PROLOGUE

Over the years of writing, I have come to realize that some followers of my work enjoy different themes of the published content. Some like the stories, some like the graphs and charts, some like the math and statistics, and others like the behavioral reminders or common-sense recommendations related to the process of long-term wealth building.

I remind readers that long-term investing success is really a practice of risk-management and probabilities. As investors, we are trying to allocate capital with positive risk-return profiles (that also are a good match with our underlying tolerance for risk.)

Many people go through life taking risks that I deem inappropriate (and often crazy.) Sometimes they are rewarded, other times they are punished. Usually over the long-term they are punished for consistently taking imprudent risks.

My approach to investing is to allocate capital with positive risk-return profiles. This must be consistently done with rationality while avoiding major mistakes that could expose us to catastrophic losses. It pains me to lose money or to watch someone else lose money that could have been easily avoided. The trick and challenge to long-term investing success is to stay rational in a very irrational world around us.

Anyone with extensive experience and exposure to financial markets can attest, “Markets can stay irrational much longer than investors can stay rational.” Your ability to stay rational is harder than we realize. That’s why bubbles are periodically created and why bull and bear cycles become a natural element of financial and economic markets.

My goal and objective as a fiduciary advisor is to help YOU stay rational in an irrational world, especially regarding financial markets. That often means putting YOUR financial interest ahead of my own personal financial interest. I’d make a lot more income if I just blindly allocated investor capital into the hottest areas of the markets. The easiest thing to do is gamble with someone else’s money. That would appease many people’s inner desire to “get rich quick” along with stroking their emotions revolved around natural greed instinct. That approach means riding the hot markets until they bust and the losses accumulate. Then just go and find new clients and start all over again. That’s actually the model of most Wall Street Financial Firms.

But it’s not the way I work or do business. I’m more interested in playing the long game. That means helping clients stay sane in bubble bull markets but then also giving them the encouragement and nudges that they need to invest in bear markets when their fear is elevated to the point of paralysis and inaction.

My priority is to help YOU make good risk decisions that will benefit you. I know that small short-term decisions will greatly impact and have long-term ramifications. If you get enough small short-term things wrong, it’s inevitable that you will make major long-term blunders.

I’ve been in accounting and finance for over 30 years now in my career. I’m aware of other’s propensity for debt, inability to control spending, over-allocating to social status cash vacuums (think big houses and fancy cars), all while making poor risk-management decisions. I encourage (plead) others to behave differently.

The difference between me and most others who don’t have a job in financial planning and wealth management is that I get to see others go broke behind the scenes. Few publicize their financial failures, their bankruptcies, their foreclosures, or their broken retirement dreams. Rarely do others bring attention to themselves for large losses made on low-probabilities investment speculation.

So on that note, I do my best to ensure that each of you give yourselves the best shot of succeeding by avoiding the most common ways of failing. Now onto the main content…

“None of this makes sense! This doesn’t even seem real…”

Statements like these are the most common I hear on calls or read in messages regarding the state of our financial markets;

- The economy is so bad that central banks need to constantly lower interest rates to allow borrowers to endlessly refinance. Short-term rates set by the central bank continue to be effectively at zero (or negative).

- The 10-year Treasury rate is 1.2% while inflation is running at 5.4% giving us a negative real rate of interest of 4.2%.

- Central bankers need to continuously pump billions of dollars into the financial markets as stimulus to keep the game going. The U.S. Federal Reserve continues to pump $120 Billion a month into the system buying $80 Billion a month in Treasury Bonds and $40 Billion in Mortgage-Backed Securities.

- The government’s CPI index indicated that housing prices have risen 2.6% over the past year, while other reports (and anyone who owns a house or wants to buy a house) suggest that home prices are up more than 13% year-over-year. The June single-family rent increase of 7.5% was the highest year-over-year hike since at least January 2005, according to the CoreLogic Single Family Rent Index. Clearly, whether people rent or buy, the cost of housing is escalating at a torrid pace.

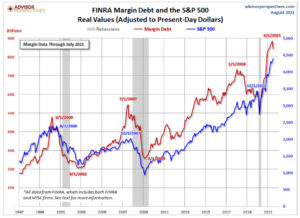

- Stocks bought on borrowed money (Margin Debt) are at all-time high while market risks are at all-time high.

