On Sunday, February 9, 2020, Joaquin Phoenix won an Oscar (the Academy Award) for best lead actor for his astonishing role in the movie “Joker.” Phoenix was the second person to win an Oscar award for portraying the Batman villain in the DC Comics series. The first to win the Oscar for playing the Joker was Heath Ledger, who won in 2009 posthumously when he won for best supporting actor in the movie, “The Dark Knight.”

One of the most memorable scenes in the 2009 movie was when Ledger’s Joker character was brought into a room in a body bag posing as a dead man with his pretending bounty hunters who were posing to collect their reward. Ledger pops up alive and well surprising all in the room, including the leader while putting a knife up to his mouth. He goes on to describe a dangerous experience as a child when his father was abusing his mother. The mother attempted to desperately defend herself with a kitchen knife in the face of horrible odds. His father captures the knife from the mother and with the child watching, he takes the knife to her. He then turns and places the knife inside the mouth of the young child. Looking down at the horrified child, he asks, “WHY…SO…SERIOUS?”

I’ve had many investors ask me over the past stretch of time, “Why so serious, Kindzia?” Why are you so alarmed by the markets? Why are you so defensive and serious when all appears glorious? Why are you so serious about what appears to be easy gains in U.S. financial markets while the Fed pumps trillions into the system while global interest rates are driven to negative yields? Why are you so serious about the record valuation levels on stocks? Why are you so serious about the never-seen-before levels in debt across all sectors like sovereign debt, municipal debt, corporate debt, and consumer debt?

Why So Serious?

And the simple answer is because the math is stacked against the market participants where large losses are the most probable outcome. With historical references available, anyone willing to look and review history will see that this entire situation comes down to possibilities and probabilities. Although markets may continue to run away from fundamental metrics like revenues, earnings, and cash flows, it’s extremely probable that market valuations will return to levels that correlate to the actual profitability of businesses that stocks certificates are tied to. Very large losses are likely in the future.

Distorted markets like the current situation do not happen often, but when they have, the eventual losses and pains are pure agony for all those who ignored history (and basic common-sense math).

As a fiduciary advisor to clients that have personal relationships with me, I adhere to a fortified standard that is similar in the medical field when physicians swear upon several items and uphold a few professional ethical standards. You may be familiar with the phrase commonly associated with the medical “Hippocratic Oath,” which is “First, do no harm.”

In my 28 years working in finance and accounting, I’m often ashamed and embarrassed at the conduct and lack of ethics of often what seems to be most of the behavior exhibited by Wall Street firms and their associated employees that represent them. Their sales tactics, advice, and motives are so far removed from a “First, do no harm” perspective that it pains me to see bubbles form and pop as we find ourselves in our third bubble and another impending crisis in less than 25 years.

Now in defense of some in the industry, many are aware of what is called “Career Risk.” Career risk is when a stock broker or financial representative may know that the odds of a profitable outcome is slim, but in times of rising and frothy markets, a failure to participate results in being left behind from the pack and eventually they are fired by the very clients that they are trying to protect. It’s a damned if you do and damned if you don’t situation for them. If they don’t participate in the bubble, they get fired as their clients leave them to chase the “easy and fast money” being promised by their competition. If they do participate, then eventually the bubble pops, clients lose their money and fire the advisor. The thought process then becomes, “Well heck, I might as well participate in the bubble with the rest of them and make some fees and commissions in the short term. When things end up going south as we expected, I can blame it on the markets, the government, the central banks. I’ll blame it on everybody except myself.”

The advisor does their best to create a situation where if account values and investment balances are going up, then it is because of the superior abilities and intelligence of the advisor (it had nothing to do with “all ships rise in high tide during a bubble and unsustainable market.”) When markets eventually fall, and clients lose their money, then the advisor quickly switches gears to say, “How could anyone have seen this coming? It’s not my fault you lost money. We’ll get it back if we just hold on (so I can still collect additional fees). We are long-term investors…don’t give up… have faith…Please don’t fire me for losing your money. Like I said, it wasn’t my fault.”

