120 years of turkey day surprises.

- Large debt loads can be sustained so long as there is enough economic output to make the minimum payments. Eventually, more and more governments, corporations and individuals become what is described as “Zombies,” whereby the only way that they can survive is with continued access to even more debt financing. For a refresher on Zombie Corporations, you can refer back to my article here.

- Based on market data, we are no longer in a bull market. We are in a bear market. Those that are anchored on a playbook that worked during a bull market and hasn’t switched to one that is relevant for a bear market may experience a lot of mental agonies.

- Bear markets on average, take 9 months to reach the bottom and another 18-36 months to return back to their past highs. Those are for regular, “run-of-the-mill” bear markets and not for those that were preceded with extreme valuations or caused by debt crisis’. For significant bear markets, the recoveries could last years (or decades – see the U.S. from 1929 to 1954 or Japan from 1989 until maybe sometime in the next 100 years.)

- Politicians, central banks, and Wall Street firms will try to convince you during a moment of crisis that “nobody could have seen this coming.” That is part of their standard operation manual to cover up the fact that anybody willing to look was able to see certain events coming. A health pandemic isn’t an “if” it’s a “when.” Nobody saw a 9/11 terrorist type of event. But people like Bill Gates have been warning about pandemic preparation for years (including our current government). You can find that here.

- And anybody that was willing to look at mountains of evidence of extreme valuations and record debt levels is not surprised when shocks to the system occur. Whether or not we get a chance to kick the can further down the road remains to be seen. But eventually, you have to pay the piper. For a summary of the warning signs that allowed us to side-step the current chaos in the markets recently, you can find all the juicy warnings in my February 24, 2020 article called, “Why So Serious” here.

WHAT TO EXPECT

Here are some basic things to expect between now and the end of the year;

- A lot of volatility with markets trending lower.

- The most impressive, rip-your-face-off stock market rallies occur during bear markets (while markets recover from over-sold conditions and short-sellers must cover positions.)

- The rip-your-face-off rallies give investors false hope that we never left the bull market. It keeps them invested while the trend continues lower and lower until they finally reach their mental breaking point.

- Bankruptcies will start to take over the headlines.

- Layoffs will grow in the labor market.

- The focus will begin to shift away from the Coronavirus and onto the real underlying economic problems of the global economy (which were showing well before the Coronavirus made headline news).

- Politicians, Wall Street firms, and central bankers will NEVER WASTE A GOOD CRISIS to move forward with their own agenda.

HOW ABOUT THIS STOCK?

Lastly, I’ve been in the accounting and finance industry now for almost three decades. This is what I believe will be the third financial bubble that I will have had to navigate in my own career while studying the many that preceded it.

While my phones are ringing and my emails are surging, I’m often asked, “What about this stock? It looks like a good deal because it used to be X, and now it is down to Y.”

Please note that between clients, family, friends, and business associates, I have hundreds and hundreds of people in my network. If each person in my network asks me about one or two “stocks that are worth investigating” and want to know if they should buy them, you could quickly see how the math just doesn’t work.

To do proper due diligence on any investment takes hours of research. If a stock fell 10% or 50%, there is a reason for that. It might just be because the entire market is down that much or it may actually have to do with the underlying business fundamentals of that enterprise. Either way, a prudent investor should spend the time to know the difference.

Besides, and as I discussed above, recency bias is real. If your whole investment thesis is based upon what a stock used to trade at (even if that was at ridiculous valuations and the business is loaded up on debt) compared to what it is trading at currently, I’d argue that it is a flawed investment process. If a stock was trading at a delusional valuation but is now trading at 20% or 30% off delusional, that doesn’t make it a good investment. It just opens you up to more downside risk as the market adjusts to what should turn out to be a significant oncoming recession.

I love talking about investing and stocks. It’s my passion. But I have to use my time wisely on analysis and research on the items that will matter the most for my clients as a whole and the best ways to build and protect wealth for the long-term. That’s our goal. That’s our focus.

Stay focused on what really matters, and that is always the principles of financial success which include prudent investing and proper risk management. We should always stay focused on the following;

- Make a substantial living.

- Live below your means and control spending.

- Save consistently. Make savings a priority by paying yourself first.

- Eliminate debt.

- Always keep adequate and liquid emergency funds.

- Invest prudently over a lifetime. Get rich quick schemes are the dreams of fools.

- Use proper risk management in all areas of your life.

For those that are smart and prepared, there is no reason why our wealth shouldn’t be higher on the back side of the next phase of the economic cycle.

A significant market correction is exactly what we were waiting for and prepared for. In the past, it was the investors who bypassed the carnage and avoided large losses that had the cash on the backside to invest at bargain valuations.

Our mandate is always the same; buy quality investments at good prices. Good prices are not “20% off delusional valuations.” We have a long way down back to normal valuations. We certainly won’t be disappointed if we are presented at some point with bargain valuations as we get into the summer and fall.