With many investors enjoying the spring break, I wanted to go over two important items that may aid you in your wealth building and wealth preservation endeavors.

A lot of investors are now wondering if the peak of the market was set a few months ago on January 26th, 2018 when the Dow Jones closed at 26,216.71. The Dow is currently a few thousand points lower with noteworthy volatility days between then and now. The reality is, nobody really knows if that will prove to be the peak of this cycle.

As a quick recap and summary, here are where things stand at the present moment;

- Extreme valuations across almost all asset classes.

- Rising inflationary pressures

- Rising interest rates at both ends of the yield curve

- Record levels of debt across all sectors; sovereign nations, municipalities, corporations, and individuals.

- Record high margin debts (investors buying stocks using borrowed money).

- Unemployment that is now below what would be considered “full-employment” within the economy.

- Central Banks removing, shrinking, and ending financial stimulus that was a huge factor in the global accumulation of debt and rising asset prices that aren’t supported by underlying business fundamentals.

- Asset prices that have moved far faster than the underlying growth in revenues, earnings, and cash flows of those assets.

Dangerous Belief #1

The first dangerous belief that is being made by investors today is the belief that goes something like this, “Since markets are rising and nothing has gone wrong, everything must be fine, and nothing will go wrong. If everything is fine, then I am safe to just keep piling my money into stocks.”

This is very flawed investor logic for a couple of reasons. First, prudent investors are value conscious. If someone asked, “Hey, have you ever heard of buying low and selling high?” Everybody would nod their head in agreement and say, “Yeah, that’s the secret sauce.” But in reality, we know this is the complete opposite of how investors behave in real markets. Investors don’t buy low and sell high. They buy high, hope to sell higher, and then sell lower when losses start to rack up.

Do you know when peak inflows into equity ETF’s were over the past few years? It was January of 2018. That’s right. Per State Street research, monthly ETF inflows reached a record high in January of 2018 (oddly which may turn out to be the peak of the market). The higher the markets climb, the more investors pile money into stocks. That’s not buying low and selling high. That’s selling high and being foolish (and greedy and ignorant).

The second is from a historical perspective. Sure, investors are inclined to get a sense of security if everything appears to be great in financial markets and prices keep climbing. That causes the greed instinct to kick in. But then ask yourself this, “how did this approach work in prior instances when markets traded at extreme levels (and some not even as extreme as today?)”

Let me take you back to December of 1996. Then Federal Reserve Chairman Alan Greenspan delivered a speech loaded with historical data and it was the time he first used the words “Irrational Exuberance.” He was referencing equity prices and markets and felt that things were getting overheated and ahead of themselves. This sounds reasonable for the man at the top of trying to control the economy for the United States right?

But what happened in reality? Did investors take note of the warnings of Alan Greenspan and “sell high?” Nope, they bought high and kept buying higher (and higher, and higher). Equity prices rose throughout 1997. Equity prices rose throughout 1998. Equity prices rose at an even faster pace in 1999. And by early 2000, equity prices were growing exponential. The higher prices got, the more investors bought.

If you believe in buying low and selling high, and prices were selling at all-time highs, you would assume that investors would be selling high. But that’s not how investors behave in the real world of greed and fear. Investors were falling for Dangerous Belief #1 which is “Since markets are rising and nothing has gone wrong, everything must be fine. If everything is fine, then I am safe to just keep piling my money into stocks.”