I find this approach personally appalling, deceiving, unethical, and personally inappropriate. I’m not managing the money of total strangers, driven by some greedy Wall Street firm that is putting quotas on me and telling me to tow the company line so corporate quarterly earnings can keep up with or exceed Wall Street competitors. As a fiduciary, my interests are in working for my clients, protecting them from harm, doing analysis that they either can’t do or don’t want to do themselves and knowing that often their entire lifetime savings are in my hands.

I’m not going to treat any client and manage their money any different than I would with my own parents, or siblings, or lifetime friends. I couldn’t sleep at night if I knew that I was gambling with their money to boost my own short-term financial interests. I’d rather take the short-term financial hit personally by not trying to worry about other firms and advisors and do what makes the most mathematical and financial sense based upon the actual situation we find ourselves in.

That’s a long way of saying, “I take this perilous financial situation we find ourselves in extremely serious…” And when in doubt and facing probable odds of large market losses that are approaching our doorstep, it’s only ethical and prudent to, “First, do no harm.” We will have plenty of opportunities over the next few years and decades to invest in various appealing opportunities that will reveal themselves. But we will only do it when the math makes sense.

Coronavirus

You may be like others and may be wondering how to “invest” around the coronavirus situation in China (and quickly spreading). I strongly recommend that you maintain the same approach and discipline as you would at any other time when you are looking to deploy capital. Can you buy a quality investment at a good price?

There is never a way to predict outbreaks with viruses. Most of these outbreaks have rather short-term consequences in the scope of your investing timeline. Often, they generate enough fear that prices and valuations decline to the point where you may be presented with an attractive investing opportunity that otherwise would not have occurred. When reviewing historical data, there hasn’t been a single case of an outbreak where things didn’t recover within a few quarters of economic activity. That’s a positive perspective.

With that said, the fact that we have the world’s second largest economy (China) completely locked down and closed for business and yet valuations are moving to even higher extremes with more loans and debt being offered to those being impacted should be concerning.

Will this be the final straw that breaks the markets? Nobody knows. Only time will tell.

But in the meantime, the process of investing should not be altered. Can you find attractive investments at attractive prices? Yes or no?

Valuations

It’s during bubble markets that people lose sight of the most important concept of investing in stocks. Although financial markets have gone full digital rather than old-fashioned paper, it does help to remember that when we buy a share of stock, we technically own a piece of paper that shows that we own a fractional share of an actual business. These pieces of paper were called stock certificates and the certificate (again, now digital) tells us how many shares of the company we own which then allows us to calculate what percentage of the overall business we are an owner in. The fact that these pieces of paper are easily tradeable is secondary to the concept of stock investing. Thus, it is critical that you determine whether you are “a stock investor” or “a stock trader.”

A stock investor desires to own pieces of good businesses. This ownership entitles them to the benefits of owning a good business. They are entitled to a share of the profits and cash flows. Investors must trust corporate management and directors to act as fiduciaries over the business and your investment of capital.

A stock trader usually doesn’t look at stock certificates as ownership of businesses. They look at them as just trade-able pieces of paper no different than baseball cards or lottery tickets. The paper is technically worthless. What is valuable is what the next trader is willing to pay for that piece of paper tomorrow, next week, next year or possible in 1/100th of a second later if they are computer algorithm traders.

This is where most working-class investors go wrong in their investing strategy because they confuse investing with trading. They may say that they are a “long-term investor” and that may cause them to make very bad decisions for several fundamentally critical reasons.

You must know and understand that most “normal” people (even if they are highly educated and make very good earnings at corporations) have absolutely no idea how to value any business let alone a multi-billion-dollar enterprise. This makes them extremely vulnerable to the influences and ever-increasing abilities of Wall Street to loot them of their hard-earned savings.

Most normal people get caught up in that gray-zone between being an investor and being a trader, which ends up exposing them to large losses on a personal financial level. Market participants feel like they are missing out on fast gains that suddenly turn into fast losses during market corrections (or crashes).

This situation is like being in a Vegas casino where you play games for hours and the person sitting next to you wins a prize while bells are rung and lights flash. You keep playing but the math odds are stacked against you. The more you play, the more likely you are to lose all your money. Any attempts to turn the odds in your favor (like card counting) are made illegal. The odds are always in favor of the casino. “Dem da rulz…”

At least in investing, a disciplined investor over time can tilt the odds of winning in their favor if they can avoid large losses and extract out grinding profits while not falling victim of the casino operators. This is done when the possibilities and probabilities are in their favor. And it is all perfectly legal. The only thing it takes is discipline of buying quality investments at good prices. Unfortunately for market participants (and fortunately to Wall Street firms), most humans lack discipline in most areas of their life, investing is just one of them.

