Equity Market Conditions – Extremely Overvalued and Fragile Dynamics

Stocks are often referred to as “paper assets.” Owning a “hard” asset means you own something physical like a commercial building that charges rent, a bar of gold, a barrel of oil, or a small business like a pizzeria that sells goods in exchange for cash. What you own with a paper asset (or hope to own) is a piece of paper that shows ownership of a small sliver of a business that is publicly traded.

When you own that piece of paper (which nowadays isn’t even a piece of paper but rather an electronic record), it allows you – the partial owner – to have a right to your share of the underlying business’s revenues, cash flows, earnings, and dividends. I should clarify and state more importantly that you own the right to “future” earnings and cash flows since past earnings were the right of the former stock owner prior to you buying the shares from the seller.

Future earnings on brand new companies using new technologies can be quite difficult to estimate. The company may be the next big thing or the new enterprise could quickly be surpassed by competition right out of the gate and never turn a profit. That’s not always the case with bigger and more established companies that have been around for years and years. These more experienced companies collectively have more predictable revenues, cash flows, and earnings which are based on both their prior proven history combined with the outlook for our overall economy over the coming years.

We are now at a critical crossroads with our equity markets. Investors are paying extremely high prices for these electronic pieces of paper that gives them the right to future earnings and cash flows. The problem is, the future earnings and cash flows that these investors have a right to receive are not impressive based on the price that they are paying for those shares of stock at today’s levels.

Alas, at some point, investors worldwide but especially here in the United States are going to collectively realize that those little pieces of paper called “stock certificates” are not worth what they thought they were worth. It is like past euphoric markets such as real estate over a decade ago. People paid too high of price for houses and then were stuck holding the mortgages while prices plummeted. What looked like a “sure thing” quickly turned into big losses.

What we have seen over the past 9 years are corporate earnings that did not grow impressively. Corporate revenue growth has been stagnant (or even shrinking with many companies). Corporate earnings growth has not exactly been something to celebrate. The economy never really got back on track after the global economic meltdown of 2008 and 2009.

But that didn’t stop investors from constantly paying higher and higher prices for those same paper assets that have the same lackluster future projections as we look out over the next 5 or 10 years.

