Speculation in pursuit of easy riches has always been part of human history. We can’t help ourselves when it looks like a trip down Easy Street will be a shortcut to our wealth desires.

Why work and produce valuable goods and services to earn a reasonable return when you can bypass the hard part and skip to the head of the line? After all, everybody wants to be rich and have an easier life, and that’s part of human history.

Speculation along with financial bubbles have been around for centuries. Although it’s debatable what the first modern-day financial bubble was, one such early bubble sticks out amongst historians; The Tulip Mania of the early 1600s.

Tulip mania was a period during the Dutch Golden Age when traders already developed the concept and systems involved with contract prices (think early futures markets for commodities.) The price for tulips (yes, the flowers) reached extraordinarily high levels before dramatically collapsing in February of 1637.

It is one of the very first recorded speculative bubbles in financial markets. How crazy was the mania for tulips at the time? Some single tulip bulbs sold for more than ten times the annual income of a skilled artisan. Think of it this way, let’s say that the average plumber today makes $50,000 annually (I’m lowballing it a bit, for example’s sake). Multiply that $50,000 by ten, and you’d come up with $500,000. That’s what a single flower tulip bulb was going for before the bubble finally burst.

The 1637 tulip bubble was highlighted in the 1841 classic book publication called, “Extraordinary Popular Delusions and the Madness of Crowds,” by Scottish journalist Charles Mackay. Mackay described Tulip Mania in the book with the following, “At one point, a speculator offered 5 hectares (12 acres) of land for a single Semper Augustus tulip bulb.”

I find it endearing that books were written about financial delusions and madness of crowds back in the 1840’s. I’m pretty sure I would have bought that book off Amazon and had it delivered to my log cabin with Prime 2-Day Shipping, where I could have read it under candlelight.

Common Denominators Of Speculative Bubbles

As Mark Twain once wrote, “History never repeats itself, but it does often rhyme…”

Each speculative bubble in financial history has had its unique spices and flavors. But one can learn from many of the similarities common to almost all financial bubbles. Some of the key features to look out for include, but are not limited to;

- A perception that the opportunity is a fast and easy way to make money above and beyond what could be deemed reasonable by historical standards.

- Prices and valuations that, over time, significantly stray from underlying economic intrinsic value.

- A behavioral acceptance across the general population that prices only go up and cannot come down.

- An inability of the masses to behaviorally factor in risks that are present the entire time of the speculative mania.

- The use of debt and leverage by market participants to enhance their precious opportunity to make additional gains.

- A belief amongst the participants that something changed about the laws of economics leading them to proclaim, “This time is different.”

- Enough time to pass in the speculative cycle so that previous gains build momentum. This allows the participants to believe that everything is safe because “It must be safe, and if it wasn’t, it would have already blown up by now.”

- Finally, your next-door neighbor, co-worker, or family member starts bragging about their extraordinary gains by participating in the speculative bubble, which drives people crazy and makes them feel like they are missing out.

Speculative bubbles evolve over time before ending catastrophically. Participants look back while saying, “Of course that blew up. That was so stupid, and anybody could have seen that it was going to end terribly. How could people be that dumb?”

Many do indeed point out, “How stupid can people be?” But that’s the point of human history.

“There are no limits to human stupidity.”

The Gamification of Gambling

If there is one thing that is different this time, it’s the gamification of the entire financial system, and it’s the gamification of our entire society. The system is morphing into incentivizing speculation and gambling rather than producing goods and services to solve problems. Earnings and cash flows from well-run businesses are taking a back seat to the week’s trending theme on an internet forum.

The system is currently running on a belief that the key to wealth building has nothing to do with fundamental value nor productivity but rather the pursuit of riches from pure speculation. This idea has currently taken on mass appeal driven by greed.

Lately, it’s all tulips.

The game is now designed to offer constantly evolving opportunities of speculation and trading rather than value creation. It’s about chasing the hot hand at the hot table.

It’s all tulips.

The good old days had speculators trading growth stocks on the New York Stock Exchange or getting nutty flipping houses without making any capital improvements, and that’s so old school.

Now you must be versed in crypto, trading options, buying NFT’s (Non-fungible tokens), or trading in stocks that have never produced a penny of earnings during their entire existence yet still have multi-billion dollar valuations.

Your old hobby was poker with friends, which then morphed into online poker, which then morphed into trading options, which then morphed into buying meme stocks, which then morphed into trading crypto, which then morphed into buying NFTs. Who wants to own a utility stock that yields 2.4% while you can trade crypto by day while attending to your DraftKings picks by night.