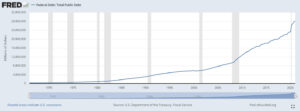

- Total U.S. Federal Debt has increased $22.36 Trillion over the past 20 years moving up from $5.77 Trillion in Q1 2001 to $28.13 Trillion in Q1 2021.

- While public debt exploded by over $22 Trillion, the size of our economy as expressed as Gross Domestic Product (GDP) only expanded by $12.12 Trillion over the past 20 years, moving up from $10.60 Trillion in Q2 2001 to $22.72 Trillion in Q2 2021.

- The government just announced the biggest long-term increase in food stamp benefits in the program’s history raising the program benefits by 25%.

- 8 million households face foreclosure or eviction.

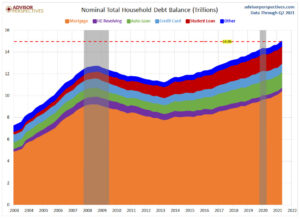

- Household debt increased by $313B to $14.96 trillion in Q2 2021. There were increases in mortgage balances, auto loans, and credit card balances. Household debt is continuing to climb to new all-time highs.

- Meme stocks like Gamestop (GME) are relevant in our financial markets. Gamestop was well on its way to bankruptcy losing $696 million in 2018, $471 million in 2019, and 215 million in 2020. Yet, this money losing company is worth almost $12 Billion in market capitalization.

- Crypto currencies like DogeCoin that were literally created as a spoof joke, has a market cap of roughly $42.4 Billion.

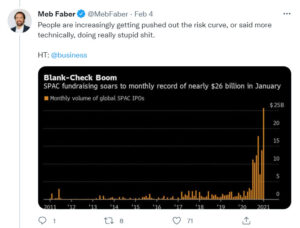

- SPAC’s (publicly traded blank check companies) have been a speculative mania even with horrible results.

We are certainly living in unusual times.

But here’s the thing. We are always living in unusual times. It’s just the degree and direction of the unusualness.

In regards to financial markets, we are always proceeding through a stage of a much bigger cycle. Boom and bust cycles are part of the natural order of economies and markets.

What we have learned is that investors are challenged in four general areas when it comes to long-term success in wealth building and investment success. Investors encounter the following four challenges:

- Investors are historically

- Investors are mathematically

- Investors are emotionally

- Investors are behaviorally

Successful long-term Investing boils down to buying quality assets at attractive prices (even reasonable prices) and then holding onto those quality assets over long-periods of time. Basically, buy low and sell high.

Buying and holding has its advantages and track record. With that said, there are definitely times in history where buying and holding was clearly the wrong thing to do. Selling at unusually high prices and avoiding the bursting of the bubble was the proper thing to do. These instances leave clues for those willing to pay attention and not repeat those mistakes.

Occasionally, bubble markets form where even quality assets are priced at unreasonable prices. The risk of losses outweighs the chance of expected gains. Buying at extreme prices and holding doesn’t increase our chance of success. Rather, it increases our probabilities of losses because we refuse to sell and continue to hold over-priced assets until prices revert down to historical norms. When we buy a business, or a share in a business, we are buying into a company with the hopes of sharing in the future stream of profits. As an owner, we are entitled to our fair share of future profits.

The Iron Law of Investing explains that the price we pay for that investment has more to do with our future investing results than any other factor. The higher we pay at the start of an investment, the lower our long-term results will be since we are paying a higher and higher price for our share of future profits. The lower we pay at the start of an investment, the higher the returns should be.

When we buy quality investments at attractive prices and hold on to those investments for long periods of time enjoying our share of the future profits, that is “textbook investing.” Buy and hold is a magic formula that allows us the enjoyment of the power of compounding interest.

If we overpay for investments, paying such a premium that it doesn’t make sense when compared to the anticipated future profits, but we do it anyway because we think that another investor is going to buy these shares off us in the future, that is no longer investing. That is speculating. It’s speculating (i.e. gambling) because we aren’t parting with our hard-earned savings to enjoy future profits of a business enterprise, we are parting with our hard-earned savings because we believe our neighbor will buy us out in the future at an even more extreme price.

Periodically, this shift in mindset from investing to speculating, is what allows bubbles to form because all good measures of prudence and risk management are thrown right out the window.

Younger investors are very willing to speculate in markets while using the term “YOLO” (you only live once). I think somebody forgot to tell them about “YODO” (you only die once as well – why rush your financial death?)