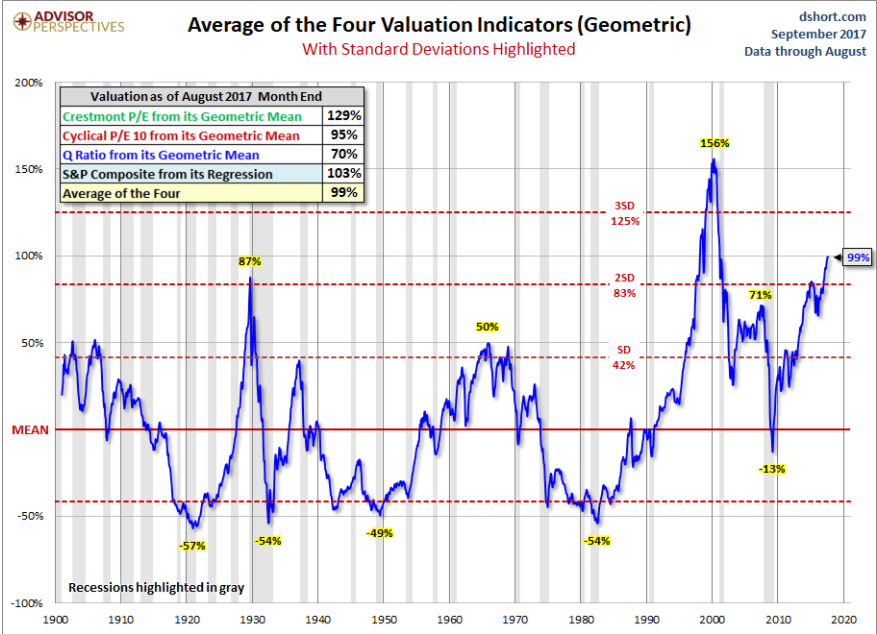

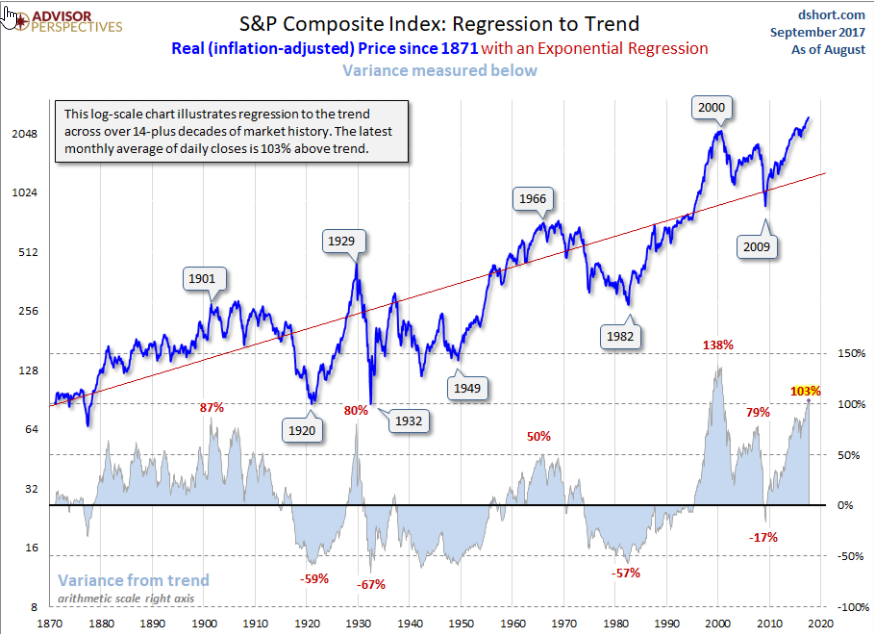

“By some metrics like comparing price to revenue on the median company in the S&P 500, we are now at the most over-valued level in the last 120+ years of equity markets.”

Using some of the more robust valuations metrics available, we can see that we have surpassed the valuation levels that preceded both the crash of 1929 which led to the Great Depression and the global economic meltdown of 2008/2009. We are only being outdone by the Technology Bubble of 2000 when so many companies had nose-bleed valuations but completely lacked actual revenues and earnings.

Here’s what we know regarding the state of the current equity markets; We know that we are well past the long-term trend for equity prices (going all the way back to 1870). We know that in the past, when markets have gotten this far ahead of themselves, the second half of the cycle eliminated most if not all the paper gains that investors felt so good about in the years leading up to the over-valued state of markets.

If markets “revert to the mean” like they have always done in the past, then the adjustment in stock prices is going to be very painful at this point for those investors who are left taking the risk in ownership of those stocks.

Remember, owning these paper assets gives you the right to your sliver of the future earnings and cash flows (which are reasonably predictable). The only variable left is the price you pay for the right to those future earnings and cash flows. The price being paid by current investors doesn’t really make a lot of sense from a risk/return basis.

What we don’t know, is when the adjustment period and the reversion of the mean will take place. It could be in two weeks, two months, or another two years. Nobody really knows. The only thing that we do know is that investors are feeling good about their paper assets but that has a funny way of turning on them as the second half of the investment cycle plays out.

Bond Market Conditions – Central Bank Manipulation Continues To The Downside Along With Weak Economic Underlying Growth Prospects

10-year interest rates from CNBC this morning were as follows:

The interest rates on 10-year bonds tell us a lot about the 10-year outlook for the economy. If things look bright with elevated levels of future growth, interest rates would be high to reflect the outlook for that growth. If long-term growth looks muted or suppressed, interest rates reflect that outlook as investors look for a safe place to park their hard-earned savings.

Our own central bank at the Federal Reserve has now acknowledged that future growth in the U.S. expressed in terms of GDP is now below 2% well into the future. The economy is stuck.

