Extreme Valuations + Bonkers Leverage = 1929 Part Deux

The Valuation Bubble in the 1990’s

The Tech Bubble that was fueled by ever growing investor speculation in technology stocks began in the mid to late 1990’s. Investors may be of the belief that these speculative bubbles rise and fall with the blink of an eye lasting only a few months. Perhaps stock prices get away from themselves for a few quarters until sanity returns to Mayville.

But that’s not the reality with bubbles. If we return to the lead up to the tech bubble, Alan Greenspan, then Chairman of the Federal Reserve (the job now held by Janet Yellen), first used the phrase “Irrational Exuberance” in a speech labeled, “The Challenge of Central Banking in a Democratic Society.” The date was December 5th, 1996. That was years before the bubble eventually popped and destroyed the wealth of millions.

“Irrational exuberance,” can be described as unsustainable investor enthusiasm that drives asset prices up to levels that cannot be supported by underlying fundamentals such as revenues, earnings, or cash flows.

This “irrational exuberance” that was clearly within the thoughts of the Chairman of the Federal Reserve didn’t stop stocks from climbing through 1997. Or 1998. And the rate of rise in stock prices not only continued to rise, they began to go parabolic into 1999.

Anything with a .com in the company name was magically worth billions of dollars. It didn’t matter if the company even had earnings. It didn’t matter if the company even had any customers that resulted in revenue. Those minor details like revenue, earnings, or cash flow were looked over by investors who were fixated on fast and easy returns in the stock markets. They wanted to believe that they were all going to be rich, and happy, and own private islands where they would fly into them on their jets. Life was going to be awesome.

But then something remarkable happened suddenly in March of 2000. Investors started to lose money. A LOT of money. By October of 2002, the technology loaded NASDAQ was down a whopping 78.4%. Investors that used margin leverage were completely wiped out. Millionaires became bankrupt. Companies that were worth billions were now completely worthless.

Now here’s the humorous part of human investing. Everyone now looking back on 1999 proclaims, “Well that bubble was obvious.” The shenanigans of hindsight and behavioral biases are sneaky like that.

Part of being in a financial bubble requires that the masses don’t believe that they are in a financial bubble. Otherwise, no bubble could exist and grow. This was true in the housing bubble, the tech bubble, the tulip bubble, or the stock bubble of 1929. You must have the vast majority of people actually believing that “this time is different and there is free/easy money to be made by doing the same thing as everybody else.” When the majority of all investors are aligned and doing the exact same thing, all with the expectations of excess returns, you are well on your way to identifying something that should smell like trouble (or the opportunity to go against the herd for profit).

The tech bubble of the late 90’s was a valuation bubble. It was caused when the prices of assets completely unhinged from fundamental values. It was yet another expensive lesson for investors who refused to ignore the obvious clues from financial history.

The Leverage and Debt Bubble of 2008.

The economic collapse of 2008 through 2009 was different than the tech bubble. It wasn’t so much that valuations were fraudulent. The period leading up to the great global meltdown was brought on by excessive leverage and debt. Consumers were using their homes as ATM machines. Companies were borrowing and leveraging their balance sheets. Most importantly, investment banks and hedge funds were using insane leverage levels to juice returns to even higher levels.

People believed that it was free and easy money that would last forever. Until it all blew up.

The great global economic meltdown was an inferno just waiting for the first spark. Once it began, there was never going to be enough water to put out the flames.

The fire retardant used by central banks to stop the spread of the financial wildfire was an interesting one. They fought fire with fire. The fire was the result of massive debt. So how does one solve a debt problem if you are a central banker? You attempt to fight a debt problem with adding massive amounts of debt. You do this by lowering interest rates to zero (or even negative rates). You do this by encouraging anybody and everybody to borrow money. Borrowing and spending pulls economic demand forward. It encourages people to spend today at the expense of spending tomorrow. For tomorrow you won’t have the same money but you’ll have to start paying back the debts (plus interest!)