Wall Street is more than happy to keep people in that gray zone because it benefits their bottom line. Wall Street is run by very greedy for-profit enterprises (under the guise of investments themselves) and their entire business model is built around keeping money at play in the markets and their offerings. Wall Street is VERY short-term focused. They train YOU to be a paper trader rather than a true investor and to ALWAYS put your hard-earned savings with them no matter the circumstances.

Wall Street and their controlled media operations work hard at getting you to believe that it is ALWAYS a good time to buy the stocks and offerings that they are selling and to keep handing your hard-earned savings over to them. Do you not believe me? Consider these often heard theories;

- If markets are low, then they recommend that we buy. The headline will be “Buy low and sell high! It’s a great time to buy.” (This usually is a true.)

- If markets are just meandering along, then they tell us to buy because, “Dollar cost averaging works. Just keep buying and it will all work out over decades.”

- If markets are at high valuations, then they will provide carefully selected examples with precisely selected sections of time to convince us that if you bought on some specific date 4 decades ago and lived to 157 years old, you would have made a good return on your money.”

- If markets are at insane valuations (something that happens infrequently during an individual’s lifetime), then they work hard to convince you that “Everything is great! The economy is great. Everybody is making money.” Then they work the emotional and behavioral side of the influence by asking, “Why would you want to miss out on all these easy gains that your neighbors are enjoying.”

Thus, to Wall Street firms, it’s always a good time to buy and never a good time to sell. There are just a few big flaws in the Wall Street model when we get caught in that gray zone between investor and trader. Anytime you buy at insane valuations, mathematically you increase your risk of loss and mathematically you limit your upside profit potential. It simply cannot be any other way.

If you remember that you are investing in businesses rather than trading pieces of paper than you know you are own a fractional piece of an enterprise that is generating revenues, earnings, and cash flows. Paying a higher and higher price for a share of that business does not increase your profit potential, it decreases your profit potential over the long-term.

Businesses can only grow so quick. Collectively, corporate revenues are only one piece of the economy. You can’t have corporate revenues indefinitely grow faster than GDP. Otherwise at some point, corporate revenues would grow larger than GDP, which is impossible. Further, earnings are what is left over of corporate revenues once business expenses are paid. You can’t have corporate earnings indefinitely growing at a fast rate than corporate revenues. Otherwise at some point, corporate earnings would grow larger than corporate revenues, which is impossible.

The data is overwhelmingly showing that “investors” have firmly taken up residence in that gray-zone and have collectively converted themselves to “traders” much to the chagrin of Wall Street who is more than happy to keep the money flowing to extract out as many fees, commissions, and earnings as possible from the capital that they want to control and manage “on your behalf.”

