Sir Isaac Newton – December 25, 1642 – March 20, 1727

Sir Isaac Newton was one of the greatest minds in all of humanity rivaling that of, Michelangelo, Galileo, Shakespeare, Leonardo Da Vinci, and Einstein.

Newton was a physicist and mathematician who led a scientific revolution in the 17th century. His breakthroughs were in the fields of optics and the composition of white light and colors, mechanics which laid down the principles of modern physics, and his law of universal gravitation (gravity). He was the original discoverer of the infinitesimal calculus and his “Mathematical Principles of Natural Philosophy” written in 1687 was one of the most important works in the history of modern science.

But Newton had one more notable accomplishment to his life’s work. He went flat broke chasing a stock bubble.

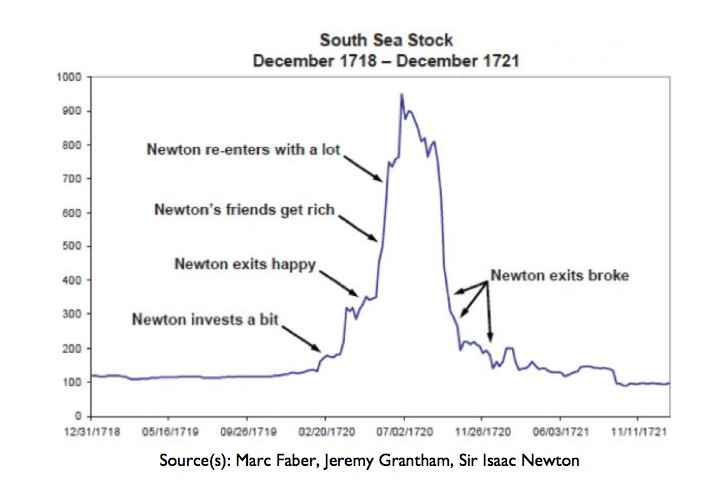

It was early in the 18th Century and the South Sea Company was granted a monopoly on trade in the South Seas in exchange for assuming England’s war debt.

Now who doesn’t like a good monopoly to invest in? Monopolies last forever, as do their unlimited profits (so we tend to believe). Just look at past monopolies that today’s investors are enjoying like Pan Am Airways, U.S. Steel, and Mohawk and Hudson Railroad.

Investors jumped on the stock as if they were investing in Tesla and the shares began to rise faster and faster.

Newton invested in South Seas stock and eventually enjoyed putting a little change in his pocket, probably for his collection of hairbrushes and saving up for a blow dryer once electricity was invented. Who doesn’t like free and easy money? Newton sold his stock in the South Sea Company in 1720 at an impressive profit.

But then something interesting happened to the South Sea Company after Newton sold his shares. They kept rising, and rising. This bothered the scientist tremendously. Why if he only held onto those shares his riches would have been multiplied.

The stock continued to rise and in the immortal words of famous investment advisor Paul Kindzia;

“You can’t stop the masses from enjoying a good bubble until they lose their underwear.”

Sir Isaac Newton, Mr. Smartypants himself couldn’t take watching everybody around him make what appeared to be free and easy money. The stock continued to escalate to higher and higher heights. The wealth being created was amazing. It was like Christmas every single day. Newton didn’t want to pass this opportunity up and thus he purchased even more shares of the South Sea Company at three times the price of his original stake. All his past profits were put back on the table. He was licking his chops driven by the dreams of the science kit and Legos he would be able to acquire for his birthday (I made that last part up…they didn’t have Legos yet back then.)

At this point, you could probably guess what happened next. Yeah, bummer…the South Sea Company was in a stock bubble. It eventually burst, and Newton made poo-poo in his Fruit-Of-The-Looms as he lost all of his savings. Reality set in for Newton – chicks don’t dig science guys without bling. Alas, and thankfully for the rest of us, Newton had to go back to his science pursuits rather than starting a hedge fund.

In Newton’s words, “I can calculate the movement of stars, but not the madness of men.”

