Posted April 12, 2017

High-level, skilled, and disciplined investors are being handed a wonderful gift in today’s markets which are trading at extreme valuations. It’s much easier to make rational decisions when probabilities are so lopsided in one direction. But most investors are not high-level, skilled, nor disciplined and feel compelled to constantly chase returns regardless of risk or probabilities.

Nobody ever intentionally sets out to work hard in an effort to save their hard-earned money and then lose it in the stock market. But that’s exactly what happens repeatedly by unsuspecting ordinary investors who are taken advantage of by Wall Street hucksters cycle after cycle.

Poker is a popular card game that when played with high-level players is based fundamentally on strategy and skill. Money is placed in the pot voluntarily by each player who either believes the bet has a positive expected value or is attempting to play strategically against other skilled players. The high-level players (top level professionals) are constantly running analysis based on the possibilities and probabilities of certain cards producing a winning hand which results in a profit. High-level investors take this same approach to probability analysis when allocating capital to investment opportunities.

To play a hand, each player must make an initial bet called an “ante.” The “ante” or “blind” is the cost of playing the game and taking a seat at the table with the hopes of winning. Once the action begins, each player must either “call” the maximum previous bet or “fold” which prevents them from losing additional money when the odds of winning are not in their favor. High-level investors are also subjected to an “ante” which could be in the form of a hedge fund fee, private equity fund fee, advisor minimum fee, or brokerage account maintenance fees. It’s the cost of allocating capital on a long-term basis.

In most poker games, there are differences in skill levels between the players. Top level players are outstanding at strategy, psychology, and running mathematical probabilities. Amateurs know the basic rules, but have little to no mathematical abilities to know when the cards are in their favor or when they are setting themselves up for almost certain defeat. In most investment opportunities, there are also differences in skill between the players. Top level investors are strategic, use proper behavior, and run mathematical probabilities.

Professional poker players love playing poker with amateurs. Over the course of the game, the ignorance and weaknesses of the amateur players are identified and taken advantage of by the professionals. Wall Street loves playing the investment game with amateur investors. Over the course of the game, the ignorance and weaknesses of the amateur investors are identified and taken advantage of by Wall Street firms who are supposed to be representing their clients (but seldom act in a fiduciary manner).

Amateurs are notorious for playing most hands too long. They “call” and continue to bet rather than “fold” when they should be saving their stash of chips for future rounds when the odds of winning are much more in their favor. Amateurs most often confuse luck with skill. They play most hands aggressively and occasionally they are dealt cards that are good enough to take a pot even against a more skillful player. These occasional winnings only reinforce their bad behavior until alas, they leave the table with big losses and shattered dreams. Investing is similar. Amateurs are notorious for constantly allocating capital to opportunities regardless of value, risk, or upside potential. When markets are richly valued, they just keep betting their chips expecting to win. They confuse luck with skill. They invest aggressively and occasionally are rewarded in the short term for that behavior even against the odds. These winnings that even occur during the final phases of the cycle only reinforce their bad behavior until alas, they experience big losses and shattered dreams.

In poker, an amateur who is playing against a professional is referred to as a “Patsy.”

“A patsy is a foolish person who is easily tricked or cheated. He is the victim of deception.”

In the world of investing and financial markets, a similar scenario plays out between rank amateurs and professional players. In a 3-hour poker game, players may get in approximately 60 hands. By then, the Patsy’s are usually going home with empty pockets.

In investing, assuming a person starts saving and investing at 25 years old, they may get in 60 years of investing if they live to be 85. Consider these 60 hands (years) of investing like a poker game. At the end of those 60 hands (years) of adulthood, it becomes clear what kind of player the investor was in the world of wealth building.

Just like in poker, the investment world is littered with patsies. These are the players who are completely ignorant on the probabilities of playing certain hands. They are the ones that have no idea how to value a company, what relative valuations are, historical statistics, or how other professional players are making money. The amateurs are those that just keep playing every hand aggressively, hoping for good cards, calling on every round, and refusing to fold when the odds are stacked against them.

Amateur investors are the ones who act emotionally and are behaviorally unsound during the 60-year game. They are impatient, undisciplined, have no formal processes, and don’t play with proven principles of success. The idea of not being in every hand at every moment just drives them bananas.

Amateurs get entirely focused on playing each hand with reckless abandonment rather than thinking strategically about the bigger picture of the entire game. It’s not about how much you win at one hand early in the game, it’s about playing fundamentally sound throughout the entire game so you come out a winner in the end.

