The Carnival Comes To Town

I remember as a kid when the carnival used to come to town. It usually entailed buying tickets and then circling the park with my friends while eating cotton candy, ice cream, and caramel corn and then being twirled around and upside down on the rides. I am still not sure why I never chose to eat AFTER the rides rather than before the rides. It is wasted money on food if you can’t keep it down.

I also remember the “Fun House,” which are traveling rooms of distortion and warped perspectives. Through angled walls, tilted ceilings, crazy paint jobs and warped mirrors, you could not tell if you were skinny or fat, short or tall, or if you had a long face or a squishy face. But I remember seeing things that weren’t reality. The fun house was built to fool you with a skew.

As adults, we are all walking around in a much larger fun house, just without the fun. Much of the world, certainly the financial world, has been warped and skewed to fool us all through altered perspectives.

- Approximately 40 million people have filed for jobless benefits, which has exceeded levels breached in the Great Depression.

- Corporate bankruptcies are now part of everyday headlines. The American Bankruptcy Institute reported 560 commercial Chapter 11 filings in April 2020 alone.

- Corporate announced share buybacks (the largest buyer of stocks over the past few years) has fallen to the second-lowest level in the past decade.

- The economy is heading for the worst recession in decades.

- Corporate earnings are expected to plunge over 40% in the current calendar quarter.

The list of problem areas in the financial markets is long, complicated, and arduous.

Bailouts

In response to the crisis, we find ourselves back at the precipice of a financial system in ruin…again… The Federal Reserve and Global Central Bankers are now backed into a corner (again), just much bigger than the last time. Each crisis is now growing larger than the last. Why should it not since we solve each crisis with more debt and more bailouts?

Remember those times back in 2008 and 2009 when the Treasury and the Federal Reserve went before Congress to ask for enormous bailout funds without ample restrictions to “save the system” while promising that they would never do it again? Well, they are doing it again. This time it is multiple times larger than the last crisis.

We have moved so far past using billions and billions to bail ourselves out. Now it is a trillion here and a trillion there. The U.S. government is back in the business of picking temporary winners and losers, further distorting any reality of a free-market capitalist system.

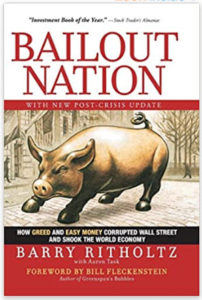

How bad is the system getting distorted? In 2010 after the Global Economic Collapse and Meltdown of 2008-2009, Barry Ritholz wrote a book called “Bailout Nation: How Greed and Easy Money Corrupted Wall Street And Shook The World Economy.”

It should be noted that Barry Ritholz is the owner of the $1.3 BILLION Ritholtz Wealth Management firm that prided itself on showing the corruption on Wall Street and Government.

But in the most hilarious of examples of Wall Street greed and corruption, Ritholtz Wealth Management through owner Barry Ritholtz, the author of Bailout Nation” received a government bailout. The firm applied for and received a “PPP government-backed coronavirus relief loan” through Chase Bank that won’t have to be paid back if Ritholtz “follows da rulz.” Oh…the irony…

Mind you that these types of loans were supposed to be only offered to support small businesses that would go out of business without them (like your neighborhood restaurant). Ritholtz Wealth Management, like many other Wall Street participants, did not let this opportunity of bailout funds go to waste. Who better to know how to receive government money than the guy who wrote the book on how others undeservingly received government money at taxpayers’ expense.

How hard is it for me to work in the financial industry and watch all of this take place crisis after crisis? Very hard…

The Catch

Now before everybody gets all crazy and loads up on stocks and high yield bonds next month because they are such awesome values at these extreme prices (wait…that part already happened this past month…), it should be noted that the government and central bankers have been quite clear in disclosing that there will be large losses incurred in the future.

On Tuesday, May 19, 2020, during a virtual Senate hearing, both Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell testified before the Senate Banking Committee that the Treasury and the Fed are “fully prepared to take losses in certain scenarios.”

They can now sleep well at night knowing that they “got that off their chest through their disclosure to anybody willing to listen” that the government is willing to take losses. This is where things get interesting. You have many market participants who could not care less about fundamentals and valuations. They repeatedly chase what they believe to be the hot money. The fact that it usually ends horribly with large losses does not matter to them.

Everybody knows the poor odds when playing casino games in Las Vegas which are stacked against them, but that does not stop millions each year from chasing the get-rich-quick opportunity at the slot machines.