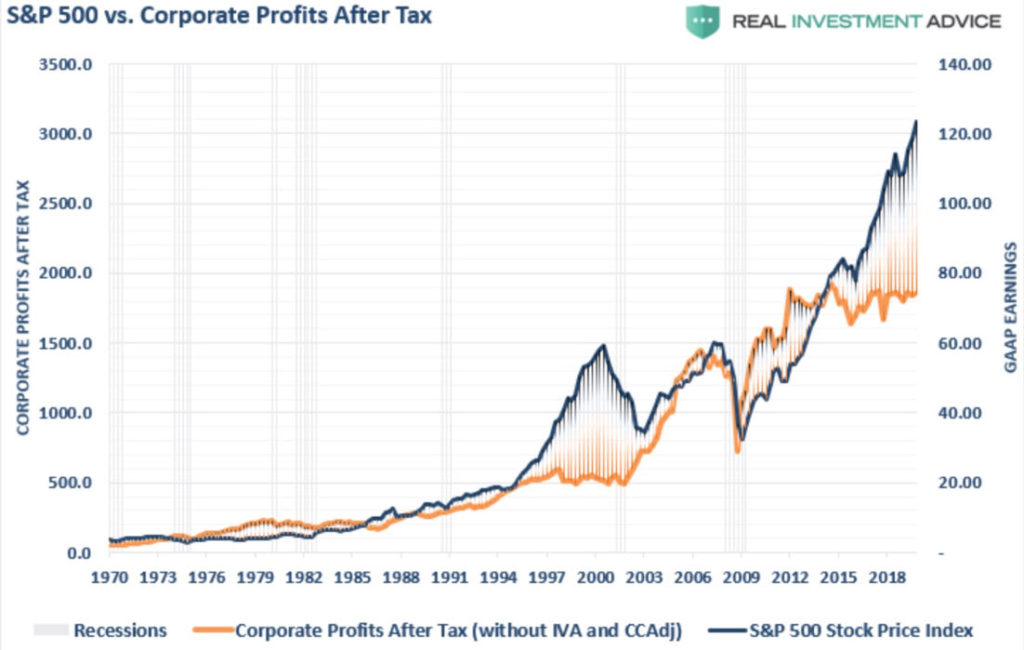

We can see from the following how the levels of the S&P 500 are deviating and no longer correlating to earnings which again are a component of corporate revenues which are a component of GDP. Valuations started to greatly deviate from underlying earnings back in 2015 and 2016 and have been stretching more and more ever-since. It’s a rubber band ready to snap.

(Credit to Real Investment Advice which does an excellent job of generating independent research).