But that’s not what we have been seeing the last 2 ½ years in the financial markets. Rather, we are seeing investors play every hand aggressively as if it is their last hand just like a patsy would play in poker. Rather than take a step back and realize that the odds of a highly successful profit outcome are extremely low while the odds of big losses are high, investors just continue to chase hand after hand until alas, they will walk away with big losses and empty pockets yet again.

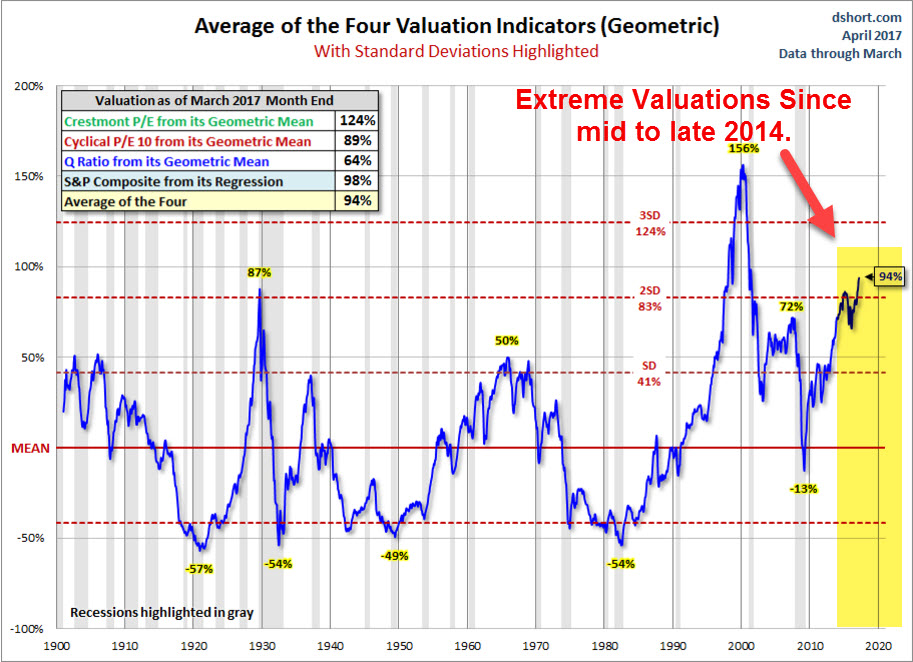

Markets are and have been at extreme valuation levels since the fall of 2014. But what we are seeing are investors who refuse to fold into those poor odds of winning the long-term game. They are fooled into believing what others want them to believe which is to just “keep playing every hand” because over the long run that is how you will win. That is how Wall Street wants you to play because that is how THEY win. There’s a big difference there. Here is a snapshot of valuations since 1900 (think of the 117 years as 117 years of “hands” in poker.) Data/chart credited to Advisor Perspectives and Doug Short.

Playing every hand in investing is not a sound strategy in markets that are extremely over-valued;

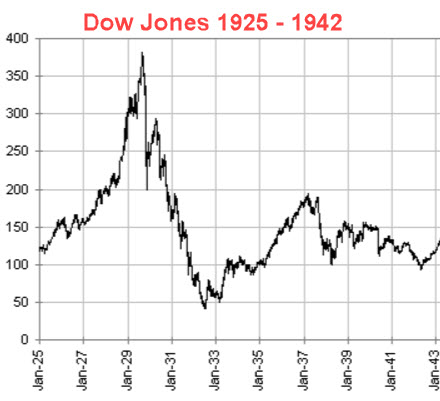

- It didn’t work in 1929. The stock market started crashing on October 28, 1929 and by July 8, 1932 concluded with an 89 percent loss rate for all the market’s stocks. VALUATIONS EVENTUALLY MATTERED!

