Posted May 12, 2017

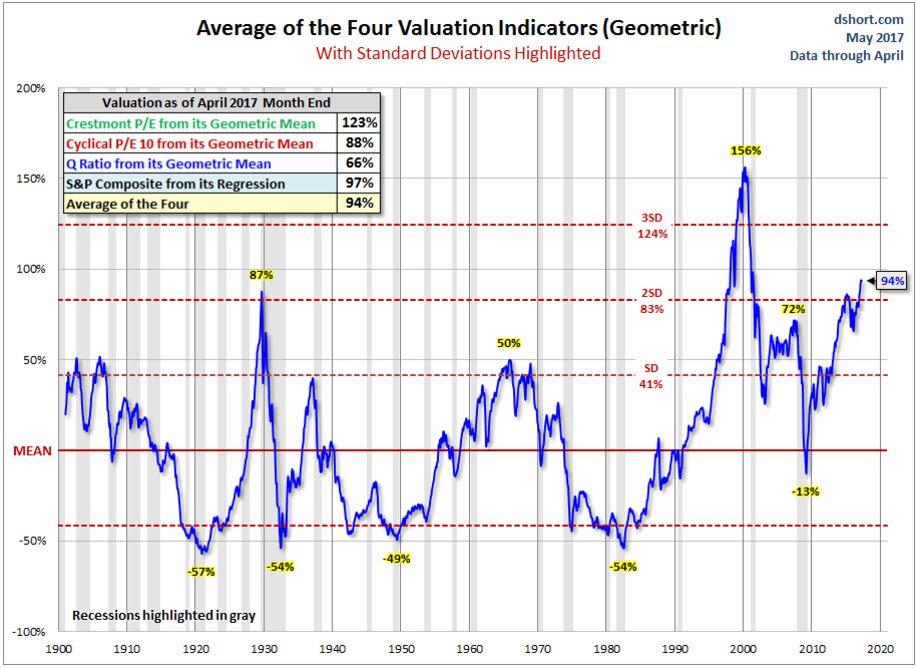

Rational Investors should be reminded that current market valuations continue to be at extreme levels seen very few times in market history. When U.S. stock markets have reached these stratospheric levels in the past, it eventually resulted in investor LOSSES THAT HAVE EXCEEDED 50% EVERY SINGLE TIME.

Market Valuation Metrics

(Data and chart referenced to Doug Short and Advisor Perspectives)

What You Are Told As Truths By Wall Street

You have all been told and remember certain absolute truths delivered to you by Wall Street. Two of these “truths” are that stocks earn 10% each year and your money should double every 7 years. It is supposed to be “LAW.” You are all supposed to be entitled to those returns and count on them. To obtain those truths however, there are a couple of rules that you must abide by. Some of these unbreakable rules are as follows;

- You are told that if you are all good little boys and girls and “buy and hold” like you are supposed to do you will earn 10% a year and double your money every 7 years.

- You are told that you should completely ignore valuations in your investing. The price you pay for any investment doesn’t matter if you are a long-term investor and “hold” long enough.

- Thou shall not try and time the market, regardless of circumstances or extremes presented in the market. Only fools try and time the market.

- If you follow the above rules, you will end up fabulously rich, retire in style and maybe have enough cash left over for a yacht, airplane, or mansion by the ocean (oh wait, those are only for people that work on Wall Street…not you gullible investors…)

The real truth is that valuation matters especially at both extremes of the investing cycle. When markets are cheap and inexpensive (usually when most investors are fearful and scared), stocks are a wonderful value with exceptional future return potential. Wise investors should be loading up on inexpensive quality investments.

When stocks are extremely overvalued and expensive, a wise investor should take note, become skeptical and be a student of history. The real fool is the one that blindly believes what Wall Street is selling. When markets become extremely overvalued, large losses and poor returns follow for extended periods of time.

I think two quotes are of value right now in these markets;

“Those who cannot remember the past are condemned to repeat it.” – George Santayana

“We learn from history that we do not learn from history.” – Georg Wilhelm Friedrich Hegel