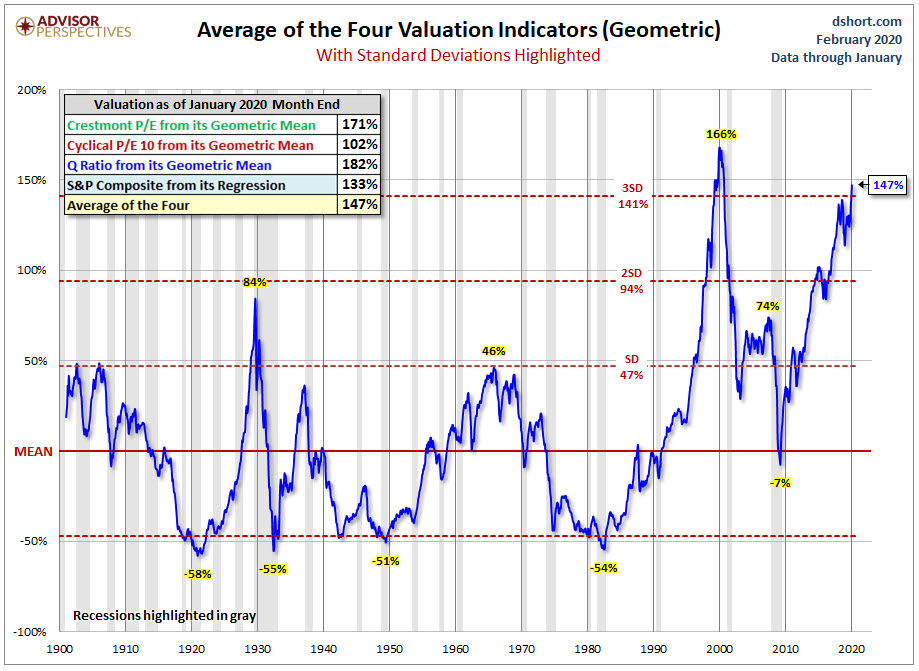

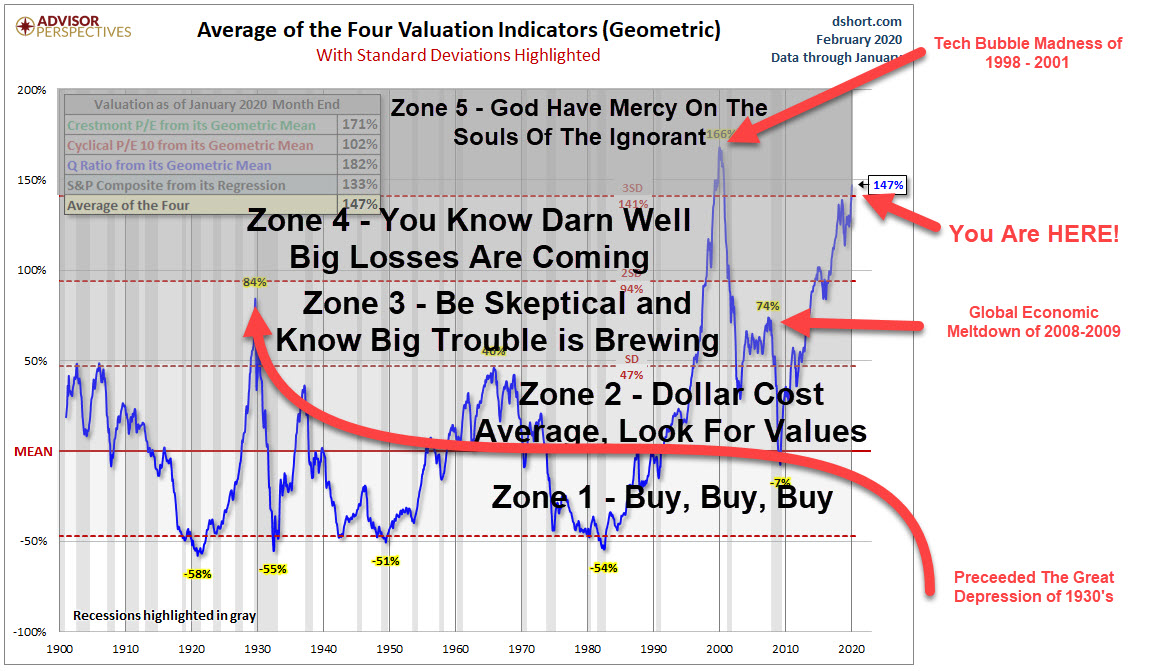

We have now moved into a zone of valuations that are so extreme that believing that “this time is different” can have severe and catastrophic ramifications to your personal wealth if you don’t play defense.

The following is an excellent and yet simple tool for investors to follow for the knowing where you are on market valuations and how to respond with your hard-earned savings using the above as a model.

We are in a liquidity driven market supported by global central bankers. If everything was as great as they are trying to convince us, they wouldn’t need to keep lowering interest rates and printing liquidity by the trillions while encouraging debt levels that in the long-run are unpayable. This is all a shorter-term phase that history needs to navigate. Central bankers will survive. Big banks (many) will survive and will probably get more bailouts with the support of government officials. Wall Street firms (many) will survive and move on to the next cycle as they always have and always will. Many individual investors may not survive. We are taking precautions that this does not happen TO YOU.

Note, that over history, not every government survives. Not every big bank survives. Not every Wall Street firm survives. And last but not least, not every individual investor survives. When you follow the masses, you follow many of them to their graves. The losers all ended up being “traders” over the short-term rather than “investors” over the long-term. Don’t ever make that mistake yourself. We prefer you do your best Diana Ross impression and sing, “I Will Survive.”

In the short-run (which in historical terms still may mean multiple years) the government, big banks, and Wall Street firms can get the population to believe a lot of crazy stuff and get us all going in the same direction. But it never lasts. It comes to an end. But humans get so wrapped up in being part of the crowd, focusing on the short-term, experiencing the greed and the fear of missing out that they can’t stay logical. They refuse to see what is right in front of their eyes no different than past bubbles. They believe they are using logic and intellect when they ask themselves, “How are my short-term performance measures doing compared to others?”

But we know through history that governments, big banks, and Wall Street firms lead the masses to extreme losses that can exceed 50% – 80%+. These cycles have happened several times in the last 100 years and they will happen again over the next 100 years.

You need to ask yourself the following to stay rational;

- How would you feel if you lost big money like others in the past? How would it feel to lose 50% – 80%+ of your hard-earned savings if you chase the sky-high valuations currently being offered on Wall Street?

- How would you feel to be looted once again if you were previously looted by Wall Street during the tech bubble or the global economic meltdown? If they created those large loss events, why would you believe that they won’t cause even greater ones at some point in our future?

- How would you feel to see big banks rescued once again by governments and your tax dollars when they won’t rescue you from individual large losses if you play their game?