The Four Challenges In Action

Historically Challenged – Periodically over time, cycles can reach limits that are extreme when compared to normal instances. These limits can create anomalies in both directions including extreme bull/over-valued markets as well as extreme bear/under-valued markets.

Only through the study of history can we see these instances by comparing cycles to previous cycles.

What we learn from history, is that humans ignore history. Or put another way, “Those who cannot remember the past are condemned to repeat it” – George Santayana

We can clearly see instances where financial bubbles have formed in the past. We can look at the market conditions prior to the 1929 market crash, The Japanese Bubble in 1989, The Tech Bubble of the late 1990s/early 2000s, and finally the market conditions prior to the Global Economic Meltdown that occurred in 2008 and 2009.

Each of these situations had many things in common for those that are willing to look. But the majority of investors are historically challenged. They don’t want to look back in time. They don’t want to study history. They don’t recognize that conditions exist today that are the same as those that led to spectacular crashes in the past.

Bubbles are only recognized by the masses in hindsight. When we look back at the Japanese Equity Bubble, The Tech Bubble, The Housing Bubble or any past bubble, everybody now says, “How could people have been so dumb to buy into that nonsense?” Yet, they look at today and don’t see how they are repeating the same mistakes made in prior history.

When valuations are extreme, investors break the Iron Law of Investing. They pay such a high price in pursuit of profit that they negate all their future potential. The higher you pay for an investment, the lower your future returns.

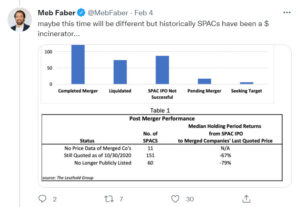

How do we know we are in a valuation bubble? We simply do the math and compare it to history. Here is where we are at right now as of the end of July 2021 going back over 120 years of modern financial market history.

(Credit to Jill Molinski and Advisor Perspectives)

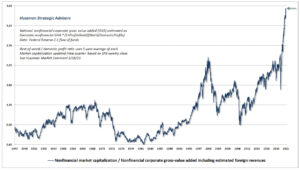

Mathematically Challenged – This one is a little harder to blame people. Most of us aren’t trained to be advanced mathematicians skilled in calculating standard deviations, correlation coefficients, understanding derivatives and the like. The good news is that we don’t have to be PhD’s in mathematics. But it might be wise to grasp the big picture of the work done by PhD’s and mathematicians who do the hard work for us.

To the surprise of many investors, there are already many models that have shown to be highly predictive in estimating long-term returns in equity markets. Note that this doesn’t imply, “the ability to short-term time the market.” It means the ability to estimate (quite accurately) the long-term returns of the markets predicated upon the price you pay for assets in the present.

Let me provide one such example. Again, we aren’t being asked to do the math and recreate the models and graphs. We are only asking ourselves if we could understand the mathematical implications of such models based on the history of markets.

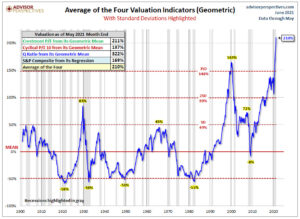

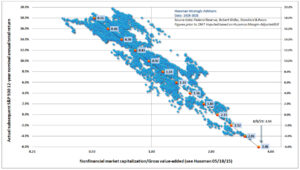

John Hussman of Hussman Strategic Advisors has developed one such model called the “MarketCap/GVA Ratio.” It begins by calculating a ratio of Nonfinancial market capitalization to Nonfinanical Corporate Gross-Value Add. The current MarketCap/GVA Ratio is 3.55 (a record high). The chart looks like this:

(Credit to John Hussman of Hussman Strategic Advisors)

The questions now are, “What does this show and why should we believe it?” It shows that this ratio is at record high. More importantly, this data supports and corroborates the “Iron Law of Investing.” When these ratios are plotted over time and compared to the actual subsequent S&P 500 12-year rates of return, it shows that the higher the ratio, the lower the 12-year actual return. The lower the ratio, the higher the 12-year actual return. The Iron Law of Investing is exposed with real historical and mathematical data. Here is the scatter plot graph below which shows these relationships between the price you pay and your long-term returns;

(Credit to John Hussman of Hussman Strategic Advisors)

The left axis is the actual 12-year return of the S&P 500 after recording the MarketCap/GVA ratio. Again, we don’t have to do the complex math. It’s being done for us by an actual PhD.

