I’ll cover a few important valuation updates and metrics first before getting into the good stuff on the bad behaviors that I see in today’s financial markets and economies.

(Courtesy and credit to Advisor Perspectives)

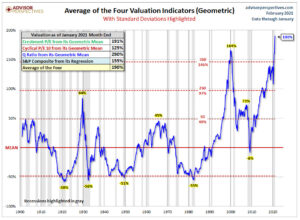

We begin with the chart above, which shows valuations over the previous 120 years of U.S. stock market history. We are now 190% above the long-term mean using the averages of four different (but very reliable) valuation metrics. Note that trouble really starts to brew once you get above 1-Standard Deviation above the mean. The previous three epic bubbles all occurred when valuations climbed above the 1-Standard Deviation line (about 50% over-valued).

I remind investors that when dealing with averages, we need to realize that to get to that average, you need to spend time BELOW THE AVERAGE to have things average out over time. Today’s investors have completely blocked out that mathematical reality as they have come to believe that stocks will forever trade “ABOVE THE MEAN” forever into the future.

(Courtesy and credit to Advisor Perspectives)

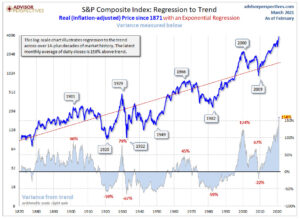

The above chart is a “Regression To Trend” that goes back to the year 1871. You should take comfort in the fact that it’s clear that stocks go up in value over the long-term but at a pace that is correlated to GDP growth and corporate earnings growth. A long-term and growing stock market should happen as the economy expands and increases over time. But investors should also take warning when valuations get too far ahead of themselves. One certainty of the stock market is that over performance turns into underperformance. Those bouts of underperformance can be vicious and longer-lasting than investors realize.

I offer you some fun and useful math based upon the regression to the trend shown above. We can see that during the tech bubble of the late 1990s, the valuations got 124% above the trend. To remind investors of some NASDAQ history, the NASDAQ 100 fell 82% once the bubble burst from top to bottom in 2000/2001.

We are currently sitting at 158% above the trend. If the S&P 500 were to revert to the trend line (not even below the trend line, which is also part of the way markets work in reality), the S&P 500 would return to a price level of around 1,600. Investors who continue to speculate at the current valuations would be staring at near 60% losses if we reverted back to run-of-the-mill average historical valuations.

Valuation levels are so extreme that mathematically, any investor buying the S&P500 at today’s levels should expect a NEGATIVE return over the next 10-12 years.

If we are supposed to “buy low and sell high,” this isn’t buying low. This is clearly buying at insanely high prices and praying they go even higher.

THE ACTION ITEM IS BUYER BEWARE.

Your Neighbors Are Crazy

For reference, when I speak about “your neighbors,” feel free to insert any of the following variations that work just as well; your cousin, your brother-in-law, your co-worker, your boss, your elected official, your friend at the golf course or book club, the guy at the gym who pulls up in a fancy sports car and gets out wearing a tank top and sunglasses.

I often get a comment or email along the following line, “Since the market hasn’t cracked yet, we obviously aren’t in a bubble. Otherwise, it would have fallen already.”

There’s a difference between what I respond with and what I’m thinking in my head. What I’m thinking in my head when I hear this logic is, “Your neighbors are crazy.”

You see, EVERYBODY wants to get rich, and it’s driving EVERYBODY crazy. Your cousin, your brother-in-law, your co-worker, the guy at the gym who works out in sunglasses, the 12-year old kid next door who trades GameStop options at Robinhood, they all want to be rich.

If I tell the 12-year-old kid next door, “Hey look, if you get a paper route, save your cash-o-lah and invest it wisely, you would over long periods of time be able to grow that money a good solid 8%-10% a year. “ Now you know as well as I do that the kid is going to look at me and sarcastically respond back with, “OK Boomer, thanks for the advice. I think I’ll stick to my options on Robinhood.”

8%-10% annual growth over decades would turn that kid into a wealthy individual. But in the here and now, making any such rational suggestion to them would be received as just plain nonsense. Why? Because the kid doesn’t know any better.