It’s amazing what the emotion of greed can do even to the most intelligent of individuals who fail to consider the price paid for an investment. When you overpay for any investment, poor future returns are already baked into the cake, even if you have a cool 1980’s hairband haircut.

Going Three Layers Deep On Valuations

As we recall the lessons of our past, we must acknowledge that cycles and bubbles are part of markets. Markets are made up of humans and humans are irrational beings driven by greed and fear. Markets won’t change because humans won’t change. They are what they are.

Valuations One Layer Deep – A Look At Basic Valuation Metrics

Valuation Metric #1 – Shiller P/E (also known as CAPE ratio which accounts for the normal impacts of business cycles.) Conclusion – Extreme valuations surpassing those just prior to the Great Depression.

Source: Multpl.com

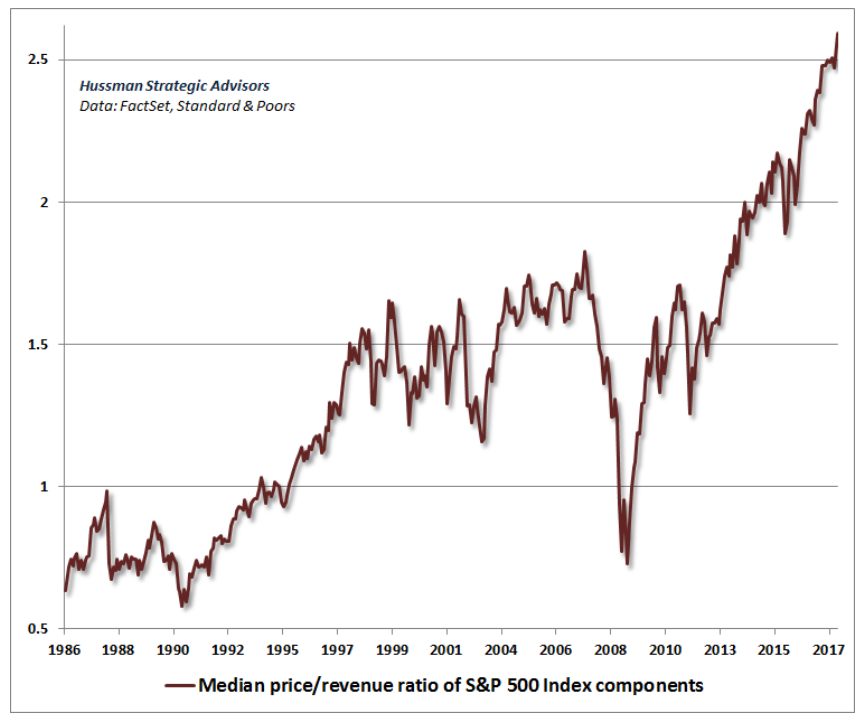

Valuation Metric #2 – Price to Sales Ratio of the Median Stock in the S&P 500. Conclusion – Extreme valuations that have significantly surpassed all-time highs. Investors are paying ever higher levels in stock prices for every dollar of revenue generated by corporations.

Source: Hussman Strategic Advisors

Valuations Two Layers Deep – We now look at some more sophisticated valuation metrics that provide insight into current market conditions.