Three Painful Examples That Investors Are Choosing To Ignore

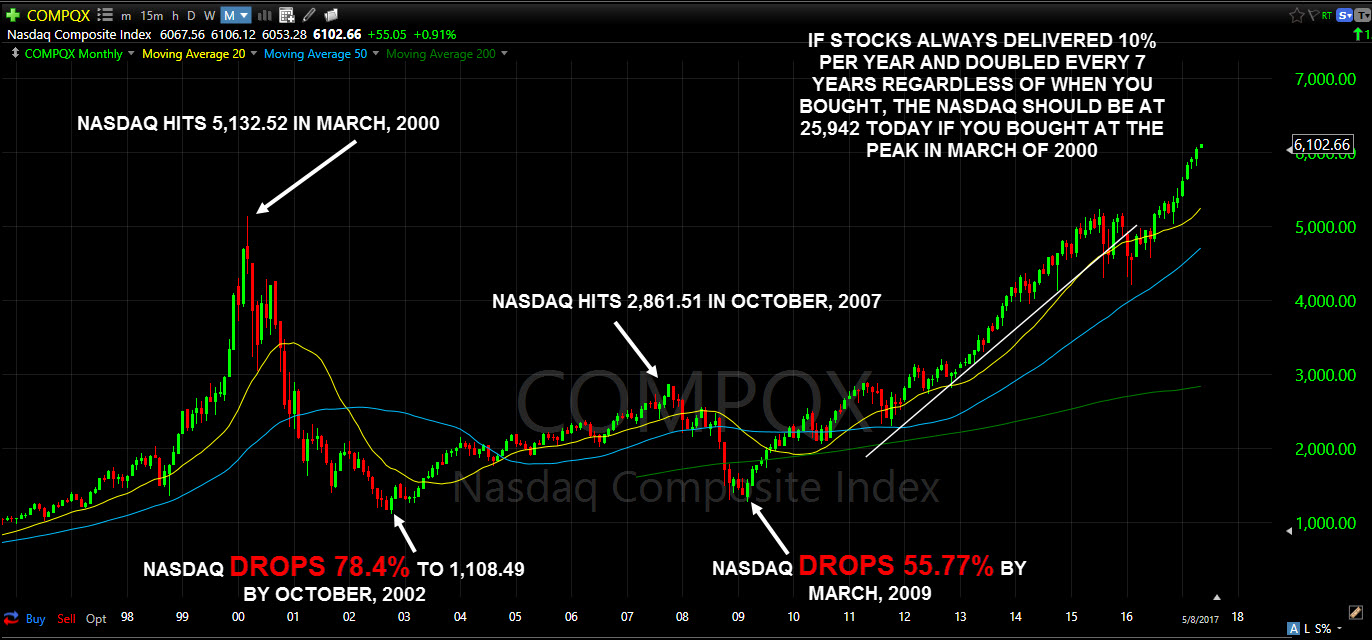

Example #1 – NASDAQ and technology stocks.

I want you to imagine that you are back in March of 2000. You are a good little boy or girl and are religiously following the truths of Wall Street. You buy and hold, you ignore valuations (no matter how ridiculous they are) and you do not try and time the market. You invest in tech stocks during the tech bubble where even grannies and ditch diggers can make strong ddouble-digitreturns due to their incredible investment acumen, talent, and skill.

You are loaded up in stocks when the NASDAQ hits 5,132.52 in March of 2000. Let’s test the “rules and truths” of Wall Street, shall we?

If you always earned 10% per year and money doubled every 7 years, then 17 years later in 2017 the NASDAQ should be at 25,942.

News flash – It’s at 6,100 and extremely overvalued based on underlying corporate earnings.

Lesson – Valuations mattered!!!

