If you are not a client of Kindzia Investments, Inc. and no longer wish to receive these emails, please respond back with “Unsubscribe” in the subject line.

Warm weather, extended daylight, and summer vacation free time are bringing the neighborhood kids outdoors more. With the pandemic looking like it is coming to an end, neighbors are starting to interact more outside.

Spending more time outside has exposed me to the neighborhood kids (and their parents) and observed the two interactions.

One particular boy in the neighborhood appears to be a good kid at heart, but his parents seem to not only hover over his every move but appear to drive the schedule and the time commitments for the boy. I’ve come to recognize the boy’s automatic response each time his Mom yells out to complete a task or mandatory requirement while he is playing with the other kids. His canned response is, “Don’t know…don’t care,” which brings a harsh reaction from the undelighted mother, who I’m sure wants what is best for the boy.

If playtime is over and it is time to do homework, the mother yells out, “Do you know what time it is?” The boy automatically responds with, “Don’t know, don’t care.”

If it’s time for dinner, the mother yells out, “Do you know what time it is?” The boy responds with, “Don’t know, don’t care.”

If the boys are climbing trees or building bike ramps, the mother yells out, “Do you really think that is a good idea?” The boy responds with, “Don’t know, don’t care.”

One time I caught him in such a rush to keep going with his friends that he didn’t have time to make the complete statement. Instead, he just shouted out the abbreviated version of, “D-K-D-C!”

Kids, they drive parents bananas. It’s not that the parents want to ruin their kids’ lives and make their childhood experience zero fun. Instead, they want to protect them and help them get through life with the best odds of success (even if the kid thinks it’s a good idea to jump out of a second-story window onto a mattress that they dragged out of the house.)

Sometimes as a financial advisor, I feel the same way as a frustrated parent trying to protect and teach their kids how to set themselves up for a successful life while avoiding catastrophic accidents.

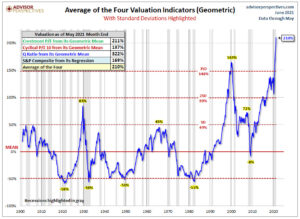

I can ask investors if they are aware of current stock valuations. On my end of tracking data, I know that we’ve never been higher on US stock valuations (ever) in financial history.

When I bring this up with investors, I get the familiar attitude of the boy who wants to do what the other kids are doing, which is, “Don’t know, don’t care.”

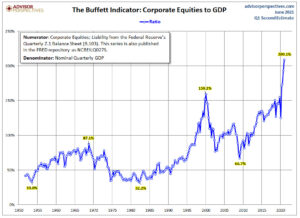

I can ask investors if they are aware that stock valuations compared to GDP are at extreme levels that have preceded previous stock market crashes. The response is usually along the lines of, “Don’t know, don’t care.”

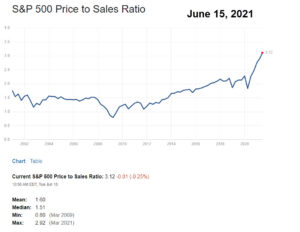

If I explain to investors that the price to sales ratio of US stocks just set another all-time high which usually leads to catastrophic investor losses, they are going to respond back with, “Don’t know, don’t care.”

Much like the parent trying to raise a kid with good habits, good discipline, and learn timeless principles of success, investors are like kids who just want to stay outside longer to do the same thing as all the rest of the kids.

If you are a parent, you know you care far less about what all the other kids are doing. You know kids do careless stuff all the time. You don’t want YOUR kid doing high-risk stuff or going along with the crowd. But, just because all the other kids are doing crazy things, doesn’t mean your kid should just blindly jump in with the crowd and follow the masses. You want your kid to be different. You want your kid to be responsible. You want your kid to learn how to avoid foolish mistakes that could have costly ramifications and downside risks.

That’s me as a financial advisor. I don’t want my investors doing reckless things with their hard-earned savings, even if the other kids are doing crazy things. I know that given a chance, kids will do risky stuff. That’s what kids do when they are around each other. They build up a false sense of security because they are surrounded by many others that seem to be going with the flow and having a good time. That is the power of group dynamics.

But then we also know what happens from time to time. Kids do things that, in hindsight, is reckless behavior. Even the kids themselves will say, “Yeah, I guess now that I look back on it, it was really not smart that we were doing that.”

It’s no different with investing. In hindsight, investors always come around and say, “Yeah, that was really stupid. I’m not sure why I went along with that at the time.”

I know why. Because at the time (in a bubble), everything appears to be groovy. Everything seems to be easy money. Everything seems to be good times that will keep lasting. Everybody is making money, and you want in on the action.