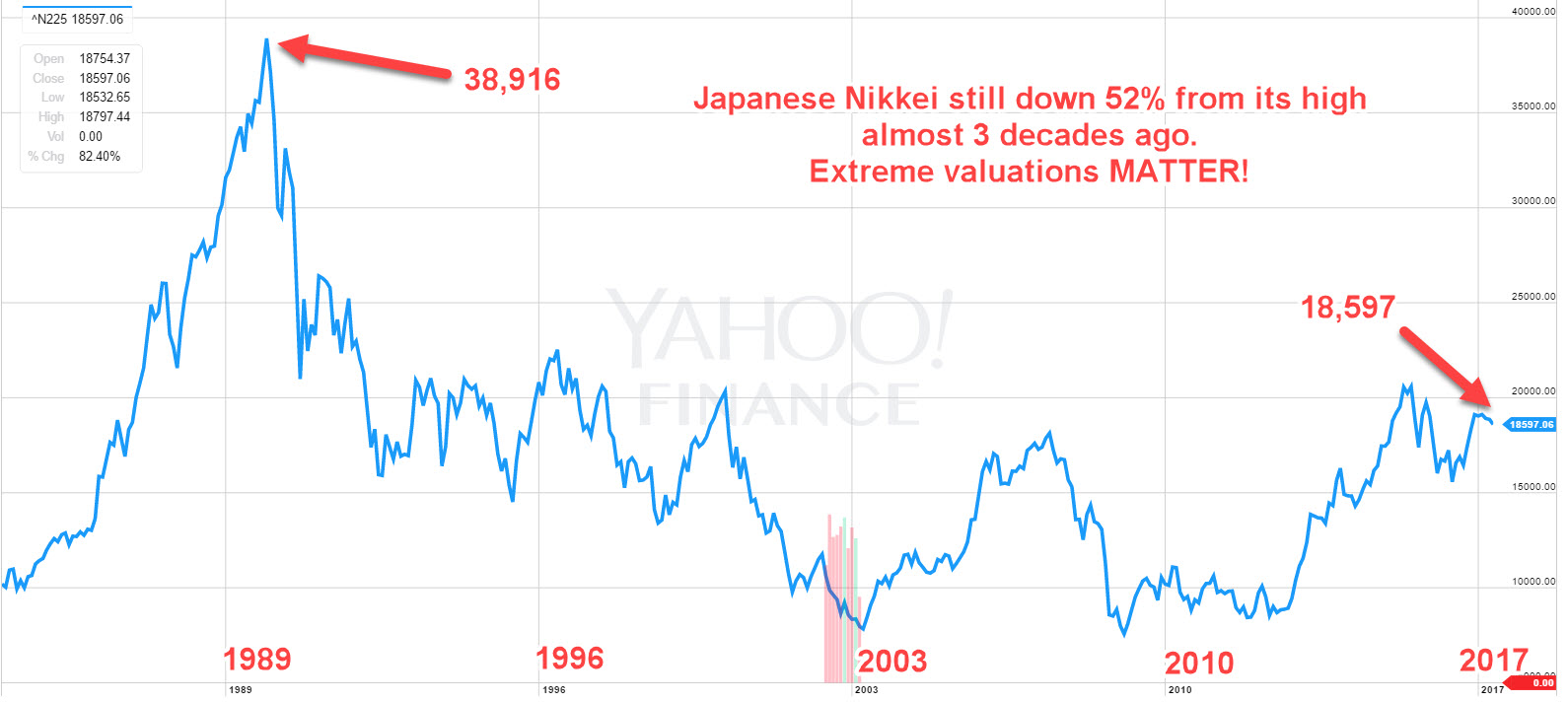

- It didn’t work in 1989 in Japan. The Nikkei finished the year on December 29, 1989 at a level of 38,916. Right now, that same Nikkei is at 18,597 which is 52% lower after 27 YEARS OF INVESTING. VALUATIONS EVENTUALLY MATTERED!

- It didn’t work in the 2000 tech bubble. The NASDAQ hit a level of 5,132.52 during the trading session on March 10, 2000. It closed on April 5, 2017 at a level of 5,864.48 which is only 14% higher after 17 years of investing and only after suffering a 78% decline when the bubble burst in the early 2000’s. VALUATIONS EVENTUALLY MATTERED!

- It’s not going to work now. Markets are now hitting valuation metrics that are either the highest or second highest ever in the history of American markets. If you don’t know who the patsy is in these investing markets, you are the patsy. Buyer beware. VALUATIONS WILL EVENTUALLY MATTER!

I thought it would be appropriate to share just a few of the lyrics from the song “The Gambler” by Kenny Rogers

You’ve got to know when to hold ‘em

Know when to fold ‘em

Know when to walk away

And know when to run

You never count your money

When you’re sittin’ at the table

There’ll be time enough for countin’

When the dealin’s done

The value of having proven principles and investment processes based on valuations is that they can help guide you during these times. They are going to help you navigate what should be very challenging market conditions during the second half of the market cycle. And here is the good news…For those wise investors who pay attention to price and value and protect their capital during bouts of extreme valuations, they are best positioned to take advantage of lower prices and better values once market conditions reset to historical norms.

Markets go in cycles which means that at times they can be over-valued and at times can be undervalued (providing you with plenty of bargains when markets eventually turn). Success is possible and available for any investor who sticks to the basic principles of investing. You CAN do it, but you will need to be prudent and disciplined.

What would it feel like to boost your wealth significantly over the coming decade? Avoiding high-risk investment conditions is one of the best tactics and strategies available to make that happen.