On August 6, 2021, the ratio stood at 3.55 (the highest recorded). This implies a 12-year future return for the S&P 500 that is below negative six percent (-6%). That negative six (-6%) is an annual rate of return. Any investor who is buying at today’s market prices is virtually locking in negative future returns.

Why would they do this? Why would any investor allocate their hard-earned savings to an almost certain negative rate of return past the next decade? Why? Because investors are both historically and mathematically challenged. They get so wrapped up in the bubble or believing that, “This time is different” that they don’t realize the future harm that they are doing to themselves.

One important point to make. This doesn’t mean that EVERYBODY is going to produce a negative rate of return over the next 12 years. It means that those who are invested today at these prices will have a high probability of generating a negative return over the next 12 years. If the market were to correct/crash next month, investors would be able to buy in at levels that may indicate a rather positive 12-year return profile. Why? Because they bought the SAME INVESTMENTS AT MUCH LOWER PRICES.

Emotionally Challenged – Investors become emotionally challenged in extremes at either end of the bull/bear cycle. Investors get wrapped up by the allure of easy and fast gains for a number of reasons (mainly greed). Who doesn’t want to make a fast buck? Who doesn’t want to accelerate their progress?

In bubble markets, investors continuously pay higher and higher prices. It feeds on itself. The higher prices rise, the more investors want to chase the returns. Likewise, in bear markets and after market crashes, investors shun the markets and act with heightened senses of fear. They won’t and don’t invest when prices are cheap and inexpensive.

When studying market cycles, we generally see that the masses do the exact opposite of long-term investing success. They buy high and sell low. Or they sell low and buy back higher. Greed and fear are powerful emotions.

It was Warren Buffett who has stated that his key to enormous success is to “Be fearful when others are greedy and be greedy when others are fearful.”

Right now, greed is in vogue. With some passing of time, fear will rear its head yet again.

Behaviorally Challenged – Investors often behave irrationally. This is often triggered by their emotions and inability to control themselves when it counts the most. This is where it can be very valuable to have and to follow proven principles of success when it comes to investing or wealth building.

Can you behave correctly when it counts? Can you execute on proven principles of success when it counts? Can you do the right thing when others around you are behaving irrationally? Can you tune out the noise of society, the press, your neighbors, your co-workers, and your own inner demons?

Can you live your life adhering to rules to live by without changing them on the fly or whatever appears to be the hot trend at the moment?

I like to have my personal principles well defined and always organized and certainly ahead of time. Principles can help you in all areas of life. In health, you could create, “Rules to live by” based upon the proven principles of health. Examples might include;

- Getting adequate quality sleep

- Reducing stress

- Eating fruits and vegetables

- Avoiding drugs, alcohol, and other harmful substances

- Getting in plenty of physical exercise

With wealth, can you do the following over an entire lifetime:

- Make a substantial living

- Live below your means and control spending

- Save consistently and pay yourself first

- Eliminate personal debt

- Always keep adequate and liquid emergency funds

- Invest prudently over a lifetime

- Use proper risk management in all areas of your life

We should all be attempting to live by proven principles of success that are timeless in nature and then behave each day in a way that forces us to follow and implement those proven principles of success.

A Generation of Challenged Investors

One item that is sticking out to me is the difference between what I would call “experienced investors” versus, “inexperienced investors.” The breakpoint appears to be around >50 years of age versus <50 years of age. The additional factor is the amount of wealth that the investor has accumulated.

Make no bones about it, across the markets, we are in a bubble and the majority of investors are on one side of the boat (grossly overweighted exposure to U.S. Equity Markets). However, those 50+ and with significant capital are a bit more willing to say things like, “Sure, I know we are in a bubble, but I’m going to ride it as long as I can.” Or, many 50+ year old investors are wisely saying, “I’ve been burned too many times before and I’m not getting burned again. I’m not going to speculate in frothy markets.”

I have to remind myself that investors who are 40 years of age and without significant capital accumulated have NEVER experienced a bear market. They have no frame of reference other than short-term pullbacks. They don’t realize how “real bear markets” work. If you don’t have at least 20 years’ experience, you are lacking perspective and experience because you’ve never lived through a bear market that wiped out a good chunk of your savings.

Further, our last battle with an inflationary economy was back in the 1970’s in the United States. Even those who are in their 50’s right now were not investors during an inflationary regime. They were still riding the school bus to elementary school back in the 1970’s.