Other participants, like pension funds, have even larger problems. They have been running massive deficits over the years (even with rising stock valuations). They are grossly underfunded to meet their pension liability obligations into the future. The government knows the pensions are in trouble. Thus, they are willing to take ownership of many “at risk” securities held by pension funds that are currently under strain and likely to incur large future losses (including stocks and corporate bonds). Buying high-yield bonds and stocks passes the ownership of those securities from former holders (like pension funds) to the government (who is willing to eat the future losses when the underlying bonds go bad).

As market participants currently celebrate thinking, “The Fed has our back and don’t fight the Fed,” the Fed and Treasury are telling us, “We’ll take the future losses.” That is the catch. That is how this will turn out. If the Fed buys stocks and bonds at today’s extreme valuations, that allowed somebody else to sell those securities to them. This is providing many participants an opportunity “TO SELL” to the Fed at high prices.

But rather than taking advantage of the opportunity to sell at high prices, market participants are trying to game the system. They are buying into the extreme valuations hoping to ride the roulette wheel for a few more spins while on a hot streak.

Market participants have begun to think that the Fun House is reality. Market participants are fooled into believing that the paper stocks equate to real wealth. They believe that the markets and the global economy are not fragile (which they are). They are forgetting that investing is about buying investments that generate revenues, earnings, and cash flows and that as an owner, you are entitled to a proportionate share of those earnings and cash flows.

But investors are now paying extreme prices for companies that don’t even have earnings and cash flows. These are companies that don’t pay dividends. These are companies that rely on debt to stay in business or continuous stock offerings to fund their negative cash flowing business models.

We now have millennials day trading stocks on Robinhood who know nothing about bear markets (or stock investing). Do you really believe these are long-term investors that will hold these securities years into the future once the market breaks to the downside (again)? Or will they, along with the rest of the traders, dump their holdings when the tide turns (again) revealing that they are not really investors, they are speculators willing to take a significant risk because they believe that they can collect on “easy money?”

How many people ended up with their “easy money” after things played out from the Tech Bubble of 1999-2001 and the Global Economic Meltdown and real estate crash of 2008-2009? Easy money normally ends up as “easy losses.” But alas, as I have mentioned many times in the past, “Everybody has a right to lose money on Wall Street…Everybody…”

“Fundamentals and valuations don’t matter UNTIL THEY DO…and eventually they always do…”

Valuations

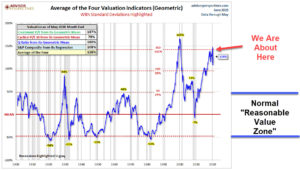

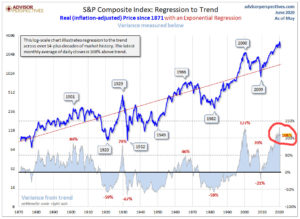

We are now closing in on the most extreme valuation metrics in market history, thanks to the fun house distortions that are in place. Market participants no longer believe that they are being fooled. They have begun to see the distortions as reality.

(Source: Advisor Perspectives)

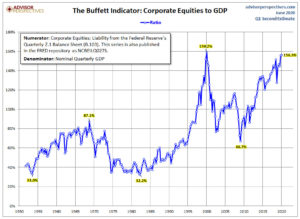

(Source: Advisor Perspectives)

When we look at corporate equities to GDP, we see that we have a legit shot at breaking the all-time record on this valuation metric, even surpassing that of the 1999-2001 tech bubble. I would not be surprised if we did this at the end of this month if we hold these extreme prices until the month/quarter end on June 30th, 2020.

(Source: Advisor Perspectives)

We are but a few weeks away from having second quarter earnings being released. We are also just a few weeks away from a lot of loan deferment programs expiring along with foreclosure and eviction moratoriums expiring on June 30th and July 31st. Soon enough, unemployment benefits will expire for millions and millions of unemployed. At the same time, corporate layoffs for white collar workers are set to begin in July once the benefits of government bailout programs subside.

We are looking at a lot of market stresses between the 4th of July and Labor Day of 2020 (and beyond heading towards the New Year). I believe some patience is more than warranted even if most people can’t stand chasing what appears to be hot and easy money. We also have a little election coming up in November.

Under the hood, the system is fragile and cracking. We are not living in a robust and strong system at the moment. That building next to you that was lit on fire or with the windows kicked in should be a warning of the system in chaos. Windows are being boarded up either because of riots or because of bankruptcies. Let the boarded-up windows across America do the talking.