I like doing a few exercises to show the status and effects of the current economy expressed in interest rates. If you had $1,000,000 (you are a millionaire bond investor) and bought government bonds in the following countries with your million dollars, your annual interest income would only be;

- United States – $22,640

- Germany – $4,600

- Japan – $280

- Great Britain – $13,730

- France – $7,437

Let’s take it one step further. Let’s say you wanted to retire and you wanted to replace a six-figure income ($100,000) but you didn’t want to put your capital into the over-valued stock market. You wanted the safety, security, and guarantee of a government bond. Below is how much you would need in capital to earn $100,000 in interest income so you could live in retirement at that desired lifestyle;

- United States – $4,416,961.13 (almost $4 ½ million dollars)

- Germany – $21,739,130.43 (almost $22 million dollars)

- Japan – $357,142,857.14 (only a cool $357 million dollars)

- Great Britain/U.K. – $7,283,321.19

- France – $13,446,282

How many people do you know with that kind of money so that they could live safely on government backed bonds? What is this telling you about the state of our global economy? How good are things really under the hood if the governments must keep manipulating interest rates through their respective central banks to keep the debt game afloat?

If you think we are in normal times and that everything is groovy in financial markets, you may want to question the sanity of interest rates right now and what that means for investors in today’s markets.

Commercial Real Estate Market Conditions – Extreme Valuations With Reckless Debt Loads and Borrowing Terms

Commercial Real Estate is a “hard” asset and usually an important component to a robust investment portfolio. Commercial real estate can include owning (or owning a fraction of) properties like office buildings, retail strip shopping centers, storage facilities, industrial warehouses, nursing homes, or apartment buildings to name just a few.

Owning assets like commercial real estate offers investors a tangible asset with very predictable and stable cash flows based upon the monthly rents collected which are usually backed with long-term predictable and stable lease agreements between the owners and the renters.

While there is nothing wrong with the underlying buildings themselves or the tenants renting those properties, the main issue in commercial real estate right now lies in the amounts of debt being used to purchase those properties along with the sky-high prices being paid.

In a normal investing climate, owners of commercial real estate would generate enough cash flow to earn a profit for running and operating the building. They would also have enough cash to fund future maintenance, repairs, and improvements to keep the property up to date. Finally, the buildings would also produce enough excess cash flows to pay back a traditional 20-year loan with a fixed interest rate.

Buying a property and holding it assures that the investor has a completely paid off property in 20 years and if they kept the building well maintained and repaired, the asset should have appreciated with the general rate of inflation.

We have been in an investing environment where buyers and developers can get funding using interest only loans for even risky projects at stunningly low interest rates (thank you central banks).

Our own Federal Reserve has named commercial real estate as an inflated asset class by name, which backs around $4 trillion in loans heavily concentrated at regional banks. The market right now is one of sky-high sales prices (seller’s market) and insane debt levels most often using short to medium term interest only loans that can reset when borrowers may be least likely to be prepared for higher rates should they come.

Long gone are the days of solid projects kicking off reasonable and stable enough cash flows that can not only generate net operating income but also have the resources to pay off a fixed rate long term traditional loan over 20 years.

Thus, BUYER’S BEWARE in commercial real estate.

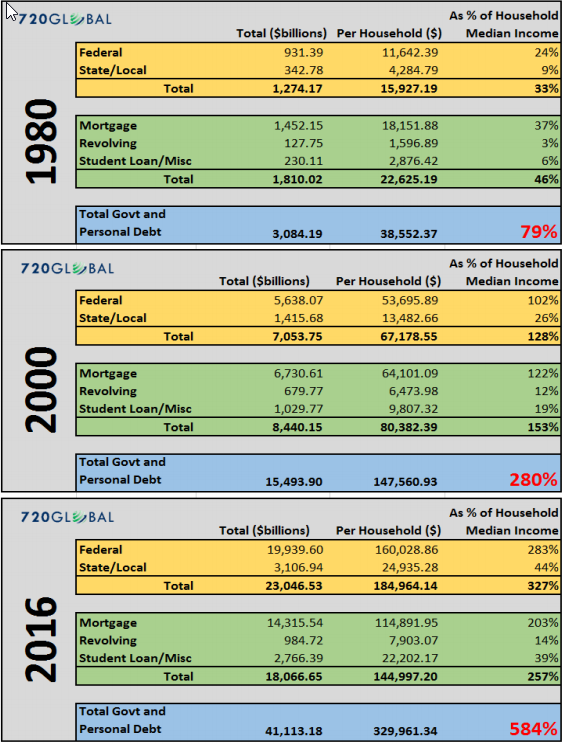

Global Debt Update

It now seems like a silly joke but the reality is, we tried to solve a global debt crisis by using massive amounts of additional debt. In 2008 and 2009 our global economy was shocked by large quantities of debt that couldn’t be repaid. How did the world’s central bankers respond? They lowered interest rates and pumped money into the system making it easier for anybody and everybody to borrow even more money to stay solvent and avoid default.