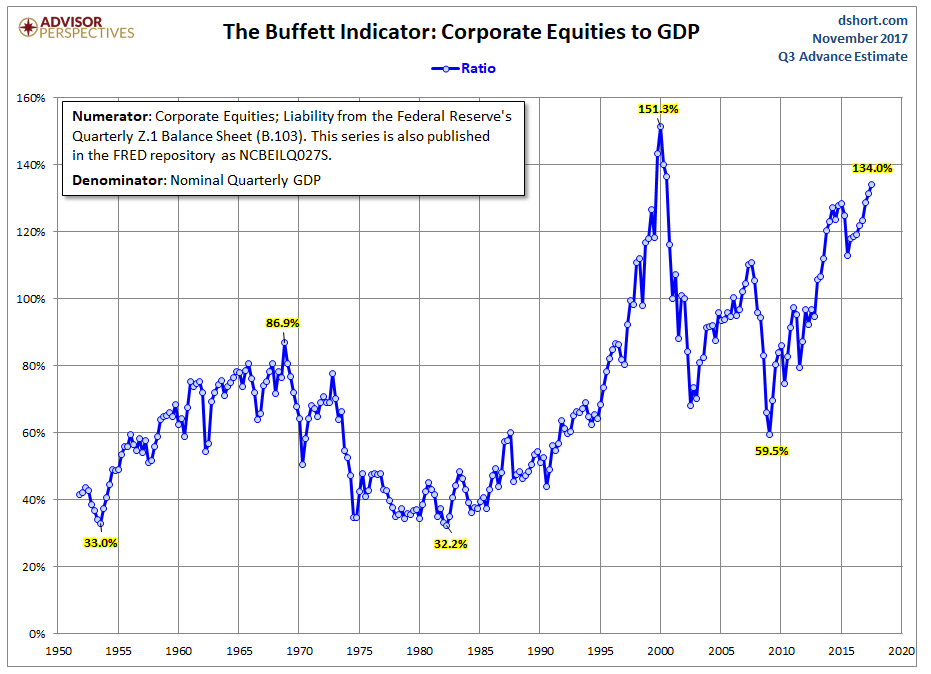

Valuation Metric #3 – Buffett Indicator, Corporate Equities Market Capitalization to GDP. This metric compares stock prices to the level of GDP (the underlying economy). Conclusion – Extreme valuations that have only been higher just before the crash of the tech bubble.

Source: Doug Short and Advisor Perspectives

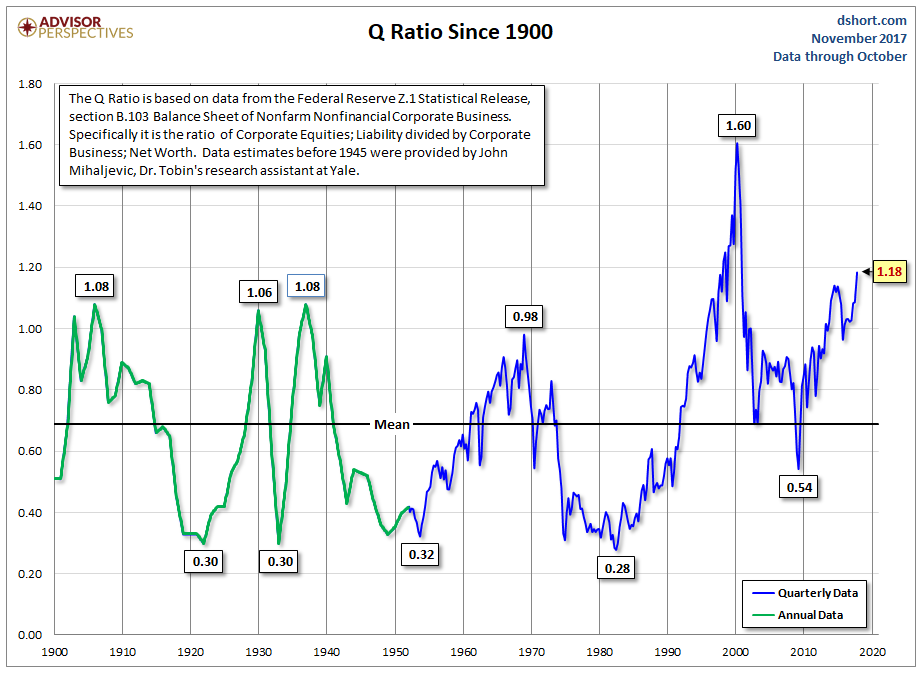

Valuation Metric #4 – Q Ratio. The Q Ratio was developed by Nobel Laureate James Tobin. It is the total price of the market divided by the replacement cost of all its companies. Conclusion – Extreme valuations that have only been higher just before the crash of the tech bubble.