We are also living in times where common sense is not so common.

Principles

Market participants have entered the fun house and have now succumbed to the illusions and distortions of the markets. History has always shown us that markets ultimately tend to revert to their long-term average levels. This, while valuation metrics are in the top percentile range while the US economy is probably in the worst 1 percent.

In the fun house, unemployment can break records, bankruptcies can skyrocket, loans can default, commercial real estate sectors can crash, debt can surge, earnings can plummet, yet stocks can surge. Welcome to the fun house.

Based on the current logic of the equity markets, apparently, all we need to be rich and wealthy is more Coronavirus, more unemployment, more bankruptcies, more loan default, more riots, more falling earnings, and more commercial real estate vacancies.

There has never been a better time to step back and remember that you are investing over years (possibly DECADES). Do you really believe NOW is the time to load up and play the stock market? Is this likely to produce the easy money that people are craving while they lose their jobs, take pay cuts or run out of unemployment benefits? Or is it better to use some risk management and prudent principles of investing?

The benefit of having principles is that you have fundamental truths and propositions to guide you over a lifetime. The principles should be based on timeless foundations that have stood the test of time. Buying and holding stocks at extreme valuation levels has NEVER been a winning bet.

In our case, the most honored principle is to “buy quality investments at good prices” (or even reasonable prices.) That does not mean to speculate or recklessly gamble. That does not mean to trade wildly. That does not mean to chase hot money. That does not mean to follow the government or Wall Street into the fun house.

It means discipline. It means fundamentals. It means history. It means wealth preservation and it means risk management.

In most ways, there has never been a worse time to be a stock investor if you believe in fundamentals and valuations. This is a time to be extra skeptical and to stick to risk management processes.

“Good habits lead to good behaviors. Good behaviors lead to good decisions. Good decisions lead to a good life. Live by principles and choose wisely.”

The Role of Your Advisor

As your financial advisor, my role often comes down to two critical areas. First is the technical and mathematical side of financial advisement. The financial world continues to get more complicated, not less complicated. My objective is to be in a strong position to assist you in sorting out the complexities of strategies, tools, resources, and offerings in terms of investments, financial planning, taxes, insurance, and estate planning, to name a few.

This portion of analytical services must be done through a lens of loss prevention, not only to prevent investment losses, but just as importantly to protect you from Wall Street, Big Banks, Insurance Companies, and the Government itself. These entities have become quite crafty of looting us and taking our money (legally), albeit with poor morals and ethics widely displayed through their past experience and misdeeds. Our puzzle is one in which we are trying to become wealthy while at the same time not being looted by those who are “offering us their helping hand,” which seem to find ways into our pockets.

The second role of being your advisor is to keep you focused on the behaviors of success. We often have a hard time getting out of our own way. Humans come pre-programmed with some behavioral flaws and biases that are well known and documented. These behavioral flaws are mixed in with human emotions, and when that happens, all logic and common sense gets thrown right out the window.

With the threat of large losses present in the equity markets, the better mathematical bet is in areas not related to extremely valued stock prices. Further, we know that the government is doing massive stimulus along with large injections of quantitative easing. It is a goal for central bankers to keep interest rates down (due to the massive leverage and debt in the system, including government debts).

We expect central bankers to print, stimulate, support, and bail-out players that are politically attractive to their own self-interests. We also expect the central bankers to support their own bond markets (in our case, we expect our Federal Reserve to defend, support, and control the U.S. Treasury bond market and interest rates). They will buy their own bonds issued by the Treasury Department if needed to fund our bailouts and continued government deficits no different than they have in the past.

What this means is that from an offensive and defensive investing perspective, we will assess the likely possibilities while using the most favorable probabilities. Thus, we should be tilting towards a strong defensive posture with our equity exposure, while stock valuations are at extreme levels. Our offensive opportunities will be targeted towards areas that tend to do historically well during a crisis with government support, stimulus, and bailouts. These offensive areas would include sectors like U.S Treasury bonds, gold, other precious metals, metal miners, and investments with reliable and consistent cash flows and distributions.

While we don’t know if we will be entering a period of inflation or deflation, patience will be a valuable practice. Our objective will remain the same. We intend to continue to build and protect wealth that results in not only protecting our hard-earned savings but also allowing us the opportunity to move much more offensively into opportunities that reveal themselves on the back side of a financial crisis. We are in the early innings of a financial crisis.

If you have any questions, please feel free to reach out and contact me. I am here for you.