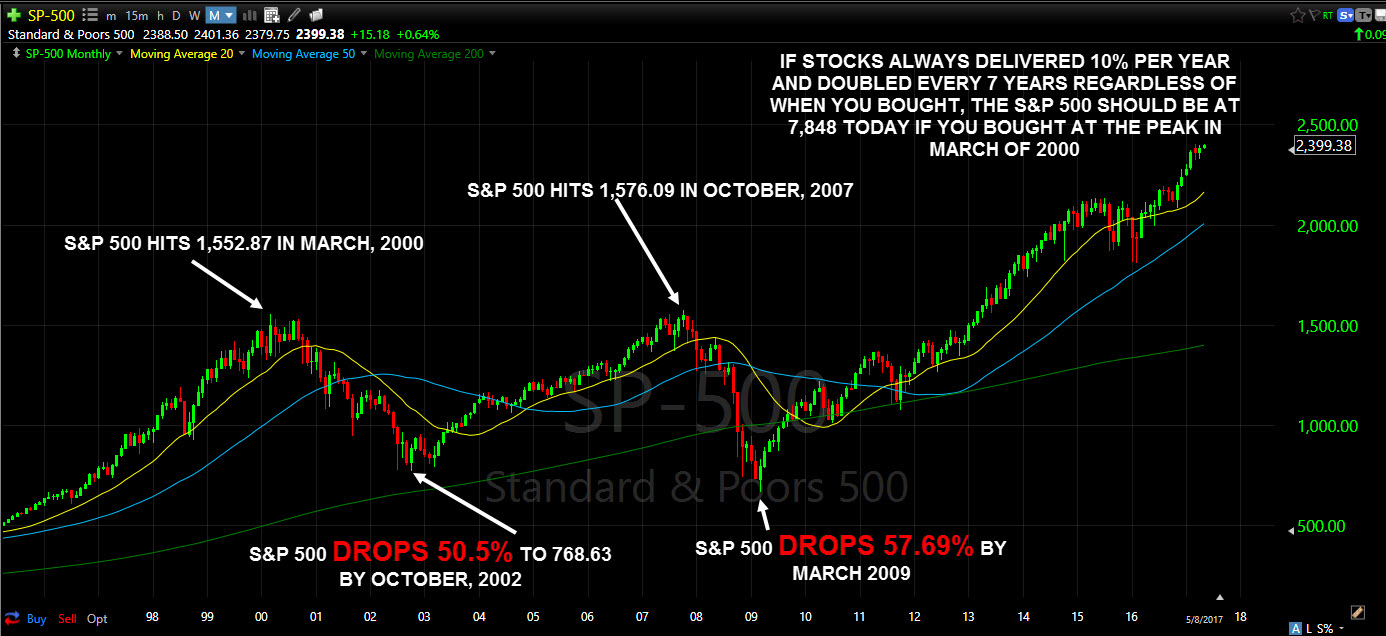

Example #2 – S&P 500 stocks

I know some of you are going to say, “But I’m not gullible enough to mess around with just technology stocks and the NASDAQ. I only invest in blue chip quality companies that would be found in the S&P 500.”

I want you to imagine that we are back in March of 2000. You are a good little boy or girl and are religiously following the truths of Wall Street. You buy and hold, you ignore valuations (no matter how ridiculous they are) and you do not try and time the market. You invest in your quality blue chip companies that are found in the S&P 500.

You load up with quality blue chips in March of 2000 when the S&P 500 hits 1,552.87. Let’s once again test the “rules and truths” of Wall Street;

If you always earned 10% per year and money doubled every 7 years, then 17 years later in 2017 the S&P 500 should be at 7,848.

News flash – It’s at 2,400 and extremely overvalued once again based on underlying corporate earnings.

Lesson – Valuations mattered!!!