Source: Doug Short and Advisor Perspectives

Valuations Three Layers Deep – We now look at some of the most sophisticated valuation metrics that provide insight into current market conditions.

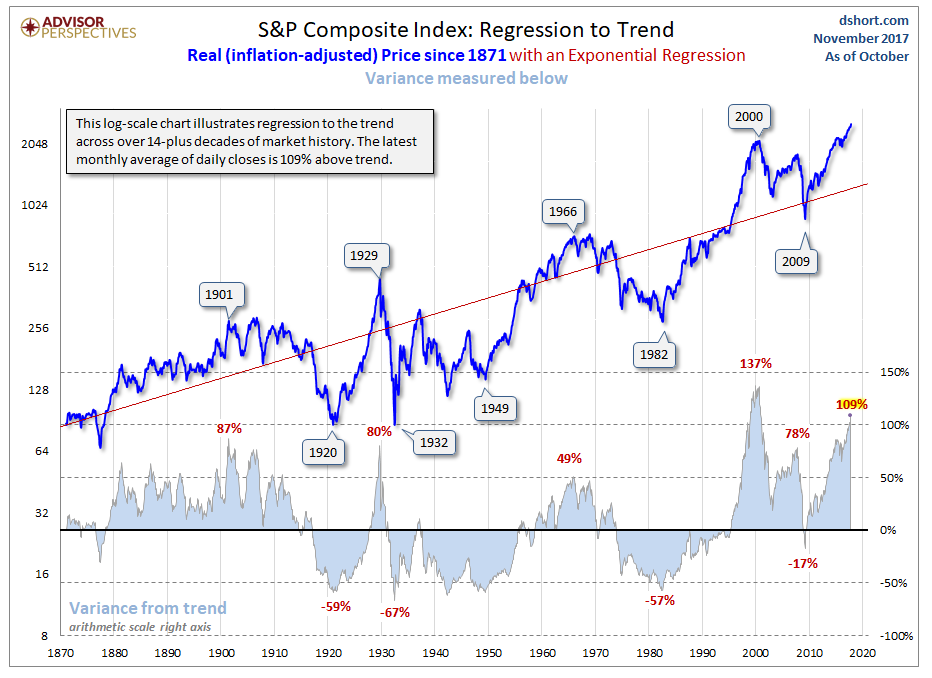

Valuation Metric #5 – S&P Regression To Trend. The idea here is that things revert back to the mean especially in the stock market and over the long-term, over-performance turns into under-performance and visa versa. Conclusion – Extreme valuations that have only been higher just before the crash of the tech bubble and significantly higher than levels before the Great Depression.