I could explain all I wanted to about how GameStop is an actual company with storefronts and sells video games as a retail business. I could explain to the kid how that business model was virtually identical to the one utilized by Blockbuster Video two decades prior. I could explain how Blockbuster Video went bankrupt as videos on demand came along and people stopped renting videos or buying VHS movies. The stock crashed, and investors lost all of their capital.

But from the kid’s perspective, it’s all irrelevant. He’s not thinking about investing in a business for the long-term. He’s trading options. He never personally picked up a pizza and VHS tape (or later DVD) from Blockbuster on the way to a Friday night date night. The historical lesson for him is beyond his scope of comprehension since he never experienced it firsthand.

The kid has never seen anything than a bull market spurred on by endless central bank policy, falling interest rates, and massive global debt increases. The kid has never personally lost money in a bear market. The kid doesn’t even know what a bear market is. The kid wasn’t even alive when the global economy collapsed the last go-around.

Armed with historical knowledge and decades of personal experience, I know the kid is crazy. But the kid doesn’t know he’s crazy. To the kid, he’s acting perfectly rational based upon his personal wants and desires.

Many will say, “But GameStop is just a one-off…, and obviously, these kids are crazy…” But GameStop is not a one-off. GameStop is just a magnified cartoon of the entire U.S. stock market right now. There are hundreds and hundreds of companies that trade for insane valuations, and the companies don’t have a single penny of earnings to show for it.

There is a more significant theme at play during bubble markets. Investing time horizons get compressed in bubble markets. Why settle for 8%-10% historical annual returns when you could try to achieve that in a calendar quarter? Then, why settle for that return in a calendar quarter when you could strive to achieve it in a month? How about a week? Maybe a day? Perhaps if you are quick with your fingers and pay attention to your little smartphone Robinhood App, you can make that in an hour or a minute.

The guy at the gym with the sunglasses and the fancy sports car…he’s leasing the car and lives in an apartment that he could barely afford. But he’s trading options on Robinhood.

You know as well as I do that your co-worker is crazy. Your boss is crazy.

But everybody wants to get rich, your neighbor is crazy, and it’s driving YOU crazy.

Stepping back for yourself, you know something doesn’t seem right in today’s markets. You know something doesn’t feel right, or look right. But you can’t put your finger on it.

But the thought of having your golf buddy brag about his big gains in some tech-stock (where the underlying business has never made a penny in profits) is too much to bear. You can’t STAND IT! You are losing your mind listening and watching supposedly “EVERYBODY GETTING RICH!”

And that’s how bubbles happen. The collective population loses their minds and loses perspective because their behaviors mimic their crazy neighbors who aren’t rich and will never be rich.

Actual S&P 500 Corporate Earnings

A math and financial history nerd like myself can show you actual S&P 500 corporate quarterly earnings for the last few years. Here you go…

![]()

I could point out the fact that S&P 500 earnings peaked in the 3rd Quarter of 2018 at $41.38. I could point out that almost three years later that quarterly profits would still be down/flat. But we know stock prices have gone to the moon. Why? Because your neighbors are crazy.

You can blame the pandemic if you want for the weak corporate earnings. There’s only one problem with that theory. The pandemic didn’t even kick in until the 1st and 2nd quarter of 2020. Go back above and look again at the actual corporate quarterly earnings for the few years prior? Your eyes aren’t playing tricks on you. Corporate quarterly earnings have been flat well before the start of the pandemic.

So You Want To Be Rich?

Bloomberg recently updated the metrics required to join the ranks of the richest 1% in 30 different countries (“rich” varies by country.) You can find those metrics here if interested.

For the United States, the minimum net wealth required to join the top 1% was $4.4 million.

Some questions to ponder;

- Is your co-worker wealthy?

- Is your boss wealthy?

- Is your sister-in-law wealthy?

- Is your book club friend or golf buddy wealthy?

- Is sunglasses dude with the sports car at the gym wealthy?

The answer to the above is statistically a resounding, “NO.” They are not wealthy. However, most are either desperate to be wealthy or often pretending to be wealthy.