The plot thickens. In the past 17 years investors have experienced two fantastic and powerful bubbles, one brought on by extreme valuations, the other with extreme debt. You would think that investors would be wise to what’s coming. But they don’t seem to be bothered at all. It’s all groovy in investor La-La-Land when we now have the powerful mixture of both supernova components; a marrying of extremes in both valuations and debt.

Which brings us full circle back to 1929, the time period leading up to the epic stock market crash followed by the Great Depression. The late roaring 1920’s brought markets to constant new heights. People were getting rich (on paper). Debt was rising, fast and extreme. Politically, the country was in turmoil. The wealth gap was widening between the rich and the poor. The country was trying to put a halt to global trade with trade barriers. Democrats hated Republicans and visa-versa. But everybody was enjoying the money train on Wall Street.

U.S. Treasury Secretary Andrew Mellon was quoted as saying, “investors acted as if the price of securities would infinitely advance.”

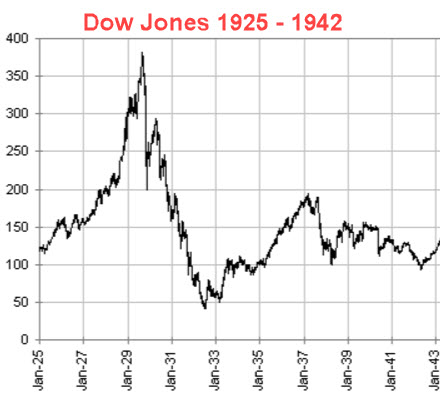

But then the party ended. Within the first four days of the crash, the stock market lost 25 percent. But that was just the beginning. It would only continue to get worse. Even safe dividend paying stocks like public utilities were getting crushed. The stocks were all trading at extreme prices and there was massive leverage in the system. Margin debt was at dangerous levels. People borrowed all of the money they could to invest in the stock market.

It would take until November 23, 1954 for the Dow Jones Industrial Average to regain the high that it set on September 3, 1929. That’s over 24 ½ years for investors to get back to those previous highs. That doesn’t count the investors and companies that were obliterated completely off the map and filed for bankruptcy.

Where Are We Now?

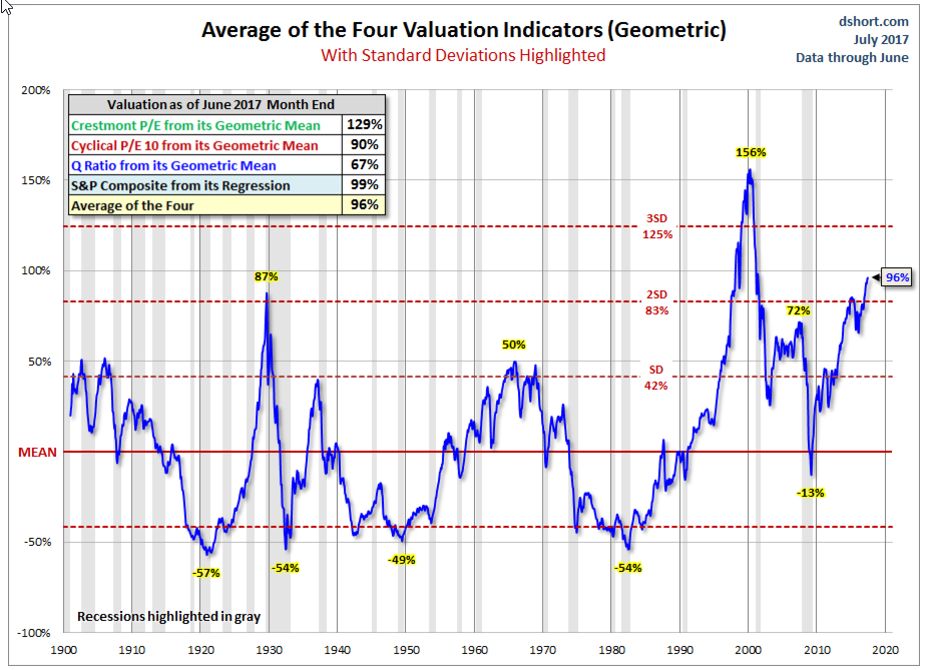

Using various valuation metrics, we can clearly see that not only is the market overvalued fundamentally, we are at extreme levels of over-valuation surpassing even levels that led to the 1929 crash and the 2008 global economic meltdown.