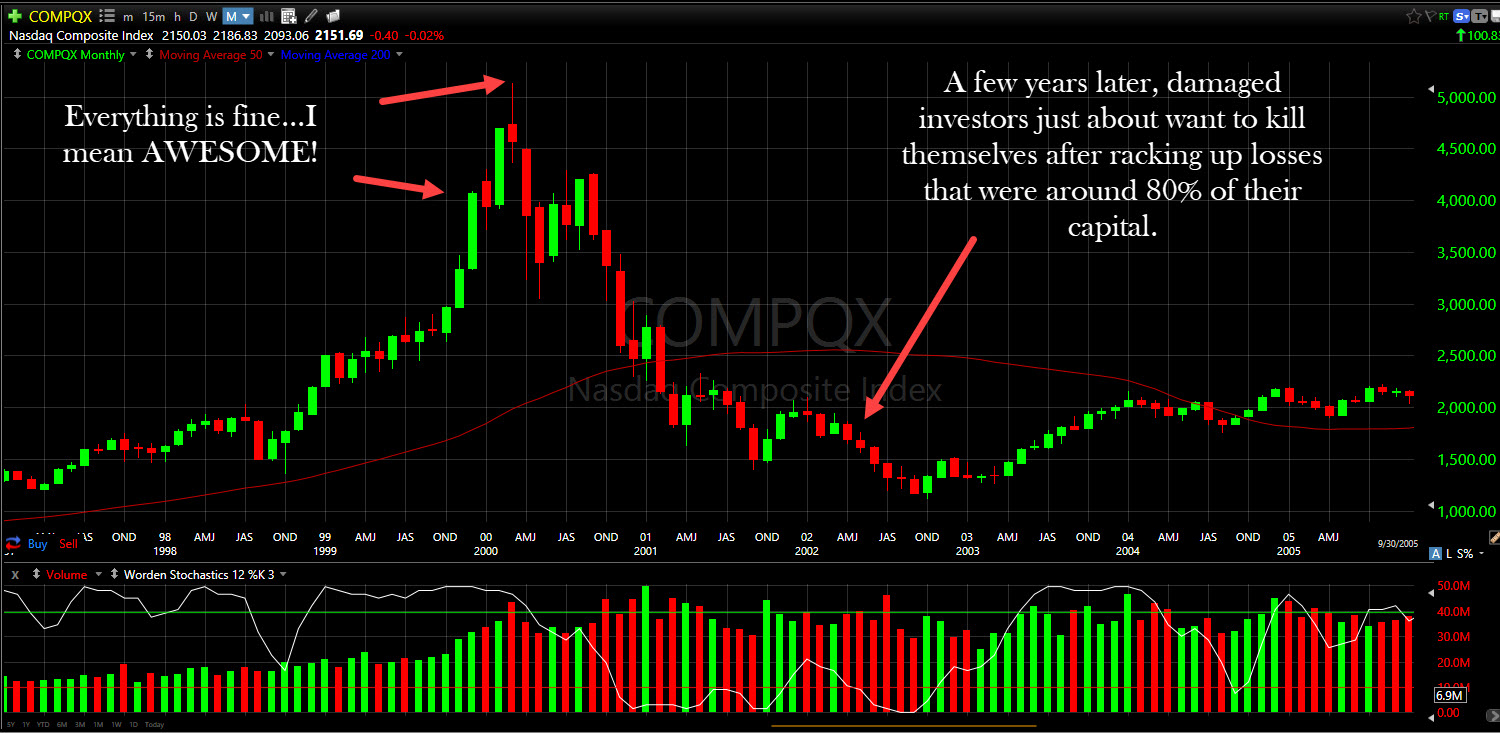

And what happened to those investors who thought everything was fine and just kept investing (you know, for the long-term because that’s how you justify paying insane prices for stocks while trying to make a short-term return?) Investors got decimated. The tech-heavy NASDAQ came down about 80%, many stocks went completely bust and even the bluest of the blue-chip stocks came down in excess of 50%. Many investors got completely wiped out because they were even buying on margin to boost returns even more (that old greed thing once again…)

Here’s a snapshot of the monthly view of the NASDAQ back in the mid to late 1990’s when investors wanted to believe that “everything was fine.”

You can look at 1926 through 1929 before the meltdown that contributed to the start of the Great Depression. You can see it in the mid to late 1980’s in Japan before the Nikkei got slaughtered. You can see it again in the mid to late 1990’s before the tech bubble with Alan Greenspan making warnings in 1996. Or you can see it in the rising housing prices from 2002 through 2006 that eventually exploded in the housing bubble and global economic meltdown that began in October 2007. What did all of these examples have in common? They all had investors having Dangerous Belief #1. Investors wanted to believe that everything was fine. Why? Because they wanted to make endless easy money and big returns. When greed is in the air, everything smells rosy.

Dangerous Belief #2

The second dangerous belief that is being made by investors today is the belief that goes something like this, “Who cares if stocks are high in price? If I am a long-term investor, it doesn’t matter what stock values are when I buy. Markets always bounce back quickly and go on to new highs anyways. So, all I have to do is invest now, enjoy the gains, and everything will work out just fine.”

For those that study market history, they know that markets don’t always come bouncing back in quick fashion. A few examples;

- The Dow Jones peaked on October 28, 1929, after years of “everything is fine” at 381.17. The Dow Jones did not reach that level again until March 5th, 1954 (about 24 ½ years later). Now, did the market go on to all new highs from there? Sure, markets eventually recovered and went on to new highs. How did it work out for human beings that have a finite life and retirement window? It didn’t work out so well. They were dead by the time the markets got back to those levels.

- The Nikkei stock market peaked in Japan in 1989 at a level of about 40,000. Today, almost 30 years later it’s barely at 50% of where it was back then. So much for, “It doesn’t matter what stock values are when I buy because markets will always bounce back quickly and go on to new highs anyways.” By the time the Nikkei goes on to set a new high, everybody may very well be dead. Here’s the chart of the Nikkei below for reference.