And Wall Street is happy to oblige. May I present to you the solutions to our problems. It’s FanDuel. It’s DraftKings. It’s Barstool Sports. It’s Robinhood. It’s Coinbase. It’s Nifty Gateway.

An image named CryptoPUnk #7523 in the form of an NFT sold for $17.1 million during an auction. To top it off, a bidder named “Sillytuna” was active on both the buy and sell sides of the sale. You have that correct, for $17.1 million, you could own the rights to the original .jpeg recorded on the blockchain.

I guess we all became bored with just the major Wall Street firms looting us out of our savings every few years? Like I said, it’s all tulips.

The funny thing about dreaming about getting rich is the idea that you would get to sit back and do nothing for the rest of your life. Here’s the funny part; your neighbor is dreaming of the same thing. So is your brother-in-law. So is your co-worker. So is your boss and your bosses-boss. So are your buddies down at the golf-club. So are the people running the Federal Reserve and global central banks. So are the people working at the same Wall Street firms that run this game.

Everybody wants to get rich so that they can stop working and live off their wealth. But all of those participants are playing the same game, under the same rules, run by the same casinos. Nobody ever stops and thinks what happens if everybody gets rich off these get-rich-quick opportunities like crypto, NFT’s, option trading, meme stocks (insert get-rich-quick-scheme here…)

- Who exactly is going to make your hamburger when you want fast food?

- Who is going to check you in at the 5-star resort?

- Who is going to do the maintenance on your private jet?

- Who is going to fill up the fuel tanks on your luxury boat?

- Who is going to fix your air conditioner when it breaks?

- Who is going to build your new house?

- Who is going to cut your hair?

- Who is going to restock the grocery shelves or wrap the two pounds of ground beef that you wanted from the butchers counter?

- Who is going to change the oil on your sports car?

Because if you are saying to yourself, “The other guy is going to do the productive work because I’m rich and he’s not,” then I have bad news for you. The other guy has been trading crypto, buying meme stocks, trading options, buying NFT’s, and loading up on zero earnings growth stocks with the use of mind-blowing leverage.

The entire world is either going to get rich speculating and gambling together or the opposite is going to happen like it always does. Most participants in speculative manias will lose tremendous amounts of money because they gambled with borrowed money just like their neighbors.

But this isn’t a State Farm insurance commercial where the jingle goes, “Like a good neighbor, State Farm is there…” Rather, it’s going to end the way it always ends. It’s going to end with people losing significant amounts of wealth and only feeling a tiny bit better because their neighbor lost their money as well. Like a good neighbor, you went broke too. Misery loves company.

IT’S BANANAS OUT THERE (I meant Tulips…)

There are so many weird things happening in financial markets lately, it’s almost tough to sort through all of the ones that really stick out. But I thought you would enjoy some of the following;

- The market for stock options is now 140% the size of the underlying market on the stocks themselves.

- Americans last year spent a record $49 Billion on video games, an amount that exceeds the GDP of roughly half the world’s countries.

- China’s banking assets (loans outstanding) are over 314% of their GDP. That’s a lot of debt…

- Inflation-adjusted yield on junk-rated debt in Europe has recently turned negative for the first time ever. By their very nature, junk-rated debt means that they have the highest probabilities of default versus institutional grade debt. Investors are now willing to accept a negative real rate of return all while knowing that some of those bonds will default and they won’t get all of their money back.

- The average price of a home in the United States increased a whopping 16% at the end of the second quarter of 2021, moving up from $322,600 to $374,900.

- Household debt in the United States has now exceeded $15 Trillion for the first time ever at the end of Q2 2021, jumping at the highest rate in 14 years. That’s a lot of debt.

- The 5 largest companies 20 years ago during the Tech Bubble;

- General Electric

- Cisco Systems

- Microsoft

- Intel

- Exxon Mobil

- The market cap of the top 5 were valued at 24% of the total economy in terms of GDP

- The 5 largest companies today’s bubble:

- Apple

- Microsoft

- Amazon

- Alphabet

- Even though Microsoft came back over the last few years, the stock price fell 69% when the tech bubble burst.

- The market cap of the top 5 stocks today equal 37% of the total economy in terms of GDP

- Crypto exchange Coinbase (which trades on the NASDAQ) has a $50.3 Billion market cap and is worth more than the NASDAQ exchange which has a $32.1 Billion market cap. I thought that was cute.

Unsustainable Imbalances Eventually Crack

We have been living through a buildup of what could be referred to as “unsustainable imbalances in the global economy and financial markets.” It’s like the old saying, “You can have anything you want, but you can’t have everything.”