(Credit to Doug Short at Advisor Perspectives.)

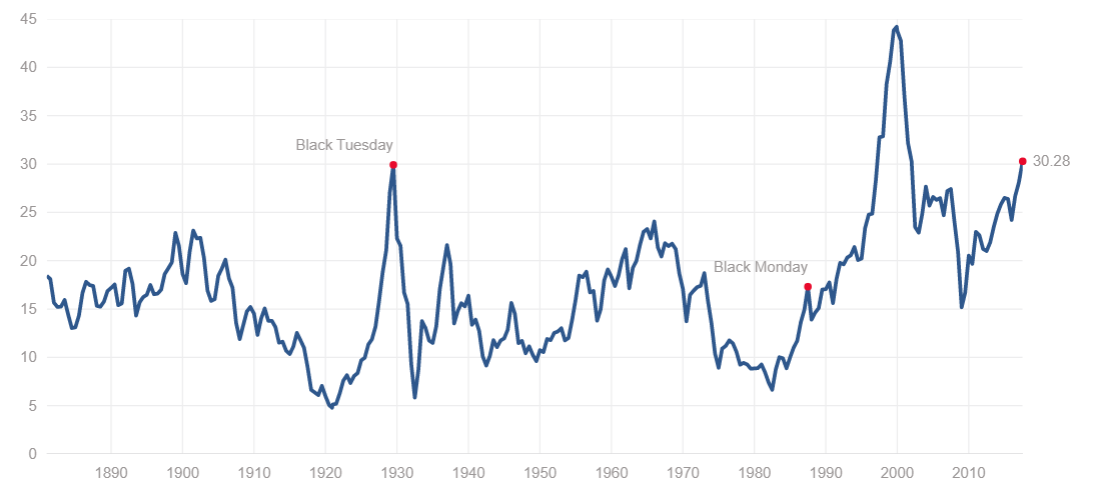

Another viewpoint can be the Shiller P/E ratio, also known as the CAPE10 because it smooths out the fluctuations of profits normally seen in typical business cycles. These levels should alarm any investor. We recently reached a level of 30.28. For reference, the historical long-term average for the Shiller P/E is around 16.

“Debt Is Super Awesome Until You Realize That You Have To Pay It Back With Interest” – Paul Kindzia

Debt cuts both ways. It can magnify investing returns and create instant gratification for consumers or if overused it can be the road to ruin and financial imprisonment. The world now lacks the future borrowing capacity to make bail on eventual financial incarceration.

While central bankers are desperately attempting to spur economic growth, they are punishing savers in the process through low or negative interest rates. But they have been successful in encouraging the origination of debt at all levels and players in the global economy. A few highlights;

Consumer Debt In The United States

- Consumer credit card debt just surpassed $1 trillion, the highest level since 2008 during the global economic collapse

- S. auto loans have now reached $1.15 trillion, a large chunk of which is sub-prime (think of the mortgage crisis but now with auto’s).

- Student loans have escalated to $1.3 trillion. 44 million Americans have student loans and the delinquency rates for these loans is now over 11%.

- Total household debt including mortgages, student loans, credit cards and auto loans is now approximately $13 trillion.

U.S. National Debt

- U.S. federal government debt is now $20 trillion (about $160,000 per U.S. taxpayer).

Global Debt

- From 2000 to 2007, global debt rose from $87 trillion to $142 trillion. Debt to GDP went up from 249% to 269%.

- From 2007 to 2014, global debt rose by $57 trillion, moving up from $142 trillion to $199 trillion which was 286% of global GDP.

- Since 2014, global debt has ballooned to $217 trillion (327% of global GDP)

- China’s debt has quadrupled in only 7 years.

When the global economic meltdown struck in 2008, central bankers attempted to solve an over-leveraged debt problem with massive amounts of additional debt. Sometimes you should question the nature of human behavior.