Source: Doug Short and Advisor Perspectives

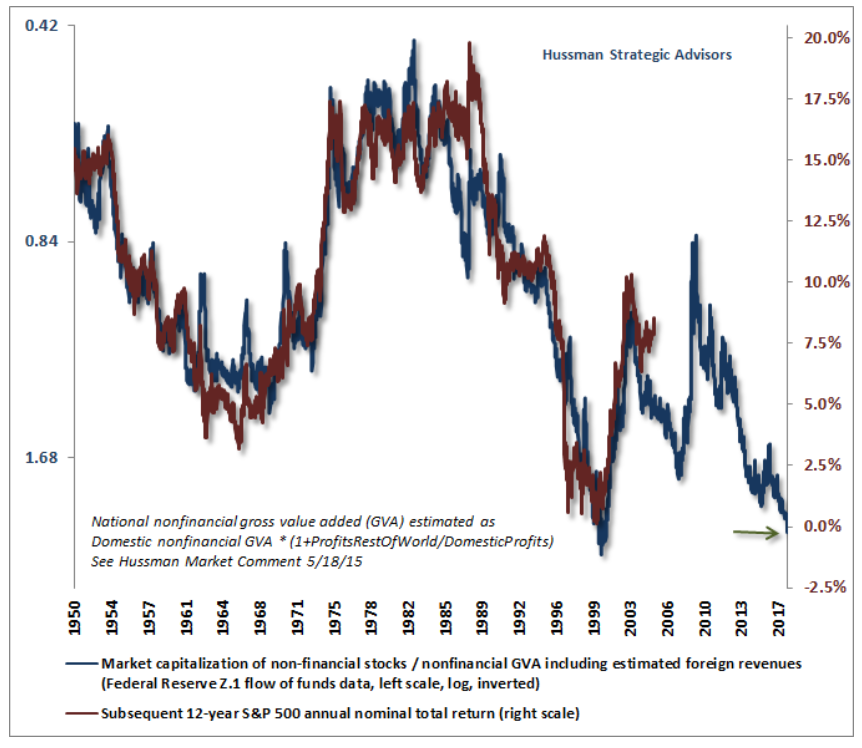

Valuation Metric #6 – Market Capitalization of Non-Financial stocks/Non-financial Gross Value Added (GVA). The idea here is that long-term GDP can be reasonably predicted based on economic productivity metrics and labor forecasts based on known demographic trends. Since corporate revenues and earnings make up a fairly consistent component of overall GDP, they can also be reasonably estimated over long-term forecasts. Thus, comparing the current price levels of equities to Gross Value Added allows an investor to make reasonably accurate assumptions on expected 12-year rate of returns based on those prices paid. Conclusion – Investors buying equities at these current levels should expect a 12-year annualized rate of return of around 0% (with large negatives along the way as prices revert to the mean between now and then). Thus, investors who are paying current prices are only subjecting themselves to extreme levels of risk with little to no upside until prices come down to more reasonable and profitable levels.

Source: Hussman Strategic Advisors

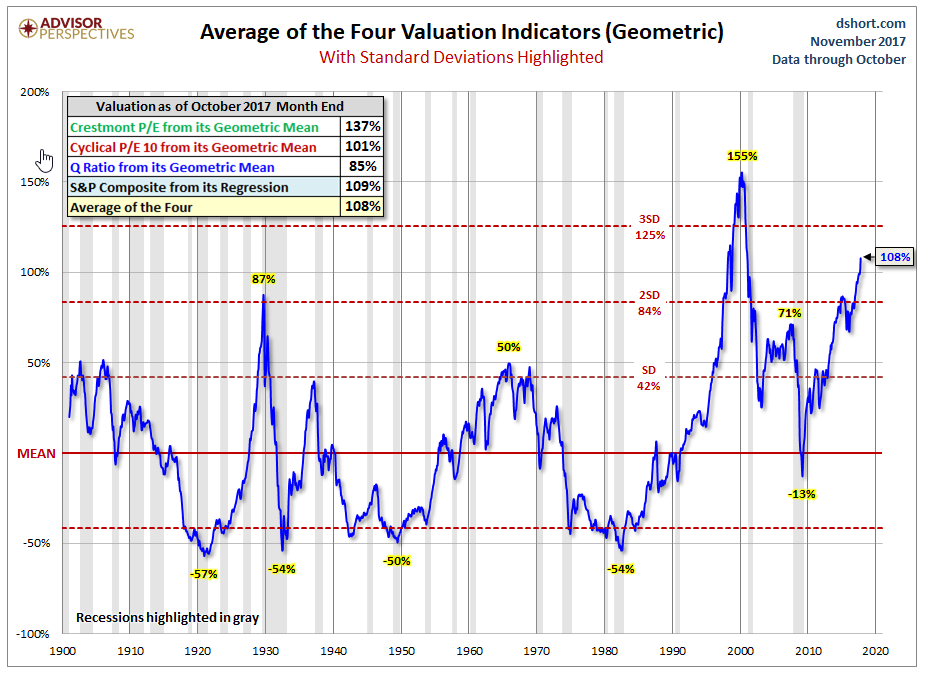

Valuation Metric #7 – Geometric Average of the Four Valuation Indicators. Using averages of four but different methods of valuation metrics can provide investors with an overview to ensure that they aren’t just paying attention to one single outlier metric that may not accurately reflect current valuations. Conclusion – Full on bonkers. Buyer beware.