That’s also the very human emotions and behaviors that create bubbles in the first place.

A Quick Lesson On Business Success

The very best way to wealth is by owning a business. That’s proven over and over again throughout history. The benefit of owning a business is that as an owner, you get to keep the earnings from the business (and then either reinvest the earnings into more businesses or spend the earnings on your lifestyle).

Publicly traded companies (stocks) is a way for ordinary people to own fractional shares of existing large scale businesses. Many investors don’t understand that. They think of stocks as little pieces of paper (or electronic shares) that they can repeatedly trade like baseball cards on the playground. But the reality is, owning a stock is owning a share of a business. You become a fractional owner. The benefit of owning a publicly-traded stock is that you aren’t responsible for running or working for the company itself.

There are many ways to value businesses and stocks. One of the most common and well-known is applying a multiple of the underlying earnings of the business. This is called the Price/Earnings multiple because the numerator is the price of the business and the denominator is the earnings or profits of the business.

If it is a publicly-traded stock being valued, then the P/E multiple may be represented as the price per single share divided by the earnings per share. You can use the P/E with either a single share or add up all the shares outstanding to value the entire company.

For example, if the last four quarters of “as reported earnings” for the S&P 500 are (and they really are these amounts):

- 2020 Quarter 1 – $11.88

- 2020 Quarter 2 – $17.83

- 2021 Quarter 3 – $32.98

- 2021 Quarter 4 – $31.44

- Total Annual S&P 500 As Reported Earnings = $94.13

If the “Price” of the S&P 500 today is 4,247.31 and you divide it by the earnings of $94.13, your P/E ratio for the S&P 500 is 4,247.31/$94.13 = 45.11.

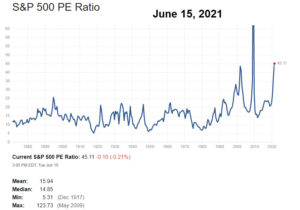

If we graph the current P/E ratio for the S&P 500 since the year 1870 (150 years of data), it would look like this:

There are a few important items to note in the above chart and data;

- You’ll see the chart line spike in 2009. That’s because corporate earnings went deeply negative during the great economic meltdown of 2008/2009. When the denominator of the P/E ratio goes negative, you get an “infinity” type situation in the math. Excluding the mathematical quirk of the global economic meltdown (which resulted in the S&P 500 declining more than 57%), we have surpassed all the previous highs on this valuation metric.

- The long-term mean of the S&P 500 P/E ratio is 15.94 while the long-term median of the S&P 500 P/E ratio is 14.85. With a current value of 45.11, you can see we are running about three (3) times higher than the long-term average. If that isn’t making the hair stand up on the back of your neck, I’m not sure what should.

Inverting the Price/Earnings Multiple

If we invert the P/E multiple, we generate what is called the “Earnings Yield” of the investment. Imagine a business that you bought for $100,000 (the Price) and it has $10,000 in annual earnings. The P/E multiple would be 10 ($100,000/$10,000).

If we invert that multiple and use Earnings/Price, we come up with the earnings yield. $10,000/$100,000 = 10%. In this example, if we were able to buy a business that earns $10,000 in profits and we were able to buy it for $100,000, our “earnings yield” would be 10%. 10% is a good solid rate of return, and most investors would be pleased to generate that rate of return, especially from a business that they don’t have to work in or manage.

Let’s go back to the S&P 500. We previously calculated the Price/Earnings to be 4,247.31/$94.13 = 45.12.

Now let’s invert it to come up with our “earnings yield.” If we take the reported S&P 500 earnings of $94.13 and divide it by the price of 4,247.31, our earnings yield is 94.13/4,247.31 = 2.21%.

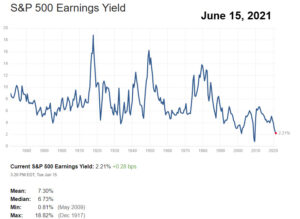

If we graph the earnings yield over the past 150 years, it would look like this:

Stated another way, if you had enough money that you were able to buy the entire S&P 500, which would entitle you to keep EVERY SINGLE PENNY OF PROFITS from all the companies that comprise the S&P 500, you would earn a yield of 2.21% on your money.

This is where, as a financial advisor, I feel like a frustrated parent. We know from past history when markets have been at such lofty valuations, 50-80% losses have been eventualities.

Valuations are highest when your “earnings yield” tends to be lowest. Unfortunately, most investors don’t stop and think about this reality. In bubble markets, investors take the most significant risks for what ends up leading to enormous financial market losses.

In our current scenario, if I ask an investor, “How would you feel about buying an investment that is currently paying you 2.21% return and it’s likely that you will at some point absorb a 50-80% loss by owning this?