Current investors are failing to understand that the entire system is not only supported by extreme debt levels but by debt levels that must continue to grow exponentially to keep the entire game going. It’s the flawed belief that debt has no future consequences. But that is not true. Debt by its nature is the act of pulling future consumption forward as you buy something today that you cannot afford. You will be required to pay it back tomorrow out of future earnings (which haven’t been generated yet nor are they guaranteed), PLUS INTEREST.

That also means that once new debt origination comes to a halt, future consumption must diminish as financial resources are being allocated to the repayment of the accumulated debt. Much of our future economic growth has already been consumed by pulling that consumption forward using borrowed money.

We are already seeing signs of debt distress in many places. Places like Greece and Puerto Rico can no longer make the minimum payments on their loans.

We are seeing the same signs of distress in state and municipal debt as for the first time in U.S. history, three individual states are on the verge of official junk rating (New Jersey, Illinois, and Connecticut). California has municipalities that have already filed for bankruptcy with more likely in the future.

Individuals are already experiencing more difficulty making minimum payments on auto loans, student loans, credit cards and mortgages. What will they do when a recession begins and if their earnings are interrupted or diminish?

How To Make Money and Build Wealth In Financial Bubbles Safely

The way to make low risk returns during the current bubble is not to buy and hold Amazon.com trading at an earnings multiple of 192.75. The way to make low risk returns is not to buy and hold Tesla which had net losses of $294 million in 2014, $888.5 million in 2015, and $675 million in 2016 yet has a market cap of $54 billion (more than Ford or GM which actually generate profits).

Building wealth requires one to see the similarities from financial history and what happens when you get into valuation bubbles and debt bubbles. This allows you to avoid those eventual losses on the back end of the cycle.

Building wealth during bubbles means keeping your personal debt levels low or better yet – getting your household debt free. Avoid the financial imprisonment that millions of others are experiencing often with life sentences.

Building wealth means doing very basic things; making a strong income from personal productivity, living below your means, building emergency funds, paying off debt, and avoiding bad investment risks by investing wisely FOR THE LONG TERM.

The rewards will be had on the other side of the mountain when prices reset and the debt bubble collapses.

The one thing we really learn from history is that humans usually completely ignore history.

The Dangers of Buying And Holding During High Valuations

If you are an investor who is buying or holding large amounts of equities during times of extreme market valuations, you are basically saying that price does not matter at all in investing. But what you should know is that eventually PRICE ALWAYS MATTERS.

Now a comment that is made very often by investors is, “But if I am too conservative for a period of time during market extremes and generate a low return, I can’t/won’t meet my goals. Plus, everybody else is making easy money while I’m missing out.” But this mindset is assuming that markets will stay at extreme valuations forever and ever. The question you need to ask yourself is this;

“If you don’t think you will reach your goals while temporarily earning a low rate of return to protect yourself during market extremes, how do you really believe you will reach your long-term goals if you watch your capital base diminish 40%, 50%, 60% or more?”

We have only been in extreme conditions like this a handful of times in market history and they all ended terribly with very large investor losses for those taking on that investment risk. Ask yourself what would happen to your retirement plans if you lost 50% or even more than 70% of your capital base? Could you hang on and recover from such a loss?

Could you hang on and recover from such a loss?

Here is the good news…For those wise investors who pay attention to price and value and protect their capital during bouts of extreme valuations, they are best positioned to take advantage of lower prices and better values once market conditions reset to historical norms.

The key to successful investing is to buy quality investments at fair prices (or better yet – attractive prices.) If the price isn’t right, you should have the fortitude to simply not buy and wait for better prices to come along in the future.

What would it feel like to boost your wealth significantly over the coming decade? Avoiding high-risk investment conditions is one of the best tactics and strategies available to make that happen.

For more resources on our current financial bubble, feel free to access these archived resources on my website and blog;

- June 25, 2017 https://paulkindzia.com/investors-are-vacationing-in-finance-fantasy-land-again/

- May 12, 2017 https://paulkindzia.com/wall-street-untruths-and-bad-math/

- April 12, 2017 https://paulkindzia.com/poker-patsies-investing/