Source: Doug Short and Advisor Perspectives

Corporate Earnings Shenanigans

We have one last item to be very skeptical of coming from Wall Street. Wall Street loves to tout the growth of earnings as a reason for the ever-increasing levels of stock prices. They have very good reason to do that as they want to keep investors in the game paying higher and higher prices for their offerings so that they can continue to collect their fees and commissions.

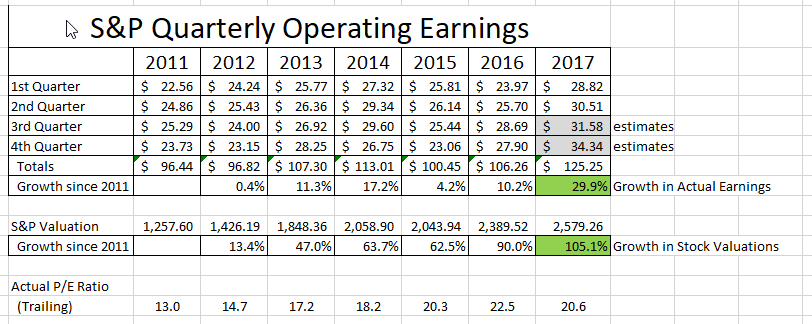

But most investors don’t know that corporations report two different sets of books and numbers. The first (and most highlighted and publicized by the media and Wall Street) is what is called “operating earnings.”

Operating earnings is what Wall Street wants us to focus on. It is the level of earnings that corporations make from what they describe as the “normal course of business.” But something isn’t right in fantasy-land. If we look at the chart below, we can see that the growth in operating earnings since 2011 has been up 29.9% yet stock prices have gone up almost 3 ½ times those levels. Should you be skeptical? Yes, you should be. Stock prices can’t deviate from earnings indefinitely. Eventually, they must reconcile and correlate.

Source: Standard & Poors and Paul Kindzia

What this is indicating is that investors have been paying higher and higher levels for the underlying stocks and earnings.

The Second Set Of Books

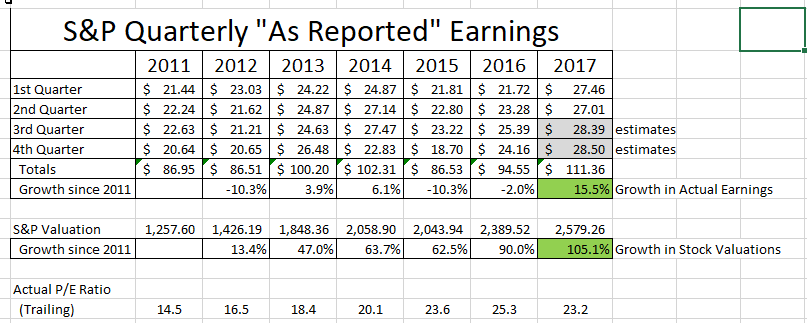

What most investors don’t realize is that these same publicly traded companies must report earnings to the SEC based on Generally Accepted Accounting Principles that are audited by CPA firms. This second set of books produces what is called, “As Reported Earnings.”

What’s the difference between the two sets of numbers? There is a big difference. With the first set of books, corporations can report earnings from what they consider, “The normal course of business.” That means what they would expect their business to produce in normal and consistent ways. This allows them to ignore actual expenditures, costs and expenses related to what corporations would describe as “One-time events” or “Unusual Items.”

This is where the magic of fictional accounting enters the scene. I want you to imagine that a corporation acquires another organization to boost their earnings per share. If the acquisition turns out to be a big flop and lost money, corporations can write-off the losses and ignore those losses in “operating earnings.”

There are all kinds of examples of how corporations exclude real losses from operating earnings by doing accounting tricks. But SEC rules mandate that all publicly traded companies also report what is called, “As Reported Earnings.” Consider these earnings to be “the real deal earnings” without all the tricks, smoke and mirrors.