Just because your boss lives in a big home, it doesn’t mean that they don’t have a $700,000 mortgage, two leased luxury vehicles, a home equity line of credit, $50,000 of credit card debt, and a personal loan from their mother-in-law.

Most Americans are broke.

Most Americans hate their jobs.

Most Americans are loaded up with debt.

Most Americans lack even a basic emergency fund.

At the same time, EVERYBODY WANTS TO BE RICH!

That doesn’t mean that everybody is a bad person. It doesn’t mean that they lack ethics or morals. It just means that sometimes it seems more attractive to kill the pain of daily life and opt for a shortcut to financial security.

In 1999, you could sense we were in a bubble because it was housewives and taxi-cab drivers passing out hot stock tips. In 2020 and 2021, it’s Uber drivers, teenagers, and your friends at the gym.

Bad Risks

I’ve been in the accounting and finance industry now for three decades. I’ve lived through two previous bubbles personally; the tech bubble of the late 1990s and the run-up to the global economic meltdown that crashed the markets in 2008 and 2009.

I’ve learned that investors usually take bad investment risks and lose their hard-earned savings for two main reasons:

- They don’t know any better. Call it basic ignorance or lack of personal experience. The kid next door never heard of Blockbuster, wasn’t even born during the tech bubble, and isn’t thinking about investing in businesses but rather is more interested in trading electronic pieces of paper. Do we really expect your golf buddy to study financial market history?

- They need a miracle. Look, as you are well aware, life is hard. Jobs are hard. Making money is hard. Keeping up with your crazy neighbors is hard. Saving money is hard. Doing investing research is hard. Work sucks. Your boss sucks. Your financial bills suck. The vast majority of people lack any type of basic financial planning. They get to a point where they are desperate for hope. They need a glimmer of something that will kill their daily pain. Telling them that if they do things prudently and correctly, they can be wealthy decades later, and it’s deflating and demoralizing. If you have no other hope, why wouldn’t you chase what is perceived to be “easy money” in the stock market? After all, everybody else is doing it, and it appears to be working… Until it doesn’t. Then things quickly spiral out of control making a bad financial situation much worse.

In an optimal world, you never want to take lousy investment risks.

My job as a fiduciary advisor is to make sure that you aren’t one of those that “doesn’t know any better.” The good news is that you don’t have to go and study market history. You don’t have to become a financial valuation expert. You don’t have to read mountains of research and market information. But you do need to have the discipline to avoid bad behaviors and avoid taking bad risks.

You also need to execute on the fundamentals of financial planning and wealth management. The entire purpose of financial planning and wealth management is so you don’t get backed into a corner where your only hope is an economic miracle. You don’t want your financial future contingent on a lottery ticket. That’s why we save our hard-earned money, live below our means, pay off our debts, and invest prudently.

Everybody wants to be rich. People not only want to be rich, but they go out of their way to cut the corner and take a perceived shortcut. Everybody wants results sooner.

But prudent investing is all about playing the long-game. Nobody looks back on 1998 or 1999 and tells me, “I wish I would have piled even more into stocks during that bubble.” Nobody says that. Rather, everybody looks back with hindsight and says, “What were we thinking?” Or, “I wish I would have just protected my hard-earned savings.”

The good news is that by avoiding bad risks, you position yourself to take advantage of good bets in the future. Bubble markets are the opportunity to accumulate cash and stockpile dry powder for future deployment.

With that said, when markets turn sour, so do human emotions. When markets correct and bear markets arrive, investors are over-loaded with fear. They don’t want to invest after large losses occurred in the markets. Nor could they invest even if they wanted to because they lost all of their savings. Investors become paralyzed with fear. By then, the greed and envy of the bubble is long gone.

But it’s when good investments are being offered at attractive prices where you get great upside potential along with much reduced risk. Why less risk? Because the prices have already fallen and everybody is already fearful.

It was Warren Buffett who stated, “Be fearful when others are greedy and be greedy when others are fearful.”

Good habits lead to good behaviors. Good behaviors lead to good decisions. Good decisions lead to a good life. Live by principles and choose wisely.

I encourage everybody to make wise decisions while also remembering, “Your neighbor is freaking crazy.”