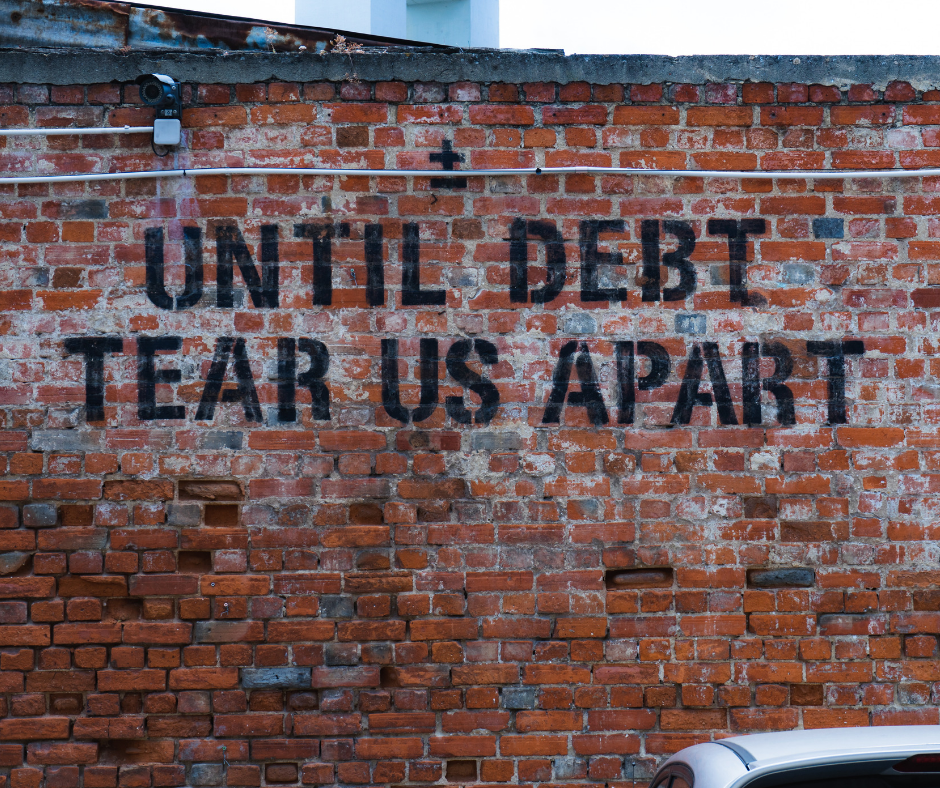

Even as a finance guy for decades, it took me a lot of years to fully comprehend the benefits and value of planning and living a DEBT FREE LIFESTYLE.

Sometimes I think the reason I and so many others wanted to resist the idea is because it seemed like an impossible dream or something that could not be accomplished. It can’t happen quickly. I takes years (often decades).

Earlier in adulthood we also have a naturally high debt to equity ratio in our households. It’s not uncommon for younger adults to have the full-monty of debts (I certainly did in my 20’s and 30’s). These would include;

- Student loans

- Credit cards

- Auto loans

- Mortgages

- Home equity lines

- Personal loans

Making things just a bit more complicated, earnings are usually very robust when we are in our 20’s and 30’s. It takes a while to figure out how to keep the earnings growing (some never figure that out). So, we are just left with a pile of debt that seems to never decline or worse yet, slowly keeps creeping up to higher and higher levels.

The first step in being debt free is:

HALTING ALL FUTURE GROWTH OF DEBT

Even the act of making a personal commitment to be debt free is enough to turn the tide for your future as you will no longer go out and take on new loans. That’s a big but important step. But it is a step worth taking.

Being debt free isn’t the one and only key to happiness but it certainly creates a situation where you have far less stress, more opportunities for exploration and personal growth, and a much higher margin of safety when things go wrong.

To get more tips on how to get out of debt sign up for your FREE download below: Five Steps To Becoming Debt Free.