Here in the United States we now have over;

- $1.4 trillion in student loan debt

- $1.1 trillion in auto loan debt

- over $1 trillion in credit card debt

- another $5 trillion in mortgage debt

In case you were curious, we only have 320 million people living in the United States and many of them are either older and retired or below the age of 18. It’s the people in the middle that are up to their eyeballs in debt and struggling to keep up with the minimum payments.

Globally, the situation isn’t any better. At some point, the debt just can’t keep expanding to Mars and will have to not only cease expanding but be paid back (plus interest).

Investors right now really want to believe in utopia where there is tons of free money to be made and everybody has a right to be rich. They are willing to pay any price for all financial assets (no matter how poor the underlying fundamentals are of those assets). What’s the point of being personally productive and working when buying financial assets at high prices hoping to sell them even higher will solve all their debt problems? It’s most likely that this will not end well at all. There is never a free lunch in economics.

How To Make Money and Build Wealth In Financial Bubbles Safely

Building wealth requires one to see the similarities from financial history and what happens when you get into valuation bubbles and debt bubbles. This allows you to avoid those eventual losses on the back end of the cycle.

Building wealth during bubbles means keeping your personal debt levels low or better yet – getting your household debt free. Avoid the financial imprisonment that millions of others are experiencing often with life sentences.

Building wealth means doing very basic things; making a strong income from personal productivity, living below your means, building emergency funds, paying off debt, and avoiding bad investment risks by investing wisely FOR THE LONG TERM.

The rewards will be had on the other side of the mountain when prices reset and the debt bubble collapses.

“The one thing we really learn from history is that humans usually completely ignore history.”

The Dangers of Buying And Holding During High Valuations

If you are an investor who is buying or holding large amounts of equities during times of extreme market valuations, you are basically saying that price does not matter at all in investing. But what you should know is that eventually PRICE ALWAYS MATTERS.

Now a comment that is made very often by investors is, “But if I am too conservative for a period of time during market extremes and generate a low return, I can’t/won’t meet my goals. Plus, everybody else is making easy money while I’m missing out.” But this mindset is assuming that markets will stay at extreme valuations forever and ever.

The question you need to ask yourself is this; “If you don’t think you will reach your goals while temporarily earning a low rate of return to protect yourself during market extremes, how do you really believe you will reach your long-term goals if you watch your capital base diminish 40%, 50%, 60% or more?”

We have only been in extreme conditions like this a handful of times in market history and they all ended terribly with very large investor losses for those taking on that investment risk. Ask yourself what would happen to your retirement plans if you lost 50% or even more than 70% of your capital base?

Could you hang on and recover from such a loss?

The value of having a trusted advisor on your side is that they can help guide you during these times. We are here to help you navigate what should be very challenging market conditions during the second half of the market cycle. And here is the good news…For those wise investors who pay attention to price and value and protect their capital during bouts of extreme valuations, they are best positioned to take advantage of lower prices and better values once market conditions reset to historical norms.

The key to successful investing is to buy quality investments at fair prices (or better yet – attractive prices.) If the price isn’t right, you should have the fortitude to simply not buy and wait for better prices to come along in the future.

What would it feel like to boost your wealth significantly over the coming decade? Avoiding high-risk investment conditions is one of the best tactics and strategies available to make that happen.

For more resources on our current financial bubble, feel free to access these archived resources on my website and blog;

- June 25, 2017 – https://paulkindzia.com/investors-are-vacationing-in-finance-fantasy-land-again/

- May 12, 2017 – https://paulkindzia.com/wall-street-untruths-and-bad-math/

- April 12, 2017 – https://paulkindzia.com/poker-patsies-investing/