As reported earnings have to include all of the corporate blunders and true costs of operating the business. Below are the “As Reported” earnings over the same 2011 – 2017 time period.

Source: Standard & Poors and Paul Kindzia

Now the discrepancy is even larger. We have actual “As Reported” earnings that have only grown 15.5% over the past six years yet the prices of stocks have gone up 105.1%. Buyer beware. Investors are being fooled and being sucked into the bubble due to greed and the dream of easy money.

Conclusion: Markets have been and continue to be at extreme levels of valuations that based on past history will end very badly for investors buying at these price levels.

Add in the additional factors that are distorting the books of companies such as borrowing money to buy back shares (decreasing the float), tax inversions, re-financing debt or issuing large amounts of debt that must be dealt with down the road and you have a recipe for an eventual day of reckoning.

How To Make Money and Build Wealth In Financial Bubbles Safely

Building wealth requires one to see the similarities from financial history and what happens when you get into valuation bubbles and debt bubbles. This allows you to avoid those eventual losses on the back end of the cycle.

Building wealth during bubbles means keeping your personal debt levels low or better yet – getting your household debt free. Avoid the financial imprisonment that millions of others are experiencing often with life sentences.

Building wealth means doing very basic things; making a strong income from personal productivity, living below your means, building emergency funds, paying off debt, and avoiding bad investment risks by investing wisely FOR THE LONG TERM.

The rewards will be had on the other side of the mountain when prices reset and the debt bubble collapses.

“The one thing we really learn from history is that humans usually completely ignore history.”

The Dangers of Buying And Holding During High Valuations

If you are an investor who is buying or holding large amounts of equities during times of extreme market valuations, you are basically saying that price does not matter at all in investing. But what you should know is that eventually PRICE ALWAYS MATTERS.

Now a comment that is made very often by investors is, “But if I am too conservative for a period of time during market extremes and generate a low return, I can’t/won’t meet my goals. Plus, everybody else is making easy money while I’m missing out.” But this mindset is assuming that markets will stay at extreme valuations forever and ever.

The question you need to ask yourself is this; “If you don’t think you will reach your goals while temporarily earning a low rate of return to protect yourself during market extremes, how do you really believe you will reach your long-term goals if you watch your capital base diminish 40%, 50%, 60% or more?”

We have only been in extreme conditions like this a handful of times in market history and they all ended terribly with very large investor losses for those taking on that investment risk. Ask yourself what would happen to your retirement plans if you lost 50% or even more than 70% of your capital base?

Could you hang on and recover from such a loss?

The value of having a trusted advisor on your side is that they can help guide you during these times. We are here to help you navigate what should be very challenging market conditions during the second half of the market cycle. And here is the good news…For those wise investors who pay attention to price and value and protect their capital during bouts of extreme valuations, they are best positioned to take advantage of lower prices and better values once market conditions reset to historical norms.

The key to successful investing is to buy quality investments at fair prices (or better yet – attractive prices.) If the price isn’t right, you should have the fortitude to simply not buy and wait for better prices to come along in the future.

What would it feel like to boost your wealth significantly over the coming decade? Avoiding hhigh-riskinvestment conditions is one of the best tactics and strategies available to make that happen.

If you should have any questions or need to talk, please feel free to contact me. I am here for you.

Very kind regards,

Paul

Enjoy The Bubble, Just Not Like Isaac Newton

For more resources on our current financial bubble, feel free to access these archived resources on my website and blog;

- September 29, 2017 – https://paulkindzia.com/be-ready-for-anything-but-especially-opportunities/

- June 25, 2017 – https://paulkindzia.com/investors-are-vacationing-in-finance-fantasy-land-again/

- May 12, 2017 – https://paulkindzia.com/wall-street-untruths-and-bad-math/

- April 12, 2017 – https://paulkindzia.com/poker-patsies-investing/