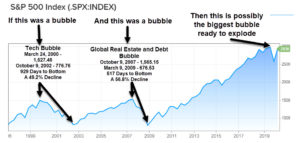

It certainly appears that we have ended the “boom” part of the economic cycle and, once again, are entering the “bust” part of the economic cycle. Let the fun begin as those levered in massive amounts of cheap debt scramble like cockroaches looking for a refrigerator to hide under. Note, this is the third economic boom/bust cycle of the last 20 years (Tech bubble of 1999 – 2002, Global Real Estate/Debt Bubble 2007 – 2009, and now the Everything Bubble of 2020 – ???)

For those in disbelief, if we knew from the late 1990s through 2000 was a bubble (tech bubble), and we knew that from 2003 through 2007 was a bubble, (global real estate and debt bubble), then what do you really believed has happened over the past few years while global debts and valuations exploded higher?

I remind individuals and households that our goal is not just to “outwit the crazy markets during the Coronavirus pandemic.” We still intend to do it, but there are greater goals and objectives in the middle of this economic mess. Our objective is to become anti-fragile, as Nassim Taleb wrote in his book called, “Anti-fragile. Things That Gain From Disorder.”

Each of our financial lives can be placed on a sliding scale as follows:

Our goal is to progress in life, building upon our past without taking big steps backwards. We do that with the right philosophies, processes, and systems. It does not matter where you started or where you are right now so long as you are working towards the right of the sliding scale and are on the path that will make the biggest difference in success over your lifetime.

What is fragile? Imagine that life is a hammer, and you are a piece of glass. Hammer…meet glass. What happens? Glass shatters as it breaks into tiny pieces under the duress of a life that must go up against a hammer.

What is robust? Imagine that you are a big boulder of rock. Life is the hammer, but now as the hammer strikes, what happens? Maybe a few pieces chip off, but that rock is not going anywhere. It does not necessarily improve upon itself under the pressure of the hammer, but it can hold, “steady as a rock.”

What is anti-fragile? Anti-fragile is something completely different than fragile. Through randomness, disorder, and stress, improvement is obtained. Anti-fragile means getting better in a world of randomness and chaos. Humanity, in general, is anti-fragile as it keeps getting better over time as nature tries to beat it down. That is how advanced civilizations become advanced in technology, politics, healthcare, engineering, and culture. Yet, while all this progress and improvement is made for humanity, individuals often stagnate or fall behind.

Imagine a muscle that is forced to lift weights. If that weightlifting is in the form of a proven strength building program, what happens to the muscle when it is exposed to stress and random pressures? Muscles get stronger. Muscles get bigger. Muscles become more flexible and pliable. The muscles are not fragile, and they are beyond robust. Muscles are anti-fragile. Muscles improve as a result of the pressure and the stress placed upon them. It is the same with a properly functioning immune system. Immune systems improve upon stresses added within reasonable tolerances.

So is the goal of our financial lives. We are moving them away from fragile, through robustness and towards anti-fragile.

“Make a lot of money and building wealth is tough. Keeping it over a lifetime is even tougher.” – Paul Kindzia

How do we do this?

- We do it with the right financial philosophies and mindsets.

- We do this by building in redundancy and layers (avoiding single points of failure).

- We avoid risks and gambles that, if lost, would wipe us completely out and bankrupt us.

- We keep our options open.

- We avoid things that have shown not to work.

- We respect the old and proven as we assemble working rules for ourselves that have been around longer than we have.

- We surround ourselves with a tribe of people that share common philosophies and mindsets.

Anti-fragile wealth building is the result of the right philosophies, with proven principles, dependable processes, and optimal systems to support those philosophies and principles.

The current Coronavirus pandemic is just one more case in human history that magnifies where an individual or household is on the wealth fragility spectrum.

- We see people that could not go a single week without income.

- We see people without emergency funds.

- We see people who took on too much risk.

- We see people that have far too much debt and leverage.

- We see people that were clearly living above their means and got exposed.

- We see who was not saving consistently over time.

- We see people that were caught chasing get rich quick schemes rather than building robust and anti-fragile financial systems for the long-term.

- We see people that had no risk management principles in place in their lives.

When we build processes that revolve around becoming anti-fragile, we are playing the long game. That often means that we sacrifice in the short-term to make ourselves far more effective and successful in the long-run. If we look at most Americans (today more than ever), we see how most of them are living their lives to optimize for today. They spend more money than they make. They eat more food than they need. They skip workouts to do things that are more fun. They consume recreational drugs, alcohol, and tobacco that are harmful but make them feel better now.

Playing the short game is not for us in our tribe. The short game is not the lifestyle we are choosing. The short game is unattractive because we know that our future will be worse than our present. Rather, we do the work today to make tomorrow better and then repeat. The only easy day was yesterday. Yet, our lives continuously get better. That is another paradox of success.