- How did it feel in the past when investors finally realized that they paid sky-high prices for worthless paper assets rather than buying quality investments at good prices?

We are clearly in a liquidity driven market and although many have heard the saying, “Don’t fight the Fed” we should also be reminded of a saying that has been around a lot longer and has shown the negative impacts when we realize, “You can’t print prosperity.” Printing prosperity is nothing new to governments that have their own currency. The idea is that they just keep creating (printing) money to keep the masses pleased and the government in power while running unsustainable deficits while devaluing the currency. Unfortunately, you can’t print prosperity. The laws of economics always reign supreme. Right now, we are frantically attempting to print prosperity. Be warned and take notice.

Personal Discipline

One of hardest parts of living in today’s culture and society within a very material world is staying personally disciplined when we are constantly being offered a barrage of endless offerings.

It’s so easy to get wrapped up in what everybody else is doing and make comparisons. It’s so easy to feel like we are missing out on something better. It could be missing out on new cars, or bigger homes, or fancier vacations, or hopping social events with important people. It could be feeling like we are missing out on more money, easier gains, or fabulous riches.

It’s hard to be disciplined with our diet, our sleep, our exercise, and certainly our investment processes. It’s easy to get sucked into what our neighbors are doing. But keep in mind, most people are not disciplined. Most of America is loaded up with debt. Most of America is suffering from stress and anxiety. Most of America is not in good physical health. Most of America has very few healthy relationships. Most of America is not disciplined. Do NOT follow the masses. Walk your own path. Use your own common sense. Don’t believe everything that the government is telling you, or what Wall Street is selling, or what big banks want to lend us. Live your own disciplined life.

If you are going to spend time and effort on seeking to build wealth, now is the time to think about how to protect your hard-earned savings rather than how much to gamble on some technology unicorn stock that has not earned any profits and may never earn any profits, even if they are trading at multiple billion dollar valuation levels.

When you are an investor, you are seeking to own fractional shares of actual businesses that earn revenues, earnings and cash flows. What you pay for those fractional shares has more to do with your eventual profits than any other factor. Simply put, if you overpay for any investment, your future returns will be muted, and you are only increasing your risk of loss.

Don’t be that person who ignores history. We can’t control Wall Street, the economy, interest rates, politics, stock valuations, or bubbles. I can only encourage you to make good decisions for yourself using proven principles of success.

Strive to control your time. Strive to control your location. Work to become financially robust and secure. Live a healthy life. Maintain good and loving relationships. Live with the proven principles of financial success.

Your Financial Planner Is An Investor And Wants To Retire One Day Too!

Keep in mind, these financial circumstances that we are navigating right now in markets have nothing to do with your financial planner. They can’t control interest rates. They can’t instruct the central bankers or the Federal Reserve what to do. They can’t tell the entire country to get out of debt and to deleverage. They can’t convince others to control their spending and lower their cost of living. They can’t convince people to stop buying houses and cars they can’t afford. They can’t tell Wall Street to stop suckering individual investors and looting them every market cycle.

Trust me when I tell you, extreme valuations are not good for your financial planner either. They are also investors. They save their money. They want to retire one day too. They want to be able to earn a fair rate of return on their hard-earned capital. They want their clients to refer them to other people and say, “My guy/gal is great! He/she makes me big money!” But none of that matters in the here and now of market realities. Big banks treat them like crap too.

Investors must stay smart. They must stay disciplined. They must stick to PROVEN PRINCIPLES OF SUCCESS that stand the test of time. Do not overpay for investments. If you do, that mistake is on you and nobody else.

Cycles are part of life. Get used to this idea because if you are going to be alive for the next few decades you will see plenty more cycles and you will be able to navigate those profitably as well. Stay focused on the big picture and your own long-term self-interest.

But whatever you do, don’t get sucked into the media of the day that result in making foolish investing decisions with your own hard-earned money. Protect your capital and eventually you will have plenty of shots over your lifetime to make good investment allocations.

Over time, profitable investments at attractive value points emerge. They always do once cycles run their course. But by then, very few investors have the cash to deploy because they have just experienced large and crippling losses that have damaged them emotionally, psychologically, and financially. Don’t be that investor. Learn from history.