If you are like the rest of us, you are trying to enjoy and make the best of this holiday season. It certainly is trickier while politics, pandemics, recessions, and market madness episodes are in full swing.

I will try not to keep you from your holiday cheer for too long.

Three Major Market Problems

Investors are facing several common problems at this point in the market cycle;

- Interest rates are so low that savers cannot earn anything on their capital.

- Global debt levels for sovereign nations, municipalities, corporations, and households are expanding furiously even after breaking record levels. These levels far exceed the debt levels that triggered the global economic collapse in 2008 and 2009.

- Equity (Stock) Valuations are at extreme/bubble levels.

The narrative during stock bubbles is usually along the lines of, “Everything is great. Stocks are going to the moon. Full steam ahead.” It is that collective mindset that moves valuations to extreme levels and allows bubbles to form in the first place.

This current extreme is on the cusp of breaking every single valuation metric that has been utilized on Wall Street over market history. If our objective is to, “buy quality investments at attractive prices (or even reasonable prices)” then valuations like these should force every investor with any sense of market history to pause and use serious restraint when it comes to allocating hard earned savings.

Investors should be reminded that investing success requires two achievements; First, you must make the money needed to reach your goals. Second, you must be smart enough to keep it and not lose it before needing it (or enjoying it).

Market Valuation Metrics

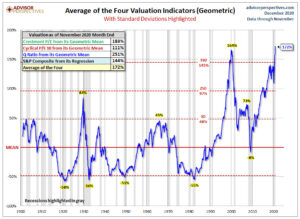

Since there are many different metrics used to value equity markets, it can be beneficial to use multiple valuation metrics. Using multiple valuation metrics ensures that you aren’t just picking up a “false signal” or being faked out by a weird anomaly in a single metric. Then it can be helpful to compare those metrics over market history to see if they strongly correlate to market cycles. Below are four valuation metrics that, when averaged together, provide some excellent context as to where we are on valuations in this market cycle;

(Chart and Research Credited To Advisor Perspectives)

Note: We have NEVER been higher in equity valuations on US stocks in the history of markets. These current levels eclipse the bubble before the Great Depression of 1929, The Tech Bubble of the late 1990s, and the levels that proceeded the Global Economic Meltdown of 2008-2009. (The extremes of 2007 look like child’s play in comparison to the current levels.)

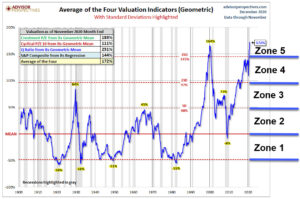

I like using the chart below to break down the valuations into five zones. Using models like this makes it a lot easier to assess where we are in the cycle and where we are relative to market history. This simple exercise makes it very easy to either; 1) deploy capital (when we are often scared to do it in a bear market) or 2) sell our holdings and exit the market (when we are in extreme/bubble markets that are prone to significant and devastating investment losses).

Description of Zones:

- Zone 1 – Stocks are historically cheap. These opportunities typically arise during bear markets after markets have already corrected and we are exiting periods of depressed economic activity and recessions. Zone 1 is the time to buy aggressively and hold for the long-term.

- Zone 2 – Stocks are valued slightly above the mean but within reasonable ranges. It should be noted that the vast majority of market history has been spent in Zones 1 and 2. It is rare to trade outside of 1 standard deviation from the mean historical levels. Zone 2 can still provide investors with opportunities to buy and hold, dollar cost average, and invest for the long-term.

- Zone 3 – Stocks are clearly over-valued and eventually revert back to the mean. Its buyer beware. There may be unique investing situations that could be uncovered but across the market in general, large losses eventually result from buying in Zone 3.

- Zone 4 – This is extreme bubble territory. It is rarified air. The only times we have seen Zone 4 levels are Japan in the late 1980’s (not included on this chart) or during the tech bubble prior to the NASDAQ dropping about 80% from peak levels.

- Zone 5 – INSANITY. Investors here are speculating against horrible odds. Losses for those investing at these levels should be expected to be catastrophic.

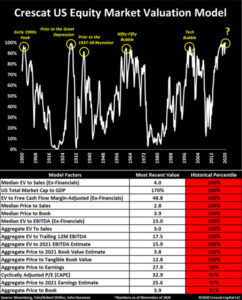

As mentioned previously, there are multiple valuation metrics that can be used to assist us in assessing equity market conditions. Some are as simple as Price/Earnings multiples or Price/Sales multiples. Another valuation metric may compare market capitalization of a stock index to GDP. Each valuation metric can be useful. The following chart is from a Wall Street firm (Crescat Capital) that tracks and utilizes 15 different valuation models. Note that 11 of the 15 models have never been higher and the remaining 4 are approaching the all-time records.