If I told the investor that this is a real estate deal, I bet 100% of them would turn it down and say, “What are you stupid? I’m not investing in that crappy deal.”

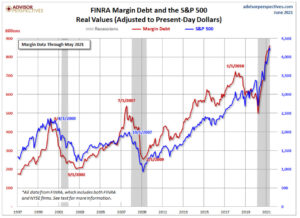

But if it is the stock market, then not only are investors lining up to buy more and more of the stock market, they are borrowing record amounts and using leverage to load up as much as possible. The amount of margin debt in the markets is at all-time highs and quickly approaching $1 trillion.

Meanwhile, as I ask, “Do you know what these numbers mean?” I get the same response as the mother does from the kid that wants to keep playing with their friends, “Don’t know…don’t care…”

Taking It One Step Further

If you ask investors what their dream outcome is when investing, the most common answer is, “I’d love to double my money.” That’s the interesting thing about this current market dynamic. If the market doubles from here, allowing investors to double their money, the risk of explosion and significant losses doesn’t go down, it goes up dramatically as underlying earnings continue to grow at their long-term rate.

Going back to our previous example, if the past four quarters of actual reported S&P 500 earnings are $94.13 and we divide it by the price of the S&P 500 of 4,247.31, our earnings yield is 94.13/4,247.31 = 2.21%. Let’s now pretend that the S&P 500 doubled from here, going from the current 4,247.31 to 8,494.62. Based on current reported earnings of $94.13 the earnings yield would drop to 1.11% from the current 2.21%.

There is nothing bad about the S&P 500 doubling. Doubling is exactly what we want it to do. But investors should want the indexes to double because corporate earnings are also doubling. If earnings are in line with prices, then everything is authentic and productive. It’s when prices keep going up without the underlying earnings going up to match the pace that problems develop (and bubbles form).

That’s exactly what has been happening since 2017. The price of US stocks have gone up at a dramatic pace without the underlying earnings matching anywhere even close to the same pace. The price of stocks has completely deviated from their actual underlying earnings.

In order to double your money from here without a doubling of corporate earnings, a new buyer would have to agree to buy stocks that have a 1.11% earnings yield and an even higher probability of a massive loss (in the 60%-85% range). Is that buy low and sell high?

The job of a financial advisor can be almost as frustrating as being a parent. You love your kids. You want to do them right. You want them to be safe. You want them to learn to make good decisions and exhibit good behavior. But at the end of the day, when they are with their friends and having a good time, they simply “don’t know and don’t care” about any of that rational nonsense you are spewing to them.

The Good News

We know from market history, when markets do the nutty things that they are doing now, it ends poorly for investors that ignore all principles of success when it comes to investing. However, it doesn’t mean that investors are stuck without options for the next decade. Sure, the outlook for US stocks over the next 10-12 years looks very bleak. But globally, things aren’t the same.

The US may be in one giant bubble, but that isn’t the case around the rest of the world. Globally, things are starting to stabilize as the rest of the world continues to deal and work through the global pandemic. Economies are hurting. But valuations are much more normal and attractive elsewhere.

Foreign stocks will likely be much more attractive than US stocks over the next 10-12 years. The US only represents half of the global market capitalization values for stocks. Moreover, the US only makes up about a quarter of global GDP. As we move forward, foreign economies and emerging markets will make up greater and greater percentages of the global economy.

Whereas the United States is currently at the highest valuation multiples in its history, the same isn’t true worldwide. European, Asian, and emerging markets are at much lower and more attractive valuations, and we fully expect opportunities to unfold in those areas.

For stock investors, it would be reasonable to assume that in the future, over 80% of your eventual stock holdings may end up being invested in companies outside of the United States. The vast majority of US stock investors are arguably greatly overexposed to a wildly overvalued market. The odds of this trend continuing indefinitely are rather slim.

Investors should prepare for US stocks at some point to return to mean valuations (which are a long way down from here). They also should prepare for their stock allocations to move towards foreign and global companies with much brighter prospects and valuations. The future probabilities are not the most promising for US stocks but rather foreign and emerging stocks in countries with far better growth and income prospects.

Behind the scenes, most investors are reacting to the markets with the attitude of “don’t know, don’t care.” That flippant attitude and ignorance towards market history will prove to be quite painful for them, as it always does when things eventually go the entire cycle. We can’t predict when the markets will finally crack. We can only predict that they will eventually crack, and the last place you will want to be is an investor holding the bag on over-valued securities with poor underlying earnings.

If we are supposed to “buy low and sell high,” investors nowadays have been programmed by central banks to buy high and hope to sell even higher one day.