Play the long-term game. Remember, today it is the Coronavirus pandemic. Yesterday it might have been the tech bubble, or 9/11 terrorist attack, or the housing crash, or a war, or an earthquake, or a hurricane, or a job loss, or a personal illness for you or a family member.

We are not building war plans to fight the last war. We are building personal processes and systems based on proven principles of success that will allow us to make improvements through all the nutty things that life will continue to throw at us while we are on this spinning rock called Earth.

The Coronavirus story will one day be behind us. But I assure you, we will move onto the next story, and then the next story after that. We each will have our own stories with our own villains, problems, and obstacles to overcome. Your objective is to move over time away from fragile and towards anti-fragile. Most people never budge. Most people stay stuck in a constantly fragile state and then need someone or something (like the government or government program) to come and save them yet again. Do not rely on the government or the system to save you. Learn to save yourself.

BEAR MARKETS

The question that I have been getting the most during the last few weeks is along the lines of, “Why are the markets doing what they are doing?” followed by, “None of this makes sense.”

To understand bear markets requires us to gain insight on three historical items related to bear markets:

- What are the average losses/declines during most bear markets?

- How long do most bear markets last?

- What are typical bear market rallies within a broader bear market decline?

To clarify a few technical terms, a market correction is a decline in the markets that exceeds 10% from the previous high. A bear market is a decline in the markets that exceed 20% from the previous high.

- Average Losses/Declines During Most Bear Markets

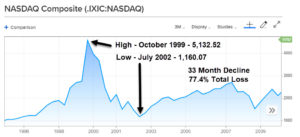

Bear markets, by their very nature, are more severe than a standard correction. They are regular events, but certainly not as regular as corrections. Further, bear markets can sometimes be quite severe. An example of a severe bear market was the NASDAQ in the early 2000s when it fell a whopping 77.4% from peak to trough.

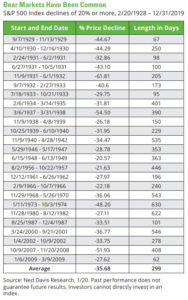

Below is a summary of bear markets that is often passed around Wall Street and to clients of Wall Street firms. You will notice quite a few bear markets with reasonably long tenures. But this chart itself is often misleading because it is counting many of the smaller bear markets that occurred within much more extreme bear markets that happen in history.

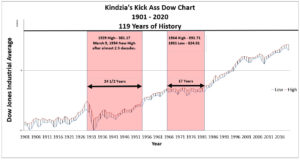

Notice all of the “bear markets” that occurred from 1929 through 1957. They were happening regularly. The same holds true from 1961 through 1982. Again, plenty of bear markets. But look at the chart below of the Dow Jones Industrial Average and notice how long the bigger bear market lasted. What we were getting were bear markets within a much bigger and longer bear market.

It often takes years and years (possibly decades) for stocks to re-attain their previous all-time highs. This is not something to be ignorant about in your investing processes.

2. How Long Do Most Bear Markets Last?

Investors often fail to realize how long cycles can last in financial markets. Cycles are part of history. They always have been and always will be. It’s boom then bust. The more we try to prevent the bust, the bigger the bust often turns out to be (thanks to leverage and extreme valuations caused by the previous boom cycle).

Although one might argue that the “average bear market” has an average decline of 35.68% and lasts an average of 299 days (approximately 10 months), that doesn’t mean;

- Some don’t decline much more or last much longer.

- That records aren’t meant to be broken.

That second item should be noted. Records are always meant to be broken. We just don’t know when the record will be broken. Will the bear market record for losses or length be broken on the current bear market? Nobody knows. What we do know is that delines are often correlated to the amounts of leverage/debt that were accumulated in the prior bull market cycle along with how high valuations got stretched before the cycle ended (the worst being in true bubble markets).

Notice how long it takes for markets to reach a bottom in severe bear markets. In the last two bubbles, it took the S&P 500 929 days and 517 days to eventually find their bottoms. We haven’t even reached 90 days yet since markets reached their previous high as economic conditions are declining, and corporate earnings are falling.

What we should be noting right now is that we have the double whammy; record global leverage and debt along with extreme valuations. Hence, investors playing the long-game should take note and be skeptical of paper assets that could be worth a lot less in short order.

- What are typical bear market rallies within a broader bear market decline?

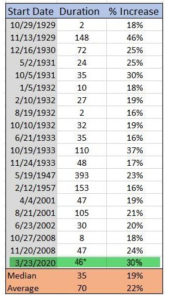

Below is a chart of some of the stronger and more impressive bear market rallies that have occurred during longer-term bear markets. Notice that some of these rallies can last months (the average lasting over 2 months) while the gains can be quite impressive (many being in the 25+% range.)

Notice below how many “bear market rallies” happened during the global economic meltdown of 2007 – 2009. These rallies were false hopes that trapped investors who believed the worst was behind, and as they got impatient and bought the dips (the same thing that worked on the way up during a bull market).