Protecting and Limiting Downside Risk

Although bubble or extremely valued markets sometimes appear to be a source of easy and fast money, those opportunities can only be achieved through horrible odds while ignoring any basic risk management protocols. The latest stretch of equity markets is like being in Las Vegas and having 20 straight spins that landed on red at the roulette table. Many get frustrated and wrapped up in regret for not betting on red during that “obvious stretch” of spins. But anyone using any sense of risk management would;

- Not bet on red,

- Not be at the roulette table,

- Not be inside a casino,

- Not be in Las Vegas.

Likewise, these are not investable stock markets. When equities trade at such extreme valuations, it is more comparable to gambling and speculation. The odds of generating long-term gains from investing in equities at this moment of time are horrible. Therefore, as the charts and metrics all demonstrate, this has been the time for buyer beware, time for defense, and protect your capital.

The important advice I could give to any investor right now is that it does not matter how long we have been in this stage of the cycle or how long this stage of the cycle lasts. The emphasis should be on protecting capital and avoiding losses that have occurred EVERY…SINGLE…TIME we have been anywhere close to our current market conditions.

Below are some valuable insights that you should be aware of so you could stay focused on what matters, which is protecting your money, avoiding large losses, and also be best positioned to take advantage of what is eventually going to follow;

- There is no way to ever know what markets are going to do in the short-term. Over the long-term, markets eventually revert back to means and averages and correlate to actual corporate revenues, earnings, and cash flows.

- Stock prices can and do deviate from corporate revenues, earnings, and cash flows for stretches of time. Stocks can be undervalued for stretches of time. Stocks can also be overvalued for stretches of time. You cannot control stock valuations. You can only control how you allocate your capital during these cycles.

- There is no law, rule, or mandate for any individual to invest their money in US stocks at all times. This is not the case in many pension plans, endowments, institutional funds, mutual funds, insurance company portfolios, or annuity company portfolios. They HAVE TO INVEST capital in stocks at all times even if they know valuations are extreme. They have a mandate to invest. You do not. Use this difference to your advantage.

- Many investors take comfort in knowing that central bankers use stimulus and monetary policy to pump up markets and keep things moving. But note that central bankers have never been able to prevent market corrections (or crashes) in the past, and they will not be able to in the future once the tide turns.

- This economic cycle is being fueled by a massive debt binge, suppressed interest rates, and endless monetary stimulus. We do not know the absolute limits of debt capacity worldwide (but we are probably going to find out soon enough). You should be using this unique opportunity of low interest rates to eliminate your debts and pay them off even earlier than if rates were higher. Most others are using low-interest rates as another excuse to lock themselves in to even more crippling debt like the rest of the world.

- Markets can remain crazy far longer than investors can keep their wits. Investing is a battle over discipline. With it, you can achieve your goals and do it safely. Without it, you are the slave of the markets and risk losing what you worked so hard to achieve.

Getting Results

Investors often are attracted to the stories of famed investors like Warren Buffett. If an investor wants positive results from investing over the long-term, they must use similar principles and processes that lead to those results and levels of success. That means following sound risk management principles. That means playing defense. That means staying the course when others gamble and speculate and get wrapped up in market hysteria.

It is imperative to remember that markets go in cycles. These cycles often last longer than people have the patience for. But do yourself a favor and go back and look at things over more extended periods. You will see that the only constant in the universe is change. Nothing stays forever. Change eventually enters our lives, and it applies to everything.

Think back to remember people that used to be your neighbors or where you used to live. Think about prior places you used to work at, who you used to work with, and what you did at work. Your cars changed. Your friends changed. Interest rates changed. Economies and countries changed. Politicians changed. Thankfully, your haircuts changed too (have you seen old pictures of yourself???)

Although life is about change, your investing and financial principles should not change. Sound principles should be good enough to guide you over a lifetime because a sound principle is timeless.

Sound investing principles should not change. Nor should crazy markets get you to stray away from your proven principles of success. Our principles should always be to buy quality companies at attractive prices. When that is not possible, we stay patient no matter how long that seems to take. Why? Because we know that things will change. Market cycles do not last forever.

Once markets change, two scenarios are going to develop. The first and most common scenario is that most investors will be exposed to large losses. They will spend years trying to make up for those large losses. The second scenario, which is the optimal scenario, is that by avoiding large losses, savvy investors are very well positioned to invest in high-quality investments at attractive prices after prices adjust. Then as markets recover, they see their net worth and financial situation improve handsomely. Meanwhile, they avoided all the headaches and risks associated with investing in bubble markets.

Tough times do not last, but tough people do.

Our objective at Kindzia Investments is to protect and grow your capital for the long-term. That objective requires two aspects of successful long-term investing; avoiding large losses and investing capital in high-quality investments that come with outstanding probabilities of success.

Good habits lead to good behaviors. Good behaviors lead to good decisions. Good decisions lead to a good life. Live by principles and choose wisely.