Global central bankers, including the U.S. Federal Reserve, have attempted to “have everything.” You can’t sustain record over-valued securities, zero-percent interest rates, no inflation, no wealth inequality, unlimited stimulus, unlimited debt, affordable housing, shut-down economies over COVID, stable shadow unregulated currencies, perpetual growth, and opposing currency debasement wars without something eventually breaking.

What breaks, when, and how badly is always the question, but it’s never a good idea to park capital in unsustainable and risky propositions. But we know that things are already showing signs of breaking and investor losses have been accumulating under the hood.

- Inflation is starting to run hotter than and more sustained than expected.

- Homes are becoming unaffordable.

- Interest rates are starting to move up in response to defaulting loans, credit risk and inflation risk.

- Wealth inequality is driving societies apart.

- Endless stimulus has added trillions to government balance sheets.

- Meme stocks AMC Entertainment (AMC) and Gamestop (GME) are down 45.79% and 60.42% from their previous highs respectively.

- Bitcoin is down 32.33% off it’s April 2021 high.

- Coinbase (COIN) is down 43.88% from it’s high right after their IPO in April.

- Investors in high yield bonds (junk bonds) have chased higher yields in a zero-interest rate world. Meanwhile over the past 13 years, the Barclays High Yield Bond ETF “JNK” has been on a steady decline in asset price. What investors gained in bond interest, they’ve lost in asset price deterioration (all while interest rates were falling which should have been bullish). The Barclays highyield (junk bond) ETF hit a high during their opening week of $143.88 in February of 2008. The current price is $109.92 which equates to a capital loss of 23.61% over more than 13 years.

- Zoom Video Communications stock is now down 52.77% from its high last fall during the pandemic.

- Peleton stock (the makers of the home exercise bike that everybody had to have during the pandemic) is now down 44.31% off their high at the beginning of the year.

- Meanwhile, debt levels continue to surge across corporate balance sheets. The cracks will continue to increase not just when the companies can’t pay back the principal years down the road when the loans come due but rather when they can’t even make the minimum interest payments before the loan coming due. Such is the case with Evergrande in China, which currently owes more than $300 Billion in debt. Sure, the loans are spread out to be paid back over the next few years. The only problem is that growth has slowed. The company can’t even make their current interest payments (in a record low interest rate environment), putting them on track for almost a certain default without government bailouts.

Valuations With Margin Debt

- Stocks bought on borrowed money (Margin Debt) are near all-time highs while market risks are at all-time highs.

(Credit to Jill Molinski and Advisor Perspectives)

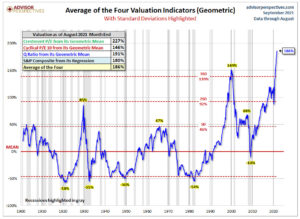

Here is where we are at right now on U.S. equity valuations as of the end of August 2021. The data goes back over 120 years of modern financial market history.

(Credit to Jill Molinski and Advisor Perspectives)

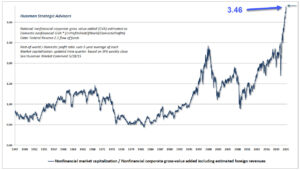

Below is the “MarketCap/GVA Ratio” which is a model developed by John Hussman of Hussman Strategic Advisors. The current MarketCap/GVA ratio is 3.46, which is just below the record high on August 6, 2021 of 3.55

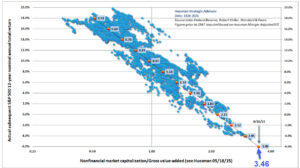

This data supports and corroborates the “Iron Law of Investing.” When these ratios are plotted over time and compared to the actual subsequent S&P 500 12-year rates of return, it shows that the higher the ratio, the lower the 12-year actual return. The lower the ratio, the higher the 12-year actual return. The Iron Law of Investing is exposed with real historical and mathematical data. Here is the scatter plot graph below which shows these relationships between the price you pay and your long-term returns;

On September 10, 2021, the ratio stood at 3.46. This implies a 12-year future return for the S&P 500 that is below negative six percent (-6%). That negative six (-6%) is an annual rate of return. Any investor who is buying at today’s market prices is virtually locking in negative future returns. For long-term investors who seek appreciation AND preservation of capital, buying U.S. Stocks at today’s prices is a foolish mathematical bet. Nobody is forcing investors to buy anything. Buyer beware.