This contribution of an enormous majority of investors who are historically and mathematically challenged is creating a perfect storm to a false sense of security in financial markets. The only lesson that an entire generation of investors has learned is “always buy a dip.” Combine that with a belief that passive investing means safe gains with never any losses, and it’s a recipe for a tragic outcome.

We have an entire market of speculators. We have an entire market that believes that central bankers can endlessly pump-up markets (they have never been able to do this in the past.) Note; central bankers and governments who are willing to print money have been around as long as money has been a unit of exchange in trade. Money printing creates bubbles and inflation.

The Challenge Today

The challenge for investors today is that we can’t invent the world we live in nor the market conditions in the present. We must play the cards dealt to us. But that doesn’t mean you bet the pot regardless of the cards you were dealt. Rather, you bet based upon the probabilities of winning (and protecting your stack when the probabilities of loss are significant.)

Markets move in cycles. Valuations move from high to low points and back again. The proven principle of success is to buy low and sell high. The proven principle of success over the long-term isn’t to “buy high and endlessly hope that another sucker will come along to pay us an even higher price.”

Many investors are under the illusion that they will just sell out when it counts. The question at that point will be, “Sell to who?” Every single share of stock in existence must be held by somebody at all times. That’s why prices in stocks can drop far faster during bear markets than people anticipate. When the speculators disappear (or get margin calls forcing them into being forced sellers,) there aren’t any willing buyers at extreme prices. The investors that eventually come in to save the day are the value investors who want to buy quality assets at good prices (or even reasonable prices) and the difference between today’s prices and what reasonable prices should be is rather significant.

Does anybody really know how all of this is going to play out? Does anybody know the exact timing that the valuations reset? Does anybody know how the systematic risks in the markets will alleviate themselves? The answer to these questions is, “NO. Nobody knows the short-term future.”

Prudent investors should be wise enough to know that market conditions constantly change and evolve over time. What is over-priced today can become under-priced tomorrow.

The Good News

We know from market history, when markets do the nutty things that they are doing now, it ends poorly for investors that ignore all principles of success when it comes to investing. However, it doesn’t mean that investors are stuck without options for the next decade. Sure, the outlook for US stocks over the next 10-12 years looks very bleak IF YOU WERE TO BUY AND OWN AT THE PRESENT LEVELS. But globally, things aren’t the same. Further, prices and valuations adjust over time even if that seems like forever forcing you to lose patience with rational logic.

The U.S. equity markets may be in one giant bubble, but that isn’t the case around the rest of the world. Globally, things are starting to stabilize as the rest of the world continues to deal and work through the global pandemic. Economies are hurting. But valuations are much more normal and attractive elsewhere.

Foreign stocks will likely be much more attractive than US stocks over the next 10-12 years. The US only represents half of the global market capitalization values for stocks. Moreover, the US only makes up about a quarter of global GDP. As we move forward, foreign economies and emerging markets will make up greater and greater percentages of the global economy.

Whereas the United States is currently at the highest valuation multiples in its history, the same isn’t true worldwide. European, Asian, and emerging markets are at much lower and more attractive valuations, and we fully expect opportunities to unfold in those areas.

For stock investors, it would be reasonable to assume that in the future, over 80% of your eventual stock holdings may end up being invested in companies outside of the United States. The vast majority of US stock investors are arguably greatly overexposed to a wildly overvalued market. The odds of this trend continuing indefinitely are rather slim.

Investors should prepare for US stocks at some point to return to mean valuations (which are a long way down from here). They also should prepare for their stock allocations to move towards foreign and global companies with much brighter prospects and valuations. The future probabilities are not the most promising for US stocks but rather foreign and emerging stocks in countries with far better growth and income prospects.

Behind the scenes, most investors are reacting to the markets with the attitude of “don’t know, don’t care.” Or they are betting on an outcome that has never happened ever in market history (that valuations can stay at permanently high plateaus.) That flippant attitude and ignorance towards market history will prove to be quite painful for them, as it always does when things eventually go the entire cycle. We can’t predict when the markets will finally crack. We can only predict that they will eventually crack, and the last place you will want to be is an investor holding the bag on over-valued securities with poor underlying earnings.

If we are supposed to “buy low and sell high,” investors nowadays have been programmed by central banks to buy high and hope to sell even higher one day.