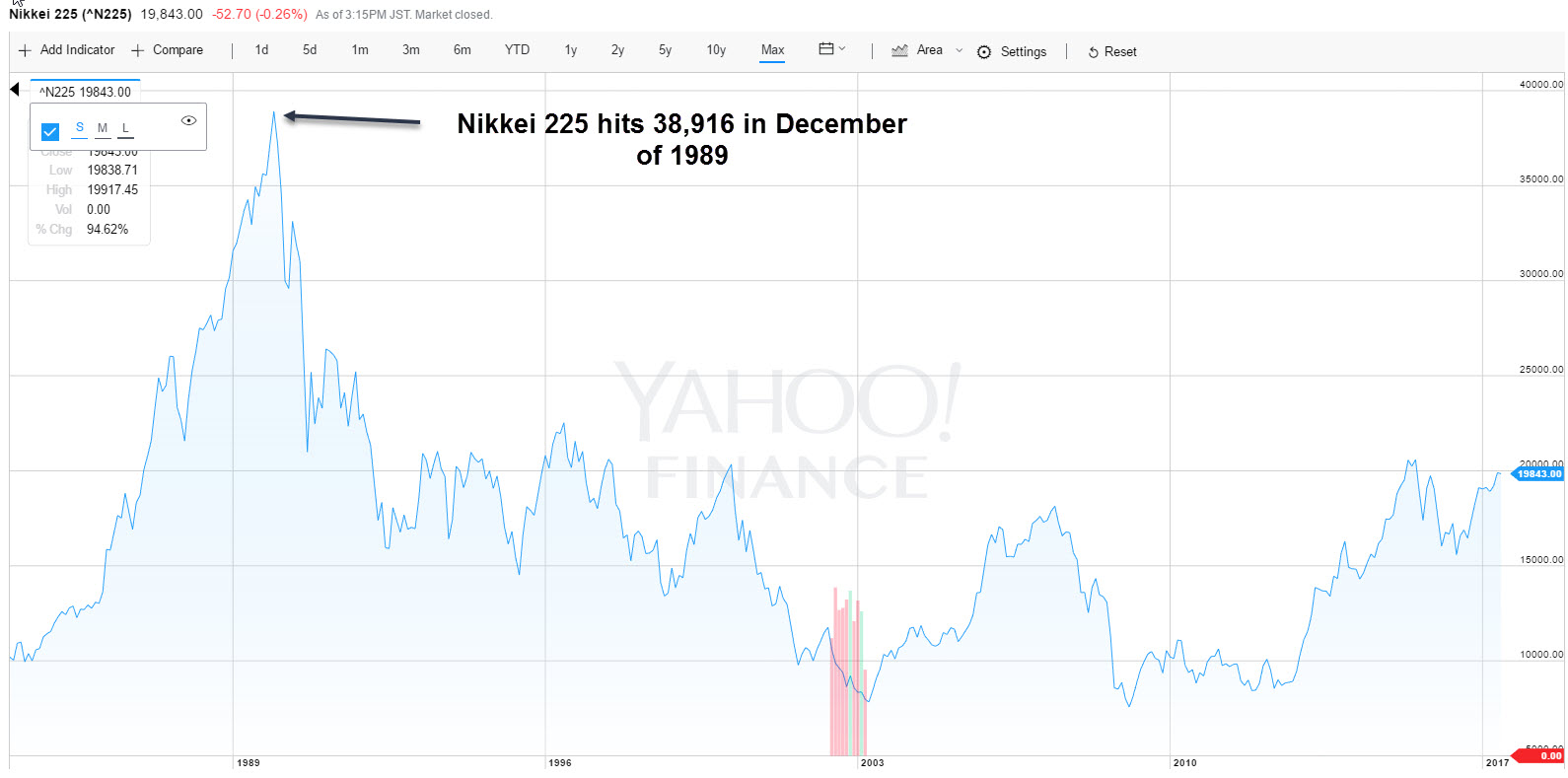

Example #3 – The Japanese Stock Market

You’ve been told another “truth” by Wall Street to support the blind “buy and hold” always wins no matter your circumstances argument. The “truth” told is that if you hold on long enough, markets will ALWAYS recover, go on to new highs, and you will once again make your 10% per year and double your money every 7 years.

Except that doesn’t always work out either unless maybe you can live to a few hundred years old (Which isn’t a bad idea. You better start eating your vegetables.)

In 1989, the Nikkei 225 Japanese stock market hit 38,916. Those investors were told that you should buy and hold, valuations didn’t matter, and you shouldn’t try and time the market. The good times would keep going and would last forever.

If you always earned 10% per year and money doubled every 7 years, then 28 years later in 2017, the Nikkei should be at least over 300,000 and probably closer to 561,207 with compounding.

New flash – The good times didn’t last forever. It’s 28 years later and we are in the year 2017 and the Nikkei is still below 20,000 almost half of what it was in 1989.

Lesson – Valuations mattered

The Principles of Investing

The principles of investing never change over time. The objective of a prudent investor is to buy quality investments at a reasonable price (or better yet, a wonderful price). The price you pay for any asset will have a greater impact on your long-term rate of return than any other factor. Simply put, if you over pay for anything; a house, a car, a business, a share of stock, your future return will be muted. If you pay too high a price, you may not even get a future positive return, you most likely locked yourself into future losses.

Investors once again are ignoring market history. You are seeing stocks trading at insane multiples. This is no longer investing but rather pure speculation and gambling.

The Dangers of Buying And Holding During High Valuations

If you are an investor who is buying or holding large amounts of equities during times of extreme market valuations, you are basically saying that price does not matter at all in investing. But what you should know is that eventually PRICE ALWAYS MATTERS.

Now a comment that is made very often by investors is, “But if I am too conservative for a period of time during market extremes and generate a low return, I can’t/won’t meet my goals. Plus, everybody else is making easy money while I’m missing out.” But this mindset is assuming that markets will stay at extreme valuations forever and ever. The question you need to ask yourself is this;

“If you don’t think you will reach your goals while temporarily earning a low rate of return to protect yourself during market extremes, how do you really believe you will reach your long-term goals if you watch your capital base diminish 40%, 50%, 60% or more?” – Paul Kindzia

We have only been in extreme conditions like this a handful of times in market history and they all ended terribly with very large investor losses for those taking on that investment risk. Ask yourself what would happen to your retirement plans if you lost 50% or even more than 70% of your capital base? Could you hang on and recover from something like that?

The value of having a trusted advisor on your side is that they can help guide you during these times. We are here to help you navigate what should be very challenging market conditions during the second half of the market cycle. And here is the good news…For those wise investors who pay attention to price and value and protect their capital during bouts of extreme valuations, they are best positioned to take advantage of lower prices and better values once market conditions reset to historical norms.

What would it feel like to boost your wealth significantly over the coming decade? Avoiding high risk investment conditions is one of the best tactics and strategies available to make that happen.