One important point to make. This doesn’t mean that EVERYBODY is going to produce a negative rate of return over the next 12 years. It means that those who are invested today at these prices will have a high probability of generating a negative return over the next 12 years. If the market were to correct to historical norms in the future, investors would be able to buy in at levels that may indicate a rather positive 12-year return profile. Why? Because they bought the SAME INVESTMENTS AT MUCH LOWER PRICES.

The Challenge Today

The challenge for investors today is that we can’t invent the world we live in nor the market conditions in the present. We must play the cards dealt to us. But that doesn’t mean you bet the pot regardless of the cards you were dealt. Rather, you bet based upon the probabilities of winning (and protecting your stack when the probabilities of loss are significant.)

Markets move in cycles. Valuations move from high to low points and back again. The proven principle of success is to buy low and sell high. The proven principle of success over the long-term isn’t to “buy high and endlessly hope that another sucker will come along to pay us an even higher price.”

Many investors are under the illusion that they will just sell out when it counts. The question at that point will be, “Sell to who?” Every single share of stock in existence must be held by somebody at all times. That’s why prices in stocks can drop far faster during bear markets than people anticipate. When the speculators disappear (or get margin calls forcing them into being forced sellers,) there aren’t any willing buyers at extreme prices. The investors that eventually come in to save the day are the value investors who want to buy quality assets at good prices (or even reasonable prices) and the difference between today’s prices and what reasonable prices should be is rather significant.

Does anybody really know how all of this is going to play out? Does anybody know the exact timing that the valuations reset? Does anybody know how the systematic risks in the markets will alleviate themselves? The answer to these questions is, “NO. Nobody knows the short-term future.”

Prudent investors should be wise enough to know that market conditions constantly change and evolve over time. What is over-priced today can become under-priced tomorrow.

With that said, this isn’t the time to buy expensive tulips.

The Good News

We know from market history that when markets do the nutty things they are doing now, it ends poorly for investors that ignore all success principles when it comes to investing. However, it doesn’t mean that investors are stuck without options for the next decade. Sure, the outlook for U.S. stocks over the next 10-12 years looks very bleak IF YOU WERE TO BUY AND OWN AT THE PRESENT LEVELS. But globally, things aren’t the same. Further, prices and valuations adjust over time, even if that seems like forever, forcing you to lose patience with rational logic.

The U.S. equity markets may be in one giant bubble, but that isn’t the case around the rest of the world. Globally, things are starting to stabilize as the rest of the world deals with and works through the global pandemic. Economies are hurting. But valuations are much more normal and attractive elsewhere.

Foreign stocks will likely be much more attractive than US stocks over the next 10-12 years. The US only represents half of the global market capitalization values for stocks. Moreover, the US only makes up about a quarter of global GDP. As we move forward, foreign economies and emerging markets will make up greater and greater percentages of the global economy.

Whereas the United States is currently at the highest valuation multiples in its history, the same isn’t true worldwide. European, Asian, and emerging markets are at much lower and more attractive valuations, and we fully expect opportunities to unfold in those areas.

For stock investors, it would be reasonable to assume that in the future, over 80% of your eventual stock holdings may end up being invested in companies outside of the United States. The vast majority of US stock investors are arguably greatly overexposed to a wildly overvalued market. The odds of this trend continuing indefinitely are rather slim.

Investors should prepare for U.S. stocks at some point to return to mean valuations (which are a long way down from here). They also should prepare for their stock allocations to move towards foreign and global companies with much brighter prospects and valuations. The future probabilities are not the most promising for U.S. stocks but rather foreign and emerging stocks in countries with far better growth and income prospects.

Behind the scenes, most investors are reacting to the markets with the attitude of “don’t know, don’t care.” Or they are betting on an outcome that has never happened ever in market history (that valuations can stay at permanently high plateaus.) That flippant attitude and ignorance towards market history will prove to be quite painful for them, as it always does when things eventually go the entire cycle. We can’t predict when the markets will finally crack. We can only predict that they will eventually crack, and the last place you will want to be is an investor holding the bag on over-valued securities with poor underlying earnings.

If we are supposed to “buy low and sell high,” investors nowadays have been programmed by central banks to buy high and hope to sell even higher one day.

Good habits lead to good behaviors. Good behaviors lead to good decisions. Good decisions lead to a good life. Live by principles and choose wisely.

One final thought. Did you know that tulips usually only bloom for one to two weeks each year and often don’t repeat bloom the following year? The best guarantee for blooming tulips is to plant fresh bulbs each season. I’m pretty sure I wouldn’t have been a tulip speculator.