All of these rallies took place over the span of 517 days while the S&P 500 eventually declined 56.8% from peak to bottom during the global real estate bubble and debt bubble that led to the economic collapse.

I like to point out that successful investing is not about “how much pain you can personally withstand.” There are no extra prizes for taking punishment and losing capital in the markets. The adage, “It’s not a loss if I don’t sell,” should be used with caution during bear markets.

Questions that are worthy of self-reflection as we continuously move towards anti-fragile:

- What happens if this is a deep and extended bear market?

- What happens if we break the record on this one for a bear market (we don’t know).

- What happens if we are like Japan with this bear market? (Japanese Nikkei is about 50% of what it was back in 1989 after 30+ years – so much for getting 10% annual gains and doubling your money every 7 years.)

Are you playing the Anti-fragile game? - Are you sticking with proven investment principles of success?

- Are you buying quality assets at good prices (or reasonable prices)?

And now, during this pandemic, we can witness in our own lives and the lives of others, those that have moved slowly, deliberately, and intentionally away from being financially fragile and towards anti-fragile. How much easier is it to get through a pandemic or major financial event when:

- You no longer have consumer-based debts. No credit cards, no auto payments, no mortgages. Would you sleep better each night if you knew that nobody could kick you out of your home or show up to repossess your car?

- You had multiple sources of income so that if one were interrupted or temporarily turned off, you had some redundancy in your income streams.

- You had emergency funds that could sustain you while things were shut down for months.

- Your investments were not 100% all in inflated pieces of paper (stocks) hyped by Wall Street that could quickly drop 30%, 40%, 50+% often tied to companies without any earnings at all.

If you are the group of households that are struggling right now, struggling for income, struggling for food, struggling for supplies, or struggling for clarity, this is just one chapter in a host of chapters that will put you in a position to choose your path for your future. Do you stay fragile? Do you make yourself robust? Or do you build your finances into an anti-fragile state? This is your wake-up call. This is your moment of truth. You must choose what you want your future to be.

It’s not where you are right now as much as it is about where you are heading. Don’t compare your chapter 2 to someone elses chapter 14.

Another of life’s paradoxes is that we must suffer to get stronger. It is like the bicep in our arm. We must lift the weight, break that muscle down, and allow it to repair itself stronger through the stress of exertion. It is impossible to get stronger without suffering.

The same is true in finances when you become a self-made anti-fragile individual. Throughout your life, there are obstacles, pitfalls, detours, hazards, problems that we must grind through. If it feels like a grind, it is because the grind is the process. It is a grind forward.

It is a grind to pay off a house after the years and years of payments and extra savings. It is a grind to climb out of credit card debt. It is a grind to stuff away funds into an emergency fund instead of spending it on yourself for something fun and enjoyable. It is a grind to constantly be prudent and patient in your investing practices rather than betting on lottery tickets. If it feels like a grind, it is because it is a grind. But it is worth it. The juice is worth the squeeze.

In many ways, that is why those who grew up with less can navigate hardships more resiliently. Why? Because they grew up with less. They had to fight for it more. They had to struggle and do without for periods in their lives. That is what made them strong and resilient. That is what put them on the path to become anti-fragile because they already knew the consequences of living a fragile financial life.

Investing In Today’s Climate

Our objective in investing in today’s pandemic climate is the exact same, and that is to invest in proven principles of success. Mainly, we buy quality assets and investments at attractive (or even reasonable prices). We diversify. We do not chase lottery tickets. We grind forward in assets that have favorable probabilities so that we can build and protect our wealth in an anti-fragile way.

We are going to grind forward in the same way we did through the tech bubble, or the 9/11 terrorist attacks, or the hurricanes, or the real estate bubbles. Market cycles can often be like roller coasters, and a successful investor must be able to get through the valleys along with the peaks to enjoy the rewards of their grind.

This pandemic will one day pass. Nobody knows when for sure. It could take two more months, two more quarters, or two more years. Nobody knows. And guess what? Nobody says that something additional cannot pile on while this pandemic is going on. Nobody says that a hurricane cannot blow our house over in the fall, or that an earthquake cannot strike a region of the country, or that a new product or service will make our employer obsolete.

Our objectives should always remain the same, and that is to grind out daily improvements while we walk that path towards an anti-fragile lifestyle and philosophy.

In the meantime, my objective is to get you to become as anti-fragile as possible in the most effective and efficient ways possible. Whether that assistance is in the area of:

- Financial planning

- Investments

- Estimating insurance needs

- Getting out of debt

- Creating personal systems

- Delivering proven processes

- Providing you principles of success

I am here to serve you.

The easiest way to proceed through these is towards a debt-free and healthy lifestyle. As we can see yet again, the current pandemic is just one more example of the benefits of living a debt-free and healthy lifestyle.

Should you have any questions, fell free to contact me by clicking on the contact tab. I am here for you.