The winter holidays are truly my favorite time of the year. This goes back to my childhood growing up in cold Niagara Falls on the Canadian border. No school, cold weather, sledding and ice skating, dreaming about my Christmas list, and then movies with hot chocolate.

My favorite holiday movie is “A Christmas Story.” If you haven’t seen it, you are missing out on life. It’s so popular that it’s almost on 24/7 during December on one cable TV channel or another.

One of the key and memorable scenes is when the father believes that he won a major award. Unbeknownst to him and the rest of the family, his major award turns out to be a horrible looking leg lamp that was shipped in a moving crate stamped with “Fragile” on it.

In all of his excitement, the father incorrectly pronounces “fragile” as “fra-gee-lay” and concludes that it “must be written in Italian.” The mother, corrects him by gently saying, “It says fragile honey…”

And then some euphoric madness ensues as the family races to unbox the unknown treasure that is contained inside. Alas…it’s a horrible looking leg lamp that the father LOVES but the mother HATES.

The father staged and glorified the leg lamp by placing it in the main living room window of the house so that the entire neighborhood could see it as they passed by the house. The irony of the storyline was how the mother took advantage of how “fragile” the leg lamp was by “accidentally” pushing it off the table, which caused it to suffer irreparable harm. The fragility of an item caused tremendous damage to the father but was a blessing to the mother.

This particular “FRA-GEE-LAY” scene has greatly humored me. Fragility is vital to me personally in health, relationships, and especially wealth building.

The fact is, none of us seek out to be financially fragile in life. Somehow it just happens to the majority of households. What is financial fragility? It isn’t straightforward, but it can be defined and studied. Fragile is all about being financially brittle. Fragility is when a household is harmed by stress, chaos, and volatility. Fragility lacks stability in the moment of truth; you know when you really desire financial stability (like in an emergency that requires money.)

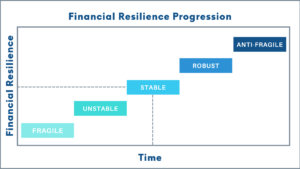

For those into financial planning and wealth building, finances and wealth usually move through specific stages during our lives. Many of us start in adulthood, genuinely fragile. We lack emergency funds. We work lower-paying jobs at an hourly rate. We usually have many forms of debt, often at high levels compared to our earnings. We don’t have much (or any) investments and passive income streams. If our car breaks, it’s bad news. If we lose our job, it’s bad news. If we get sick, it’s bad news. If we get into any type of financial pickle, it’s bad news.

Some move past this stage and become what I call, “Unstable.” It’s a step up from fragile but still not on solid and stable footing.

Households can then progress up to “Stable.” At this point, they may be able to tolerate a bit of volatility in their lives and come out the other side in one piece.

The next phase that households can progress to is what I call “robust.” Robust is where you are strong like a rock. It’s like the old Timex watch commercials, “You can take a licking and keep on ticking.” It’s being financially resilient even under times of duress, stress, volatility, and chaos in the world (or your personal situation.)

Finally, a few households reach the holy grail of wealth building and become, “Anti-Fragile.” In an anti-fragile state, you actually get stronger and improve your financial situation when the world around you is going through bouts of chaos, stress, disorder, and volatility. Anti-fragility benefits from volatility, chaos and disorder.

When we lift weights, we break down muscles with micro-tears. The muscles improve under a stress load. But the muscles come back stronger from the stress (they don’t stay weakened.) Muscles can be anti-fragile. We witness anti-fragile systems in science and the physical world with our human bodies.

The same is true with immune systems. With exposure to small doses of harmful particles and pathogens, our bodies react and build more robust immune systems to protect us. Exposure to stress improves the human immune system. Immune systems can be anti-fragile.

We see the same thing with bones that break. The fracture line is stronger than the original bones when they heal, so long as the damage doesn’t exceed reasonable limits. Bones can be anti-fragile.

The same can be true in finance and wealth building. A major stock market crash or bear market can wipe out a household. Owning over-valued stocks turns out to be fragile wealth. Owning businesses without revenues, cash flows, and earnings is fragile wealth. But that same market crash that can wipe out one household can create a lifetime opportunity for another anti-fragile investor. The best example of this is Warren Buffett. Over his investing lifetime, he consistently waited for markets and economies to enter into times of stress, chaos, and volatility. He made himself anti-fragile and watched his wealth grow exponentially over his lifetime utilizing this concept.

When a person who owns a home with too much debt and not enough liquidity loses their job, they go into foreclosure and loan default. They find themselves financially fragile. That same foreclosure and default allows another person who is flush with liquidity to buy the home at a discount to market value when the house is auctioned on the courtroom steps. The buyer is anti-fragile. The buyer benefitted from stress, chaos, and volatility.

How can this be? We all are in one global stock market. We are all a part of one global economy. We have one global financial system. Yet, households have an uneven and lopsided distribution curve regarding financial resilience.

The vast majority of households are fragile and unstable. Some eventually figure out and achieve financial stability. Fewer reach a level of being robust. Finally, only about 1% of the households achieve a level of anti-fragility where they play the game differently. They play from a position of being anti-fragile.

There are levels to this game. Understanding this is a critical component of achieving your goals, growing your wealth, and protecting/preserving your wealth.

As time progresses in your life, your financial resilience should be increasing. The progression looks like the below;

A household can reduce its financial fragility by practicing proven wealth-building principles. A household can follow clear and proven principles to decrease financial fragility over a lifetime. They include;

• Make a substantial living

• Live below your means and control spending

• Save consistently.

• Eliminate debt.

• Always keep adequate and liquid emergency funds.

• INVEST PRUDENTLY OVER A LIFETIME. GET RICH QUICK SCHEMES ARE THE DREAMS OF FOOLS.

• Use proper risk management in all areas of your life.

In part 2 of this series, we are going to get into more details on what makes up fragile investments. Investing is supposed to make us less fragile. But investing in the wrong things turns out to make households very fragile. Over history, we see this as the market goes through cycles from booms to bust. Bubbles form, and markets crash taking down paper assets with them. The wealth people thought they had turned out to be an illusion only revealed after the bubble bursts.

Just because something looks attractive, doesn’t mean it’s good for you. Just ask Ralphie’s mother.

In Part 2 of this series, we will look into the common denominators of fragile investments, how to spot them, why you need to avoid them, and look at examples of fragile investments. These concepts become critical in building anti-fragile wealth that will last a lifetime.

In Part 3 of this series, we will explore specific real-world examples of others who chased fragile wealth and the ramifications. There are lessons to be learned from the errors of others.