What matters most in prudent investing are the items that investors ignore the most. Investors ignore proven principles of long-term success (buy low and sell high). Investors ignore valuations. Investors ignore fundamentals like earnings and cash flows. Investors ignore history. Investors ignore warnings.

What investors tend to do during times of extremes is what I call “opinion shop.” If they don’t like the news from one outlet, they turn to another. But some things to keep in mind;

- If you switch from watching Bloomberg TV to CNBC, stocks are still currently insanely expensive.

- If you switch from reading Kiplinger’s to Money Magazine, stocks are still currently insanely expensive.

- If you switch from reading the Wall Street Journal to Investors Business Daily, stocks are still currently insanely expensive.

- You can switch advisors, you can switch internet sources, you can switch TV channels, you can switch friends, and you can switch anything you want. If you follow most of the major valuation metrics, they don’t change based on opinion and journalism techniques. They change only based on data.

- Opinion shoppers will experience the same fate as anyone else that ignores market history.

Wealth building and wealth preservation go hand in hand. There are times to build and there are times to protect. It’s like sports. Sports teams employ offense and they employ defense. Building wealth to only lose it down the road is worthless (and stressful and depressing).

The way to build wealth during times of market extremes is to focus on basic principles of success;

- Make a substantial living

- Live below your means and control spending

- Save consistently

- Eliminate debt

- Always keep adequate and liquid emergency funds

- Invest prudently over a lifetime

- Use proper risk management in all areas of your life

How To Make Money and Build Wealth In Financial Bubbles Safely

Building wealth requires one to see the similarities between financial history and what happens when you get into valuation bubbles and debt bubbles. This allows you to avoid those eventual losses on the back end of the cycle.

Building wealth during bubbles means keeping your personal debt levels low or better yet – getting your household debt free. Avoid the financial imprisonment that millions of others are experiencing often with life sentences.

Building wealth means doing very basic things; making a strong income from personal productivity, living below your means, building emergency funds, paying off debt, and avoiding bad investment risks by investing wisely FOR THE LONG TERM.

The rewards will be had on the other side of the mountain when prices reset and the debt bubble collapses.

“The one thing we really learn from history is that humans usually completely ignore history.”

The Dangers of Buying And Holding During High Valuations

If you are an investor who is buying or holding large amounts of equities during times of extreme market valuations, you are basically saying that price does not matter at all in investing. But what you should know is that eventually PRICE ALWAYS MATTERS.

Now a comment that is made very often by investors is, “But if I am too conservative for a period of time during market extremes and generate a low return, I can’t/won’t meet my goals. Plus, everybody else is making easy money while I’m missing out.” But this mindset is assuming that markets will stay at extreme valuations forever and ever.

The question you need to ask yourself is this; “If you don’t think you will reach your goals while temporarily earning a low rate of return to protect yourself during market extremes, how do you really believe you will reach your long-term goals if you watch your capital base diminish 40%, 50%, 60% or more?”

We have only been in extreme conditions like this a handful of times in market history and they all ended terribly with very large investor losses for those taking on that investment risk. Ask yourself what would happen to your retirement plans if you lost 50% or even more than 70% of your capital base?

Could you hang on and recover from such a loss?

The value of having a trusted advisor on your side is that they can help guide you through these times. We are here to help you navigate what should be very challenging market conditions during the second half of the market cycle. And here is the good news…For those wise investors who pay attention to price and value and protect their capital during bouts of extreme valuations, they are best positioned to take advantage of lower prices and better values once market conditions reset to historical norms.

The key to successful investing is to buy quality investments at fair prices (or better yet – attractive prices.) If the price isn’t right, you should have the fortitude, discipline, and patience to simply not buy and wait for better prices to come along in the future.

What would it feel like to boost your wealth significantly over the coming decade? Avoiding high-risk investment conditions is one of the best tactics and strategies available to make that happen.

For additional specific resources related to the current financial bubble, feel free to access these archived resources on my website and blog;

- March 6, 2018 – https://paulkindzia.com/is-the-market-peak-behind-us/

- January 19, 2018 – https://paulkindzia.com/why-you-dont-want-to-be-a-star-in-a-future-michael-lewis-blockbuster-film/

- November 9, 2017 – https://paulkindzia.com/what-you-can-learn-about-investing-from-one-of-the-greatest-human-minds-of-all-time/

- September 29, 2017 – https://paulkindzia.com/be-ready-for-anything-but-especially-opportunities/

- June 25, 2017 – https://paulkindzia.com/investors-are-vacationing-in-finance-fantasy-land-again/

- May 12, 2017 – https://paulkindzia.com/wall-street-untruths-and-bad-math/

- April 12, 2017 – https://paulkindzia.com/poker-patsies-investing/